ArcBest Corp. posted its best first quarter in seven years, reporting net income of $745,000, a profitable three months from its largest subsidiary and continued growth among nonasset businesses.

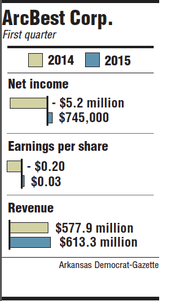

The results were a sizable improvement from the same period in 2014, when the Fort Smith-based company reported a $5.2 million loss in the first quarter. ArcBest also reported $613.3 million in total revenue for the quarter and earnings per share of 3 cents, which were improvements from 2014 first quarter results of $577.9 million, a loss of 20 cents per share.

Both marks fell short of analyst estimates of $621.3 million in revenue and 10 cents per share, but Chief Executive Officer Judy McReynolds said in a news release that ArcBest was "gratified" with the first-quarter earnings as it strives to become a company that generates $3 billion in revenue in 2015.

"It gives us confidence we're moving in the right direction and that our employees are really working hard on behalf of customers," McReynolds said later on a conference call. "While there's always more work to do, there were certainly some bright spots in the quarter."

ABF Freight, the company's less-than-truckload division and largest subsidiary, was responsible for $441.2 million in revenue in the quarter. That was a 2.9 percent increase from the $428.9 million last year.

The division experienced revenue growth in the quarter because of improved pricing, which helped offset a 0.5 percent decrease in total freight tonnage. ArcBest also pointed to improvements in productivity and efficiency at ABF Freight for the results.

"It was the first profitable [first] quarter they put up on the [less-than-truckload] side in seven years, so you're seeing some improvement in business," said Brad Delco, an analyst with Stephens Inc. in Little Rock. "It sounds like productivity levels have improved with some of the workforce after such a massive hiring spree a year ago. The overall environment sounds fairly constructive, and they're still seeing the benefits of some pretty good pricing in the industry."

ArcBest's nonasset-based businesses -- Panther Premium Logistics, ABF Logistics, FleetNet and ABF Moving -- accounted for $183.7 million in revenue in the first quarter, which was 29 percent of the company's revenue and a 16 percent increase from 2014. The company's report noted that the "other and eliminations" category accounted for a $11.6 million revenue loss for the quarter.

ABF Logistics experienced the biggest growth in revenue at 59 percent, which was credited to an increase in the number of active brokerage accounts and shipments received. McReynolds described the recent acquisition and integration of Smart Lines Transportation Group in Oklahoma City as a success, calling the business a key contributor to ABF Logistics' success moving forward.

McReynolds also said she remains "pleased with the steady progress" the company is making with all of its emerging businesses even with lower profit margins in the quarter.

The biggest effect was felt at Panther, which experienced a 4 percent increase in revenue and 16 percent increase in loads handled in the first quarter. But Panther's gross-profit margins were affected by "demand softness," lower rates in the expedited market, and a shorter length of haul, according to ArcBest. First-quarter operating costs were affected by a $1.5 million increase in the company's health care and casualty expenses from the same period in 2014.

"Panther, in addition to the unusual health care costs, had terrible experience in casualty claims that were primarily weather-related," David Cobb, chief financial officer, said. "The associated first-quarter casualty claims charge was $700,000. The higher-than-expected consolidated health care costs in the financial casualty claims impacted operating results by combined 5 cents per share."

Panther's operating income fell to $1.2 million in the quarter compared with $3.4 million last year. The combined operating income for ArcBest's asset-based businesses was $2.8 million, which was down from $4.5 million from the first quarter of 2014.

Delco said that if there was one slight disappointment for ArcBest, it was the fact there was a "lot of revenue growth, but not as much earnings growth."

Cobb said the company incurred $2.9 million in added health care costs across all businesses, which were nearly twice the amount as expected. Fuel prices are lower, but Cobb said ArcBest was affected by "significantly" lower fuel surcharges tied to the decline in the cost of diesel as well.

Still, ArcBest reported each of its companies experienced "positive growth" in the quarter.

Shares of ArcBest stock ended Monday trading at $36.59, down 16 cents per share.

"As we move into the busier period of the year, our array of companies are in a position to offer the needed capacity solutions to meet our customers' needs," McReynolds said. "While we work on improving our operating margins, we believe that the improved pricing environment and our customers' increasing use of a variety of ArcBest services are encouraging signs."

Business on 05/05/2015