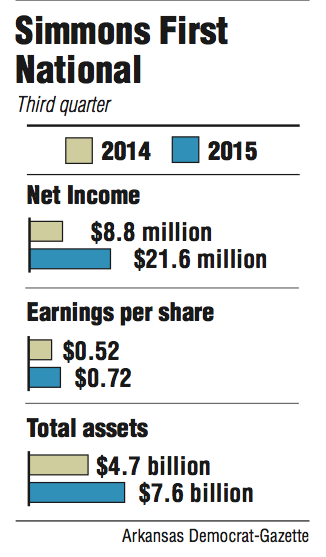

Simmons First National Corp. earned $21.6 million in the third quarter, more than double the $8.8 million it earned in the same period last year, the Pine Bluff bank said Thursday.

The bank had earnings per share of 72 cents. Excluding one-time costs, Simmons had earnings of 85 cents per share, beating the estimate of 81 cents per share from five analysts surveyed by Thomson Reuters.

Simmons closed up $4.05, or almost 8.5 percent, a share to $52.00 Thursday in trading on the Nasdaq exchange, reaching a 52-week high.

Excluding loans that were acquired through bank acquisitions, Simmons increased its loans by almost 50 percent in the third quarter.

The markets that are primarily responsible for Simmons' loan growth are the Little Rock area; Wichita, Kan.; the St. Louis area; Pine Bluff; and southeast Arkansas and the Jonesboro area, George Makris, Simmons' chairman and chief executive officer, said in a conference call Thursday.

"We see a lot of upside potential in those markets," Makris said.

The bank is making progress with improving its efficiency, both in revenue growth and expense control, Makris said.

Simmons had an efficiency ratio of 57.54 percent in the third quarter. That means it cost Simmons $57.54 to earn $100.

Simmons has done a good job cutting its expenses, said Matt Olney, a banking analyst in Little Rock with Stephens Inc.

"[Expenses] were lower than I expected," Olney said.

Lowering expenses and becoming more efficient makes Simmons more profitable, Olney said.

"That's been a big part of the Simmons story over the last year or so," he said.

Simmons is due for another acquisition, Olney said.

"They've been pretty quiet for a while now," Olney said.

Simmons hasn't announced a bank acquisition in more than a year. In May 2014, it announced it would buy Community First Bancshares of Union City, Tenn., and Liberty Bancshares of Springfield, Mo. Both of those deals closed in the first quarter of this year.

There were six-month regulatory delays in the closing for both of those purchases, Makris said.

Simmons is active in discussions about banks to acquire, both inside and outside its existing markets, Makris said.

"We believe that is still a great strategy for our organization," Makris said. "We're prepared to announce a deal if the right deal comes along."

Olney expects Simmons will announce another acquisition over the next few months, he said.

Simmons has $7.6 billion in assets, and that will rise to $8.6 billion when its purchase of Ozark Trust and Investment Corp. of Springfield, Mo., closes soon, Makris said.

Simmons has been talking with advisers about how to prepare for surpassing $10 billion in assets, which will bring extra costs and regulatory scrutiny, Makris said.

Business on 10/23/2015