Fueled by rising individual income tax collections, Arkansas' general revenue in April surged by $56.5 million from a year ago to $801.2 million.

The month's tax collections exceeded the state's forecast by $73.4 million, the state Department of Finance and Administration said Monday in its monthly revenue report.

April's tax collections were fueled by a $43.5 million increase in individual income tax collections, a $7.3 million increase in sales and use tax collections, and a $5.3 million increase in corporate income tax collections.

But April's collections fell short of the record for the month.

Historically, the state's best month for tax collections is the one in which tax returns are due. That month has been April in recent years, although it was May in earlier years.

The state's record for general revenue collections for a month is $817.4 million in April 2013, said Whitney McLaughlin, a tax analyst for the finance department.

John Shelnutt, the state's chief economic forecaster, said April's revenue report shows Arkansas' economy is still on "a moderate [growth] track."

Gov. Asa Hutchinson said he's "pleased that April revenues are well above forecast and that our economic numbers remain solid, but it is imperative that we continue to take a conservative approach as we wind down this fiscal year and look toward the next.

"I appreciate the work of the [Arkansas] Legislature during the session for passing a balanced budget that both funds the essential needs of the state and keeps spending growth at a low level," the Republican governor said.

Earlier this year, the Legislature authorized increased general revenue spending of $133 million to $5.18 billion in fiscal 2016.

Larry Walther, director of the finance department, said the state's tax collections were higher than expected in April largely because individual income tax collections from tax return filings and extensions exceeded the state's forecast by $47.1 million, and corporate income tax collections exceeded the forecast by $23.1 million.

He said state officials expected the surge in corporate income taxes to occur in May -- not April -- "so that will reverse itself" with lower-than-forecast corporate income tax collections in May.

Tim Leathers, deputy director of the finance department, said state officials are still analyzing April's larger-than-forecast individual tax collections from the tax return filings and extensions.

"We do know that it is significantly weighted with higher-income taxpayers," he said. "There are about 48 [individual] taxpayers that paid about $23 million more than they paid last year."

Shelnutt added that "it seems to be happening in other states," as well.

Leathers noted the state "had the big surprise [with a large increase in individual income tax collections in April 2013], and it turned out to be money we gave back the next year, so we are going through that analysis now to determine exactly what's going on."

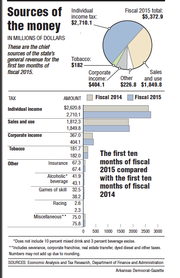

During the first 10 months of fiscal 2015, state general revenue increased by $172 million (3.3 percent) over the same period in fiscal 2014 to $5.37 billion. That's $130.2 million (2.5 percent) above the state's forecast.

Tax refunds and several other government expenditures come off the top of total general revenue, leaving "net" general revenue that agencies are allowed to spend.

During the first 10 months of fiscal 2015, the net increased $159.7 million (3.8 percent) over the same period in fiscal 2014 to $4.32 billion. That's $163.8 million (3.9 percent) above the state's forecast.

Walther said the entire $163.8 million probably won't end up as a surplus at the end of the fiscal year.

"I wouldn't make a large wager on that," he said.

Richard Wilson, assistant director of research for the Bureau of Legislative Research, said his best forecast model in February suggested a $125 million surplus in fiscal 2015 and that "April was even bigger than we expected."

The Legislature's Committee on Economic and Tax Policy is scheduled to meet Wednesday, "at which we expect to discuss revenue forecasts and possible revision," Wilson said.

Walther declined Monday to offer any updated projections.

If the state collects more than forecast in the current fiscal year, measures enacted this year by the Legislature would distribute up to $50 million to rainy-day funding and up to $30 million to the Quick-Action Closing Fund.

Any surplus above $80 million would be money that the Legislature could decide to allocate in the future, said Brandon Sharp, the state's budget administrator.

Last year, the Arkansas Legislature approved a $5 billion general revenue budget for fiscal 2015 that increased projected spending by $109 million over the previous year, with most of the increase targeted for public schools, prisons and human services.

That budget anticipates $85 million in general revenue reductions from tax cuts enacted by the Legislature in 2013 and up to $89 million in savings from the use of federal funds to purchase private health insurance for some low-income Arkansans under the so-called private option Medicaid expansion.

April's general revenue included:

• A $43.5 million (9.3 percent) increase over a year ago in individual income tax collections to $510.1 million, exceeding the state's forecast by $41.9 million (8.9 percent).

Last month's individual income tax collection included $230.9 million from tax returns and extensions, which increased by $45.9 million over a year ago and exceeded the state's forecast by $47.1 million.

April's individual income tax collections also included withholdings collections of $221.1 million, which represented a $7.6 million decrease from a year ago that was $9.8 million below the state's forecast.

Shelnutt said the decline stems from the updating of payroll withholding formulas by payroll service companies and large employers.

Arkansas' unemployment rate remained unchanged at 5.6 percent in March, the U.S. Bureau of Labor Statistics reported last month. The federal agency also revised February's unemployment rate from the original 5.5 percent to 5.6 percent.

The national unemployment rate was 5.5 percent in March.

• A $7.3 million (4 percent) increase in sales and use tax collections over a year ago to $190 million, exceeding the state's forecast by $5.6 million (3 percent).

Walther said April's sales tax collections rebounded after declining in March, and "that's getting back to where we had expected it to be because ... in March we had the weather-related issues. Well, that kind of corrected itself."

• A $5.3 million (8.7 percent) increase in corporate income tax collections over a year ago to $66.5 million, outdistancing the state's forecast by $23.1 million (53.1 percent).

"We know $23 [million] is going to be reversed immediately this month [from corporate income taxes]," Walther said.

Metro on 05/05/2015