It took more than two years of negotiations, but the parties to a forfeiture complaint involving One Bank & Trust of Little Rock have settled their differences.

In July 2013, about 3½ months after the death of Layton Stuart at age 62, the federal government sought to have nearly $18 million in his assets -- primarily proceeds from a life insurance policy on Stuart -- turned over to the government, claiming that the money constituted "the fruits and derivatives of criminal activity."

Stuart was chairman, chief executive officer and almost 100 percent owner of One Bank, which is branded as "onebanc" in its advertising.

In the settlement, One Bank received $6.9 million, $4 million went to the U.S. Treasury and $4 million went to Stuart's widow and children. One Bank previously had received $3 million as repayment for premiums the bank paid for 10 years on Stuart's policy.

Stuart was forced out in 2012 at One Bank by federal regulators who told him to relinquish any bank-owned property and ordered the bank to eliminate Stuart's access to bank records.

Banking experts considered it to be one of the most serious orders ever handed down by federal regulators against an Arkansas bank.

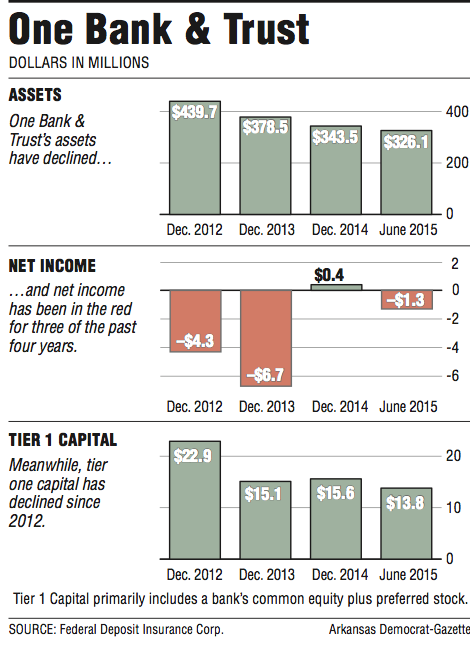

Since 2012, One Bank has lost $11.9 million, its assets have fallen $113.6 million and its capital level has dropped $9.1 million.

The bank has been deteriorating, said Tom Prince, who was appointed as a special administrator last year in the probate case of Stuart's estate.

"As long as the dispute [with the government] was outstanding and the bank was bleeding capital every quarter, nobody was really interested in stepping in and buying the bank, in my opinion," said Prince, a former Little Rock mayor and president of Little Rock-based Worthen Bank in the 1980s. "Most knowledgeable people would either try to cut a sweetheart deal or wait and see if the bank would fail."

The settlement allows One Bank's executives to stabilize the bank where they could begin talking in earnest with possible buyers, Prince said.

"A lot of people have been working hard to try to salvage a community bank," Prince said.

The Stuart family wanted more "but we're grateful we got what we got," said Richard Torti, the executor of Stuart's estate.

The Stuart family had not been paid their money from the settlement as of last week and Torti also has not been paid for his work since 2013, he said.

One Bank will put the $6.9 million toward its capital, said Jerry Pavlas, One Bank's chief executive officer. Pavlas has a history of of repairing banks in poor condition, including one Texas bank that had $800 million in assets when Pavlas took over and $2.6 billion in assets when it was sold.

"The next step is taking advantage of this additional capital," said Pavlas, 66. "The legal lending limit goes up. It helps us accelerate our return to profitability. And we will try to take care of the issues that are currently at the holding company."

One issue is that the owner of One Bank hasn't been determined, Prince said. Technically, all of the bank is owned by the holding company, One Financial Corp., and the holding company is completely owned by the Layton Stuart estate, Prince said.

But the Stuart family relinquished any ownership interest when it received $4 million in the settlement agreement, Prince and Torti said.

The government and Johnelle Hunt, the billionaire widow of trucking tycoon J.B. Hunt, are still "slugging it out over who should own the bank," Prince said.

Stuart borrowed $26 million from J.B. Hunt businesses and still owed about $10.6 million when he died. Stuart secured the loan with the stock of One Financial, according to BHL Financing, owned by Hunt, in a 2013 filing. Stuart also borrowed more than $5 million from another Hunt firm and still owes about $4.6 million on that loan.

There is one other owner of preferred stock in the holding company, Prince said. StoneCastle Financial Corp. of New York, which has investments in community banks across the country, has invested $7 million to $8 million in trust preferred shares in the holding company, Prince said.

Because of its loss history, it is difficult to determine how much One Bank is worth but its book value is almost $13 million.

Any sale of the bank has to be approved by the holding company, Prince said. There is a provision that could allow stock to be transferred out of the estate to a special trust established for the benefit of the government and Johnelle Hunt, Prince said.

Torti believes Stuart wasn't guilty of all the accusations against him.

"If [the government] thought he was guilty, why would they settle?" Torti said. "If they could have proven beyond a reasonable doubt that he was guilty, why would they settle?"

Prince has a different perspective.

"I think [Stuart] treated the bank like it was the corner grocery store that he owned," Prince said, "and he could dip into it any time he wanted to. You can't do that, even if you're 100 percent owner of the stock.

"I don't know what was inside his mind, whether he meant to steal or not. But I know how he operated. He made some serious mistakes. He liked to live the high life and it cost a lot of people."

SundayMonday Business on 10/12/2015