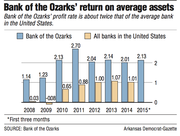

For the past five years, Bank of the Ozarks has earned money at about twice the rate of the average banks nationally, George Gleason, the bank's chairman and chief executive officer, said Monday at the Little Rock bank's annual meeting.

Since 2010, Bank of the Ozarks' return on average assets -- the ratio of profits to average assets -- has ranged from 2.01 percent last year to 2.7 percent in 2011. The return on average assets for all banks in the country ranged from 0.65 percent in 2010 to 1.07 percent in 2013.

For each of the past five years, Bank of the Ozarks has had a return on average assets above 2 percent. Only six banks in the country with at least $3 billion in assets have done that since 2010, Gleason said.

"We're pleased to be in such an elite group of banks," Gleason said.

Much of Bank of the Ozarks' statistical data -- including profits and loans -- is better than the industry average, said Matt Olney, a bank analyst with Stephens Inc. in Little Rock.

"For them to do that consistently year after year is just incredible," Olney said. "Without question, [Bank of the Ozarks] is one of the top banks in the country."

Bank of the Ozarks now has 165 offices in nine states -- Arkansas, New York, Texas, Florida, Georgia, North Carolina, Alabama, South Carolina and California. California has no branch but only a lending office. The bank has more than 1,550 employees in the nine states.

Bank of the Ozarks has about $1.3 billion in loans in Arkansas, Gleason said. New York is second in loans for the bank at almost $976 million.

Primarily because of the work of its real estate specialties group, which focuses on making relatively high-dollar loans almost anywhere in the country, Bank of the Ozarks also has loans in states where it has no offices, including Arizona, Colorado, Connecticut, Illinois, Maryland, Massachusetts, Michigan, Missouri, Ohio, Oklahoma, Oregon, Tennessee, Virginia, West Virginia and Washington.

The bank has at least $10 million in loans in each of these states.

"While we're an Arkansas-based company, and we do a lot of business here and we're growing our business here, we're also growing a very diversified national franchise," Gleason said. "This diversification based on types of loans and the geographic diversification we think is a real source of strength for our company."

The real estate specialties group has made loans in 41 states, Gleason said. The bank's leasing division has done business in all 48 contiguous states, Gleason said.

"It's not just an Arkansas story," Olney said. "They have diversified across the country. We think there is a lot more growth for the next several years."

Bank of the Ozarks has made 13 acquisitions since 2010, including the purchase of Bank of the Carolinas, which was announced this month.

"I don't see any slowdown [in purchases] for them anytime soon," Olney said. "I'd be surprised if there wasn't at least one more this year. Another two or three deals this year wouldn't surprise me at all."

Business on 05/19/2015