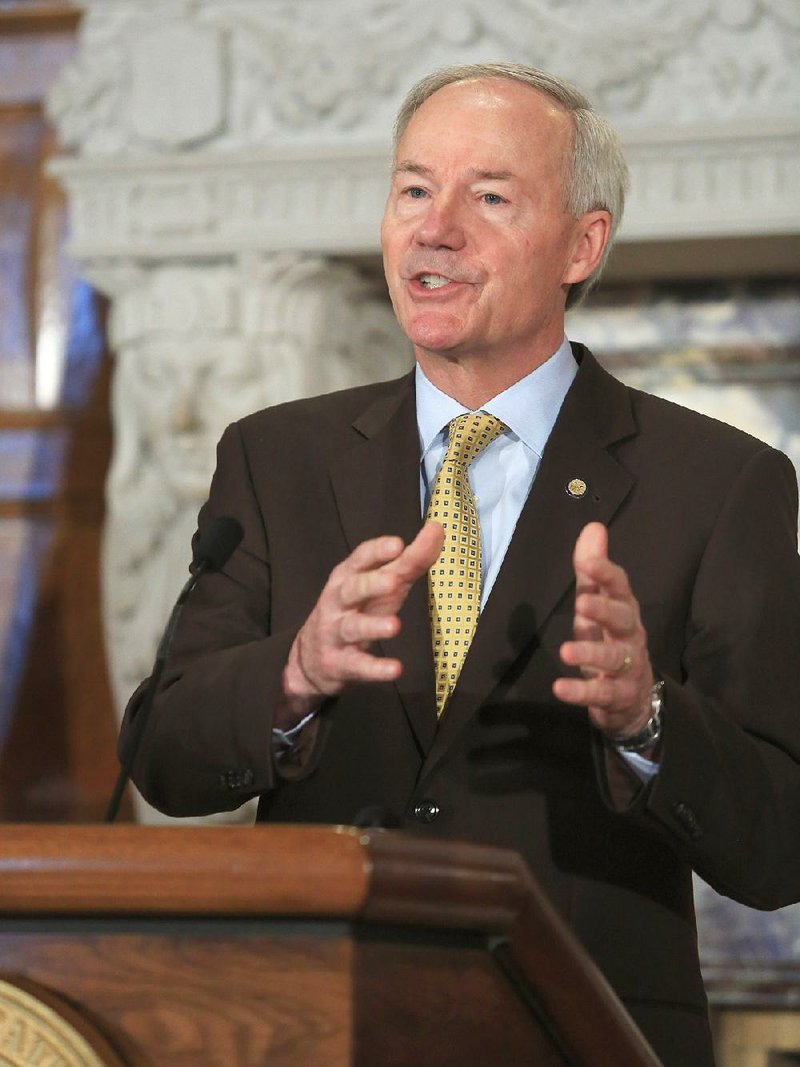

Any proposed tax increase to provide more funding for the state's highways should be offset by a tax cut, Gov. Asa Hutchinson told a trucking industry group Wednesday at its national safety conference in Little Rock.

RELATED ARTICLE

http://www.arkansas…">I-30 project faces region's six-lane limit

The Republican governor said a task force will give him a range of options to review for a different way of funding state highway construction.

Highway construction in Arkansas is now funded with a gasoline tax of 21.5 cents a gallon and a diesel tax of 22.5 cents a gallon. The tax revenue has not been enough to keep up with state highway needs.

Whatever funding methods are chosen need to be revenue-neutral, he said.

"In this political environment, I do think our legislative leaders are correct that if we are going to have any kind of a tax increase, it will have to be offset by a tax reduction.

"That is an important focus as we look at both the needs of our state in terms of highways, but also the political challenge of getting some support that is necessary to change the formula to increase our highway revenues," Hutchinson said.

He said his primary "objective is to change the formula, so we are not limited to the diesel tax per gallon, but that we can have a different formula that can grow with our economy as every other tax does."

He told several hundred people at the American Trucking Associations' conference: "We are going to work with your industry as to what the best plan is."

The governor's highway task force has determined that the state needs $110 million per year for its Highway and Transportation Department over the next three years. Since state dollars are shared, with 70 percent going to the Highway Department and the rest to city street departments and county road departments, the task force's target is devising solutions that will raise $160 million per year.

The group's recommendations include various increases in the state taxes on fuel; revenue-neutral changes in the state budget to direct more money to highways; and transfers of a portion of general revenue from the sales tax on new and used vehicles to the Highway Department over several years.

"Ultimately, it will be up to the governor and the Legislature to pick a package that incorporates their other various priorities in order to get any additional funding for highways," said Arkansas Trucking Association President Shannon Newton, who is a member of the task force.

"The task force has not addressed, and really it's not our job, to determine what's politically feasible and what there's a political appetite for," Newton said.

More money for highways "is either going to come from an increase in our diesel tax or other taxes, or it is going to come from general revenues," Hutchinson said. "General revenues have been sacred traditionally in Arkansas, and we have to be careful to make sure that we have sufficient funding for education, prisons and our other needs in this state."

Two years ago, the Legislature passed a law requiring that when the state stops making $70 million a year in desegregation payments to school districts in Pulaski County, the money will be used to reduce the 1.5 percent state sales tax on groceries to 0.125 percent.

Some House and Senate members have suggested using that $70 million for highways instead. Hutchinson said he has heard discussions about that, and "I am getting feedback on it."

The sales tax on groceries cannot be completely eliminated because in 1996 Arkansas voters approved a constitutional amendment that increased the state sales tax by one-eighth of 1 percent to fund land conservation.

The Legislature, at the behest of Gov. Mike Beebe, cut the state's sales tax on groceries from 6 percent to 3 percent in 2007, to 2 percent in 2009 and to 1.5 percent in 2011.

As for diverting the $70 million to highways, Senate President Pro Tempore Jonathan Dismang, R-Searcy, said "Honestly I don't think there has been that much discussion on the Senate side about doing that.

"That's probably because most of us were here when that grocery tax decrease was passed and the plan was set in place," he said. "It is understandable that House members that weren't here would probably have a different point of view. But at this point, I think everything should be on the table for discussion, and I don't think it is anything that should be ruled out today."

Sen. Jason Rapert, R-Bigelow, tweeted Tuesday that "I don't support repealing the law I sponsored in 2013 to eliminate the sales tax on groceries in AR. We shouldn't 'rob Peter to pay Paul.'"

But, House Speaker Jeremy Gillam, R-Judsonia, said repealing that law "may be a very viable option. But I don't know it at this point. I think it is way early in the process."

Hutchinson also expressed optimism that Congress will pass a multiyear highway bill, now that Paul Ryan is the new U.S. House speaker. Hutchinson said it's hard to predict what will emerge from the U.S. House version of the highway bill, but moving to the next step is vital for the state.

"What does that mean for Arkansas?" Hutchinson asked. "It means a reliable source of funding. Right now, the temporary [funding] extensions, the short-term extensions are not building confidence that we can enter into long-term contracts. It gives uncertainty. So we need certainty most importantly as well as increased funding. A highway bill gives us both of those."

During his address at the conference, Hutchinson said trucking is a key indicator of the economy. One in every 11 people employed in the state are in the industry, earning $3.5 billion in wages.

The governor applauded the trucking groups' continued push for legislation to let trucking companies test drivers' hair as an alternative to urinalysis in conducting drug and alcohol screenings.

Currently, urinalysis is the only form of drug screening recognized by the U.S. Department of Health and Human Services. Some companies, like Lowell-based J.B. Hunt Transport Services Inc., elect to do both kinds of testing, believing that hair tests are more effective in detecting drug use.

"That adds, obviously, to the safety of all the people on the road, and I applaud your industry for supporting that shift in testing for a more thorough safety program," Hutchinson said.

The U.S. Senate's long-term highway bill, which passed during the summer, includes an amendment that would allow trucking companies to test drivers' hair instead of urine for drug use. The House version of the bill, which moved through the Transportation and Infrastructure Committee late last month, is being debated on the House floor this week.

Hair-testing advocates are not pushing to make such tests mandatory but to give trucking companies more flexibility in their drug screens in hopes of keeping habitual offenders off the road. Currently, companies that test hair in drug screenings are required to conduct urine tests as well and pay the cost of both tests.

American Trucking Associations President Bill Graves said giving carriers the testing option makes sense, but making it a reality has been challenging.

"Apparently in Washington there's a problem with stuff that makes sense because we've struggled to get that done," Graves said. "But we're very close. And I think if we get a highway bill done, we'll probably get the hair-testing piece in there, and we think that's a good development for this industry."

A Section on 11/05/2015