State general revenue in September slipped slightly compared with a year ago but still exceeded the state's forecast.

Last month's collections decreased by $8.4 million, or 1.4 percent, from year-ago figures to $577 million and were $13 million, or 2.3 percent, above the state's projections, the state Department of Finance and Administration said Friday in its monthly revenue report.

The growth in sales and use tax collections exceeded the state's forecast for the sixth consecutive month, while the state's individual tax collections dropped last month from a year ago partly as a result of having one less payday, state officials said.

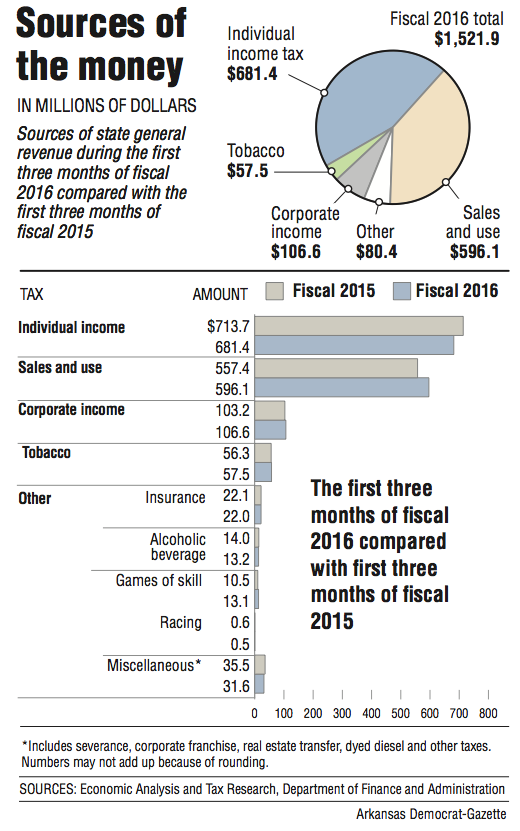

Individual income taxes and sales and use taxes are state government's biggest sources of state general revenue.

Gov. Asa Hutchinson said he's "encouraged by the sales-tax revenue uptick."

"It's good momentum for the economy of Arkansas. But we continue to budget cautiously and in a conservative manner," the Republican said in a written statement.

The state's record tax revenue for the month of September is the $590.3 million collected in September 2013, said Whitney McLaughlin, a tax analyst for the finance department.

John Shelnutt, the state's chief economic forecaster, said September's 8 percent increase in sales and use tax collections compared with a year ago was "broad-based" and that the recent stock market downturn didn't appear to be stopping people from spending money.

The state has experienced good job growth, he said.

Arkansas' unemployment rate dropped to 5.4 percent in August, down from 5.6 percent in July, the U.S. Bureau of Labor Statistics reported two weeks ago in its latest figures on the state. The national unemployment rate in August was 5.1 percent, the same as in September.

Arkansas' rate in August was the lowest since July 2008, when it fell to 5.3 percent.

The lowest the unemployment rate has dipped in the past 25 years was 4.2 percent, where it stood for six months from April to September 2000.

State government's fiscal 2016 started July 1.

During the fiscal year's first three months, state general revenue increased by $8.7 million (0.6 percent) from the same period last year to $1.52 billion and exceeded the state's forecast by $40.7 million (2.7 percent).

Sales and use tax collections increased by $38.8 million (7 percent) from the same three-month period last year to $596.1 million and exceeded the state's forecast by $27.7 million (4.9 percent).

Individual income tax collections in the first quarter of fiscal 2016 declined by $32.3 million (4.5 percent) from the same period last year to $681.4 million, but are $8.1 million (1.2 percent) above the state's forecast.

Cuts in individual income tax rates, enacted by the 2013 Legislature, are projected by the finance department to reduce state general revenue by $55 million in fiscal 2016.

State tax refunds and several other government expenditures come off the top of total general revenue, leaving "net" general revenue that agencies are allowed to spend.

During fiscal 2016's first three months, the net increased by $14.4 million (1.1 percent) from the same period last year to $1.33 billion and exceeded the state's forecast by $49.9 million (3.9 percent.)

"I was pleased with that we are 3.9 percent above forecasts, over projection. This was a great start to the year," Hutchinson said at a news conference at the state Capitol.

Finance department Director Larry Walther said he doesn't expect the state to have similar surpluses in each of the next three quarters or to end fiscal 2016 with a $200 million surplus.

"We take one month at a time," he said.

The net in September decreased by $4.7 million (0.9 percent) from a year ago to $516 million, yet still exceeded the state's forecast by $15 million (3 percent).

Earlier this year, the Republican-controlled Legislature enacted a $5.18 billion general-revenue budget for fiscal 2016 -- a $127 million increase from 2015 -- as it approved tax cuts projected to reduce state general revenue by $26.5 million in fiscal 2016 and nearly $101 million in 2017.

According to the finance department, September's general revenue included:

• A $26 million (8.9 percent) decrease in individual income tax collections from a year ago to $265.3 million, falling $4.2 million (1.5 percent) below the state's forecast.

Withholdings are the largest category of individual income tax collections. They dropped by $30.6 million from a year ago to $173.8 million, falling $9.9 million short of the forecast.

Last month had one less payday than in the same month in 2014, resulting in a reduction in the state's individual income tax collections, state officials said.

• A $14.7 million (8 percent) increase in sales and use tax collections from a year ago to $198.4 million, exceeding the state's forecast by $11.1 million (5.9 percent).

"The results reflect continued growth in underlying economic indicators for consumption and now totals six consecutive months of elevated growth in collections," the department said in its written report.

• A $3.1 million (4 percent) increase in corporate income tax collections from a year ago to $80.1 million, surpassing the state's forecast by $5.4 million (7.2 percent).

• A $0.8 million (4.3 percent) increase in tobacco tax collections from a year ago to $18.6 million, exceeding the state's forecast by $0.8 million (4.3 percent). Monthly changes in tobacco tax collections can be attributed to uneven patterns of tobacco stamp sales to wholesale purchasers, the department said.

• A $0.7 million (20.2 percent) increase to $4.4 million in collections from "electronic games of skill" at Oaklawn Park in Hot Springs and Southland Park in West Memphis, exceeding the state's forecast by $0.8 million (21.8 percent).

Information for this article was contributed by Brian Fanney of the Arkansas Democrat-Gazette.

Metro on 10/03/2015