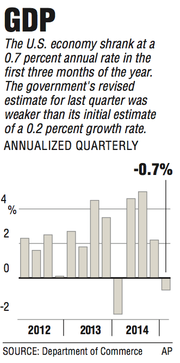

WASHINGTON -- The U.S. economy shrank at a 0.7 percent annual rate in the first three months of the year, depressed by a severe winter and a widening trade deficit, the Commerce Department reported Friday.

The government's revision for last quarter was weaker than its initial estimate of a 0.2 percent growth rate. The U.S. trade gap -- the difference between the value of exports and the larger value of imports -- was found to be wider than first estimated. And consumer spending was slower than previously thought.

But steady job gains are expected to fuel modestly healthy growth for the rest of 2015. The harsh winter, which kept many consumers home and businesses closed, and a labor dispute that slowed trade at West Coast ports are both over. Home sales and construction are rebounding, along with business investment.

Analysts generally foresee the economy, as measured by the gross domestic product, growing at an annual rate of 2 percent to 2.5 percent in the April-June quarter, with further strengthening later in the year.

But risks remain. A stronger dollar, which makes U.S. exports more expensive, will likely continue to keep the trade deficit wide. And cutbacks in oil drilling, a result of low energy prices, could depress spending in the energy industry.

"While the evidence of a second-quarter rebound hasn't been overwhelming, we still think that the outlook for the economy is very encouraging," Paul Ashworth, chief U.S. economist at Capital Economics, wrote in a research note.

Last quarter's contraction marked the first since a drop in the annual rate of 2.1 percent in the first three months of 2014, a slump that was also attributed in part to severe winter weather.

Last quarter, the trade gap subtracted 1.9 percentage points from growth, the biggest drag in 30 years. Consumer spending, which drives about 70 percent of economic activity, slowed to annual growth of 1.8 percent for the quarter, slightly below the government's first estimate. Consumers spent less on mobile-phone services, among other expenses, than initially thought.

One of the biggest hits to the economy last quarter came from cuts in drilling activity by energy companies -- fallout from the sharp drop in oil prices over the past year. The government said investment in the category that covers energy exploration plunged at an annual rate of 48.6 percent, the steepest drop since 2009, during the recession.

The government also downgraded its estimate of the boost the economy got from business restocking. That change should be a positive for second-quarter growth, because it means businesses won't have as large a backlog of unsold goods.

Not all the revisions to the initial estimate for the first quarter were lower. Housing construction and business investment in equipment were both revised higher.

Though falling GDP can be a sign of a recession, economists see little cause for such concern this year.

Many economists suspect that the government's calculations have tended to underestimate growth in the first quarter of each year. GDP has contracted in three quarters since the recession ended six years ago, and all three declines came in the first quarter of the year.

"A lot of the weakness was really contained in the first quarter," said Gennadiy Goldberg, a U.S. strategist at TD Securities USA LLC in New York. "This sets us up nicely for a rebound in the second quarter."

The outlook has brightened considerably since winter. Most economists expect lower gasoline prices will eventually accelerate consumer spending.

A Bloomberg survey of economists in May predicted growth will accelerate to a 2.7 percent pace in the April through June period.

Although the U.S. trade deficit was clearly a negative in the first quarter, some experts such as Ian Shepherdson of Pantheon Macroeconomics say a return to normal trade patterns could propel a healthy rebound in the second quarter.

But he cautioned that the data remain in flux and warned that even his own estimate could end up being wide of the mark.

"Anybody estimating gross domestic product for the second quarter is kidding themselves, because the trade data is so unpredictable at the moment, and we have no hard numbers yet," Shepherdson said.

So far, most consumers haven't used their gasoline savings to spend much more on other goods and services. The average U.S. pump price reached $2.03 a gallon in January, the lowest level in eight years. Though the average has risen back to $2.74, according to AAA, that's still nearly a dollar below its point a year ago.

Analysts also say that steady hiring, which has helped cut the unemployment rate to a seven-year low of 5.4 percent, will continue to put money in more people's hands and fuel spending gains.

"We are more than halfway through quarter two and we are seeing signs that the economy is recovering from the weak first quarter," said Jennifer Lee, senior economist at BMO Capital Markets.

She said several economic reports next week including consumer spending, the trade deficit and auto sales for May should provide important clues on the economy's momentum.

The government will release its third and final estimate for first-quarter GDP on June 24.

Consumer confidence in the U.S. fell to a six-month low in May as Americans became less positive about the prospects for the economy.

The University of Michigan said Friday that its final index of sentiment for the month decreased to 90.7 from 95.9 in April. It marked the biggest decline since the end of 2012.

Information for this article was contributed by Martin Crutsinger of The Associated Press; by Shobhana Chandra and Victoria Stilwell of Bloomberg News; and by Nelson D. Schwartz of The New York Times.

Business on 05/30/2015