Wal-Mart Stores Inc. saw same-store sales in the U.S. grow for a fifth-consecutive quarter, a measurement the company's executives used to illustrate that their turnaround plan is working.

Traffic increased for a fourth-consecutive quarter in U.S. stores, up 1.7 percent. Same-store sales were up 1.5 percent, drawing attention away from a decline in earnings that the company warned investors last month was coming. Same-store sales is a measurement used to compare year-to-year changes in sales, based on a fixed number of stores.

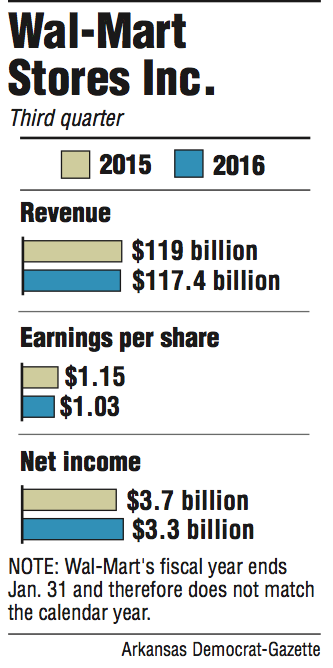

Wal-Mart reported quarterly earnings of $3.3 billion, down 10.8 percent from a year ago, and earnings per share declined from $1.15 to $1.03. Earnings did beat analyst estimates of $0.98.

Still, executives were pleased with the results from the company's U.S. division. Wal-Mart U.S. accounts for about 60 percent of the company's total revenue. Wal-Mart Stores Inc. reported overall revenue of $117.4 billion, down from $119 billion last year.

Greg Foran, Wal-Mart U.S. CEO, said increases in same-store sales and traffic are proof that the retailer is headed in the right direction. Net sales were $2.7 billion, up 3.8 percent from last year.

"We would say we're starting to get some good momentum," Foran said in a conference call.

Foran and other executives have stressed that stores need to be "clean, fast and friendly." Company measurements indicate that 70 percent of stores are meeting or exceeding benchmarks that measure those three areas, and Foran said Wal-Mart will raise expectations next year.

Randy Koontz, vice president of investments for Pinnacle Wealth Management of Raymond James & Associates Inc. in Rogers, said modest increases are possibly a reflection of retail in general and not specific to struggles Wal-Mart is facing. Because of that, any growth could be viewed as a positive.

Improvements are particularly important for Wal-Mart, which has invested heavily in increasing in-store labor and wages.

"Mr. Foran says that the investment in associates and wages, while hitting profits, are also starting to translate into better customer service and helping to lift sales," Koontz said. "That seems, to me, to be the key for domestic sales for the foreseeable future, because that is the bet Wal-Mart management has made."

Neighborhood Markets continued to perform well for Wal-Mart, reporting an 8 percent increase in same-store sales for the quarter. Foran also was pleased with a 1.9 percent decrease in inventory that came without decreasing in-stock or sales levels in stores.

The performance of Wal-Mart U.S. does seem to indicate that the turnaround plan is working, Stephens retail analyst Ben Bienvenu said.

"I think the most noteworthy element of the results was same store traffic being up 1.7 percent," Bienvenu said. "It was the fourth consecutive positive traffic [comparison] they delivered. It goes back to them spending a lot of money in stores, both in wages and e-commerce, but it is evidencing itself on the sales side. That is encouraging. I suspect management is encouraged by that."

Other results for Wal-Mart Stores Inc. were viewed as less positive, however.

Wal-Mart International saw sales decline 11 percent for the quarter, and income was impacted by 4 cents because of currency exchange rates. Sam's Club sales were down 2.2 percent when including fuel purchases and up 1.6 percent when not including fuel.

Global e-Commerce had a 10 percent increase in sales. That number was strong compared with other divisions, but well behind the 15-plus percent growth experienced in previous quarters. Weak performance in Brazil and China was a drag on online results.

Wal-Mart adjusted its guidance for the full year to between $4.50 and $4.65 per share. Initially, executives had estimated earnings would be between $4.70 and $5.05 per share.

Shares of Wal-Mart stock ended the day at $59.92, up 3.5 percent. Edward Jones retail analyst Brian Yarbrough said the size of the increase was somewhat surprising but not entirely unexpected after the way investors reacted to last month's presentation by company executives.

Wal-Mart laid out a three-year plan that included a warning that earnings could drop as much as 12 percent in fiscal 2017. Wal-Mart is currently in fiscal 2016. Following the presentation by Wal-Mart executives on Oct. 14, the company's stock price dropped 10 percent in a single day.

"I thought it would be up a little just because it's been so beaten up," Yarbrough said. "I still think you've got another down year next year, you've got all these investments in labor and e-commerce. ... Look, I think they're doing everything they can. They're doing all the right things for the business longer-term. It's going to be difficult."

CEO Doug McMillon, in a prerecorded call for analysts, said the retailer believes that it is on the right track. Investments in e-commerce will help Wal-Mart better serve customers who shop online and in-store and that the money spent on improving employee wages and increasing labor in stores is paying off, even if profits are lower than the company would like.

"We're confident these are the right steps because we know where and how we are going to win," McMillon said. "We will be the first to deliver a seamless shopping experience at scale. ... We will add between $45 [billion] and $60 billion of revenue to the company in the next three years. That's a lot of growth; it just happens to be on a big base."

Business on 11/18/2015