Tyson Foods beat analysts' expectations Monday, posting strong profits for its second quarter as the company continues to adjust to the challenges of acquiring Hillshire Brands, port strikes and blocked overseas markets due to avian flu concerns.

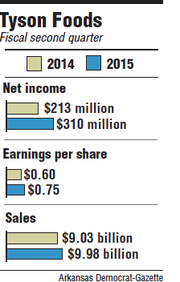

The Springdale-based meat giant saw net income of $310 million, or 75 cents per share, for the quarter ended March 28, compared to net income of $213 million, or 60 cents a share, for the quarter a year ago. A consensus of 11 analysts predicted average earnings per share at 72 cents for the second quarter of fiscal 2015.

Revenue for the quarter was $9.98 billion, up 10 percent from $9.03 billion in the same quarter in 2014. The average estimate of 10 analysts predicted revenue of $10.11 billion.

Tyson kept its annual guidance for fiscal 2015 at $3.30 to $3.40 adjusted earnings per share.

The company booked adjusted operating income of $553 million, a new record for the second quarter, up 53 percent when compared to $361 million last year. Operating income is earnings before interest and taxes are paid.

Tyson shares closed at $41.09 up 60 cents or 1.48 percent in trading Monday on the New York Stock Exchange. Shares have traded as low as $34.90 and as high as $44.00 over the past year.

President and CEO Donnie Smith told analysts during a conference call the prepared food and chicken segments were key elements in the successful second quarter.

He credited the ongoing integration of Hillshire Brands with helping earnings, noting the cost savings and efficiencies from the acquisition were valued at $77 million for the second quarter. Smith said the company raised its savings target to $250 million in fiscal 2015. New projections for 2016 savings will be $400 million and $600 million for the end of fiscal 2017.

Tyson closed the deal to buy Hillshire Brands in August, a move valued at $8.55 billion, including debt.

The prepared food segment saw sales of $1.87 billion, up a bit more than 70 percent from $860 million in the second quarter of 2014. Operating income for the quarter was $160 million for the quarter, up from $21 million for the year ago period.

"We believe we have a lot going for us," Smith said in a later conference call with reporters.

The poultry segment revenue for the second quarter was nearly flat when compared to last year. Sales were $2.8 billion, down 0.2 percent when compared to $2.84 billion in 2014. Operating income was $332 million for the second quarter, up nearly 40 percent from $234 million for the same quarter a year ago. Operating income increased on the strength of an improved sales mix and lower feed ingredient cost.

Tyson's international segment performed poorly, with sales of $222 million, down just over 32 percent from $328 million for the second quarter of 2014. Operating income was down as well, with $15 million for the second quarter, down 50 percent from $30 million for the same quarter in 2014.

The company's international segment saw reductions due to the sale of the company's Brazil operation, along with pressure from weak demand in China. Smith said the segment saw some international markets closed due to concern over U.S. outbreaks of avian flu in turkey and layer chickens, and loss of business due to port strikes on the West Coast.

During the conference call, the company said it was considering using money from the $575 million sale of the Brazilian units and operations in Mexico to rival meat company JBS SA of Brazil to pay down debt or possibly fund another acquisition. Barring that, the company is considering buying back stock.

Tyson's beef segment saw sales of $4.13 billion in the second quarter, up nearly 8 percent when compared to $3.83 billion from the same quarter in 2014. Operating income for the segment saw a loss of $20 million, down from $35 million in the second quarter last year.

Second quarter sales in the pork segment were $1.2 billion, down nearly 20 percent from $1.49 billion for the same period last year. Operating income for pork was $99 million for the second quarter, down 7 percent from $107 million in 2014.

In late May, Tyson said it will stop the use of antibiotics approved for humans in its broiler flock by 2017. Smith said Monday the move will not cost the company materially going forward, noting Tyson already raised more than 80 percent of its birds without the chickens ever being treated with antibiotics approved for human use.

He said improvements in housing for chickens and flock management overall has made it possible for the company to phase out the use of the drugs.

Business on 05/05/2015