WASHINGTON -- The U.S. job-creation machine kept exceeding expectations in February, but wages continued to disappoint.

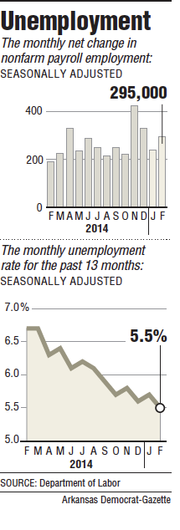

U.S. employers added 295,000 jobs, the 12th-straight monthly gain above 200,000, the Labor Department said Friday. And the unemployment rate fell to 5.5 percent from 5.7 percent. But the rate declined mainly because some people out of work stopped looking for jobs and were no longer counted as unemployed.

"Labor-market conditions are quite good right now, even though the wage situation is not so hot," said Nariman Behravesh, chief economist at IHS Inc. in Lexington, Mass. "Our expectation is that as the year progresses, we'll start to see those wage numbers look a little stronger."

The average hourly wage rose just 3 cents to $24.78 an hour. Average hourly pay has now risen just 2 percent over the past 12 months, barely ahead of inflation.

Still, over that time, 3.3 million more Americans have gotten jobs. More jobs and lower gasoline prices have led many consumers to step up spending. That's helping the economy, offsetting sluggish growth overseas and giving employers the confidence to hire.

"We were all on guard for signs of a February freeze-up, but this is a barnburner of a jobs report," said Mark Hamrick, an analyst at the personal finance site Bankrate.com.

Most economists have forecast that the economy will grow about 3 percent this year, supporting about 250,000 job gains a month. Those increases should lead to pay raises this year, they say.

Friday's figures provide "more evidence that the labor market is recovering rapidly, with employment growth more than strong enough to keep the unemployment rate trending down," said Jim O'Sullivan, chief U.S. economist at High Frequency Economics. Falling unemployment "makes more acceleration in wages increasingly likely."

At 5.5 percent, the unemployment rate has now reached the top of the range the Federal Reserve has said is consistent with a healthy economy. That could make it more likely that the Fed will raise interest rates from record lows as early as June.

"This is quite a symbolic change that increases the pressure on the Fed to hike rates in June," said Paul Dales, an economist at Capital Economics.

After the jobs report was released Friday, investors sold U.S. Treasury notes, a sign that many anticipate a Fed rate increase. The yield on the 10-year Treasury note rose to 2.24 percent from 2.11 percent before the report was issued.

Investors also sold stocks. The Dow Jones industrial average fell 278.94 points, or 1.5 percent, to end the week at 17,856.78.

Yet the Fed's decision is complicated by many factors. The 5.5 percent unemployment rate doesn't reflect as healthy a job market as it typically has in the past. One reason the rate has fallen so low is that many people have stopped looking for work. The proportion of Americans who have a job or are seeking one dipped one-tenth of 1 percentage point in February to 62.8 percent. That's close to the lowest level in 37 years.

Economists calculate that about half that decline reflects the aging of the population as baby boomers retire. But another factor is that many Americans have been discouraged by their job prospects and have given up looking.

The Fed also may be reluctant to start raising rates as long as wage growth remains weak.

Megan Greene, chief economist at John Hancock Financial Services, noted that hourly pay fell in February from January in the construction and mining industries. Greene suggested that such figures will outweigh the falling unemployment rate in Fed Chairman Janet Yellen's mind and perhaps discourage a rate increase soon.

"Fed guidance on rate hikes has centered on the expectation that ongoing improvement in labor market conditions would support wage growth," Michael Gapen, chief U.S. economist at Barclays Plc in New York, said in an email to clients. "We continue to forecast the first policy rate hike from the Fed in June of this year, with risks skewed in the direction of a later takeoff."

February's hiring gains were broad-based. Some of the industries with the biggest gains include mostly low-paid work: Hotels and restaurants added 60,000 jobs, retailers 32,000. But higher-paying fields also added jobs: Professional and business services -- which include accountants, engineers and lawyers -- gained 51,000; construction 29,000; and financial services 10,000.

"The word that keeps coming to my mind here is confidence," Labor Secretary Thomas Perez said. "Businesses have confidence. Workers increasingly have confidence to leave their job to go for a better job. Job seekers have confidence that they can get a good job. That's creating a virtuous cycle."

The U.S. economy expanded at an annual pace of 4.8 percent in last year's spring and summer, only to slow to a 2.2 percent rate in the final three months of 2014. Many economists estimate that growth is picking up slightly in the current quarter to an annual rate of 2.5 percent to nearly 3 percent.

Still, economists remain bullish about hiring despite the slowdown in growth. The fourth quarter's slowdown occurred largely because companies reduced their stockpiles of goods, which translated into lower factory output.

But companies focus more on consumer demand in making hiring decisions, and demand was strong in the October-December quarter. Americans stepped up their spending by the most in four years.

And although consumers are saving much of the cash they have from cheaper gasoline, spending in January still rose at a decent pace after adjusting for lower prices.

Information for this article was contributed by Christopher S. Rugaber of The Associated Press; by Michelle Jamrisko, Nina Glinski and Kristy Scheuble of Bloomberg News; and by Dionne Searcey of The New York Times.

Business on 03/07/2015