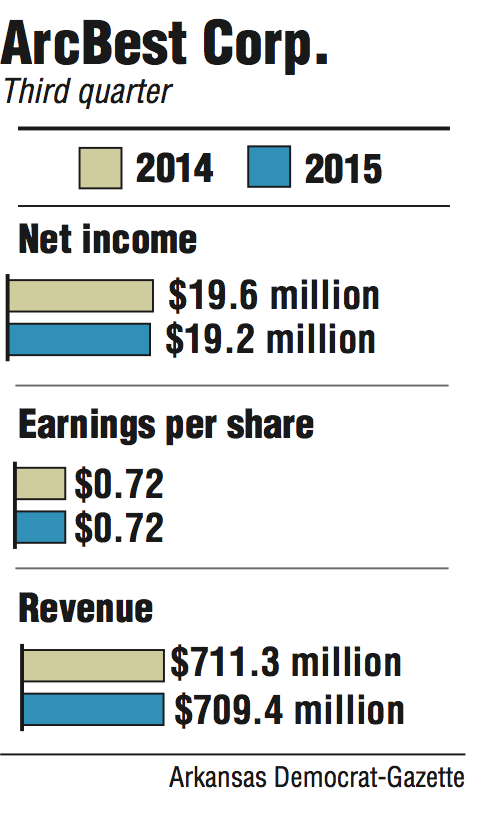

ArcBest Corp. reported $19.2 million in net income for the third quarter of 2015, a 2.4 percent decrease from the same period last year.

Earnings per share of 72 cents for the quarter matched the previous year's results, while revenue slipped to $709.4 million. The results missed analyst expectations of 79 cents per share and $715.1 million in revenue for the quarter.

The Fort Smith-based company attributed the net income and revenue decline to weaker freight demand, lower industrial manufacturing production and weaker consumer spending. ArcBest Chief Executive Officer Judy McReynolds said there were encouraging factors despite "general economic weakness and lower fuel surcharges."

"The pricing environment remains favorable, and I was pleased to see ABF Freight trim its operating ratio and improve dock-handling metrics," McReynolds said. "The double-digit increases in revenue at ABF Logistics, ABF Moving and FleetNet America also were encouraging."

ABF Freight, ArcBest's largest subsidiary, reported $511.3 million in revenue for the quarter, down from $523.4 million over the same period a year ago.

The trucking division saw a 1.1 percent increase in the number of shipments for the quarter, but tonnage dropped 2.5 percent. ArcBest said the decrease was because of softer freight demand and smaller customer shipments.

"The message without question for ArcBest and for others that provide less-than-truckload services is we are seeing some softening in demand. ArcBest sort of alluded to that," said Brad Delco, a transportation analyst for Stephens Inc. in Little Rock. "You have to ask yourself what does it mean when we're shipping the same number of packages, but the weight of those shipments are less? You're seeing some slowdown in activity."

The slowdown led to a reduction in ABF Freight employees. McReynolds said about 150 people -- 100 in September and 50 earlier this month -- were laid off by the company. ABF Freight has about 11,000 employees, according to a spokesman. No other details were provided.

The company also implemented a 4.95 percent general rate increase at ABF Freight that went into place on Oct. 5 and applies to 35 percent of the business.

Delco said it's no surprise as ArcBest emulates other less-than-truckload carriers like FedEx and UPS, which have previously announced increases.

"Once it sort of starts everybody does the same," Delco said. "But is it sticking? Are customers accepting higher rates despite there being a softer demand environment? It sounds like they were."

McReynolds said ArcBest's non-asset businesses -- Panther Premium Logistics, ABF Logistics, FleetNet and ABF Moving -- "continue to evolve as an important part of the services we offer to customers" after reporting $211.1 million in revenue during the quarter. It represented a 6.1 percent increase from the same period last year and 29 percent of ArcBest's total revenue in the third quarter.

The businesses accounted for 28 percent of ArcBest's revenue last year.

ABF Logistics, FleetNet and ABF Moving all reported double-digit increases in revenue, while Panther's performance dipped from its record levels in 2014. Panther's $73.6 million in revenue was an 11.1 percent decrease from $82.8 million in the third quarter of 2014.

David Cobb, ArcBest's chief financial officer, said Panther's revenue totals for October are projected as 14 percent lower compared to 2014 despite a 5 percent increase in loads handled. ABF Freight's projected revenue for October is estimated to be 3 percent to 4 percent lower as well, while projections show total tonnage decreases between 5 percent and 6 percent.

Still, Delco said the overall revenue growth among the non-asset businesses and productivity improvement at ABF Freight have produced good results considering the environment. He also pointed to ArcBest's strong balance sheet and efforts to return value to shareholders.

"This is a company that continues to invest in growth and diversifying the business, all of which puts them in a good spot," Delco said.

ArcBest recently announced that it was raising its quarterly dividend to 8 cents, up from 6 cents, to shareholders of record as of Nov. 5. The company's board of directors also extended its stock repurchase program, making $50 million in company stock available for purchase.

"We believe our future is bright and opportunities for further progress are available," McReynolds said. "Following these recent actions, we continue to have the financial resources to execute on those opportunities in a manner that will strengthen ArcBest's value for both customers and shareholders."

Business on 10/31/2015