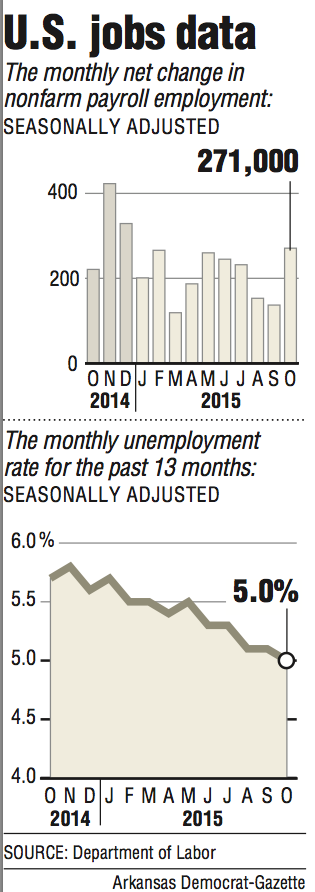

WASHINGTON -- U.S. hiring increased in October by the largest amount all year, and unemployment dropped another notch to 5 percent, increasing the likelihood that the Federal Reserve will raise interest rates next month for the first time in a decade.

With Americans spending more on everything from restaurant meals and clothing to new cars, employers added 271,000 jobs last month.

The burst of hiring, the most since December 2014, filled jobs across a range of industries as companies shrugged off slow overseas growth and a struggling manufacturing sector. Significant job gains occurred in the construction, health care and retail sectors.

"It's a solid labor market," said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York and a former economist at the Fed. "The report is pretty good across the board. December is now a very high likelihood for the Fed to hike rates."

Friday's report from the government suggested that the U.S. economy is rebounding after a worrisome summer and is continuing to outshine other major economies. During August and September, U.S. hiring had flagged amid financial turmoil in China and faltering growth in Europe and emerging markets.

Even so, American consumers have kept spending at a healthy pace, supporting strong job growth even as factory payrolls were flat last month and oil and gas drillers cut jobs.

After a prolonged period of relatively stagnant pay raises for many Americans, last month's robust hiring also raised the average wage 9 cents to $25.20. That wage is 2.5 percent higher than 12 months ago, the sharpest year-over-year gain since July 2009. The percentage gain is comfortably above inflation, which was been flat in the past year.

The solid pay gains should fuel more consumer spending in coming months, which, in turn, could support further hiring, economists said.

"These are very strong numbers and likely to continue," said Carl Tannenbaum, chief economist at Northern Trust.

Retailers added nearly 44,000 jobs in October, the most since November and a sign that they anticipate healthy sales for the Christmas shopping season. Hotels and restaurants added 41,000.

"The weaker job gains in the previous two months look like nothing more than speed bumps," said Mark Zandi, chief economist for forecaster Moody's Analytics. "At this pace of job growth, unemployment and underemployment are rapidly declining, and full employment is coming into view."

During October, many higher-paying sectors enjoyed healthy gains, notably professional and business services, which includes lawyers, architects and engineers. That sector added 78,000 positions, the most in nearly a year.

Some economists cautioned that the explosiveness of October's job growth was likely in part a bounce back from the tepid gains in August and September, when fears about the global economy had led some employers to hold back.

"We see some makeup from hiring that was put off when the economy was hesitant in the late summer and early autumn," said Patrick O'Keefe, director of economic research at CohnReznick.

Any job gain above roughly 150,000 was expected to keep Fed policymakers on track to raise interest rates from record lows at their Dec. 15-16 meeting, though the Fed will have one more jobs report to digest before then.

Fed Chairman Janet Yellen and other leading Fed officials have said that the economy is generally healthy and that the December meeting is a "live possibility" for a rate change.

"This data tips the scales toward a rate hike in December but more importantly is a sign that our economy may have more punch than we thought," said Tara Sinclair, chief economist for job site Indeed.com.

Investors have raised to about 70 percent the probability of a rate increase at policymakers' December meeting, according to pricing in the federal funds futures market. That compares with 56 percent on Thursday.

Consistently strong hiring would continue to reduce the unemployment rate. The economy typically needs only about 100,000 jobs a month to keep unemployment from rising. That figure has fallen in recent years as an aging population and increasing retirements by baby boomers have slowed the growth of the U.S. workforce.

Other data show that consumers have kept spending in part because of lower gasoline prices and a recovery in the stock market. The economy grew at just a 1.5 percent annual rate in the July-September quarter. The slowdown occurred mostly because businesses cut back on their stockpiles and exports weakened.

Still, Americans increased their spending at a healthy 3.2 percent annual pace. That spending has encouraged many services firms, which make up roughly 80 percent of the economy, to step up hiring.

Information for this article was contributed by Christopher S. Rugaber, Josh Boak and Paul Wiseman of The Associated Press; by Shobhana Chandra of Bloomberg News; and by Kevin G. Hall of McClatchy Washington Bureau.

Business on 11/07/2015