Bolstered by rising sales-tax collections, state general revenue in August increased by $21.1 million from a year ago to $478.1 million.

Last month's general revenue exceeded the state's forecast by $23.2 million, the state Department of Finance and Administration said Wednesday in its monthly revenue report.

August's general revenue of $478.1 million is a record for the month, surpassing the $457 million collected a year ago, said Whitney McLaughlin, a tax analyst at the Department of Finance and Administration.

Gov. Asa Hutchinson said the stock market's fluctuations of the past week "remind us that our economy continues to react to uncertain global conditions.

"It is reassuring that our state revenues continue strong, and it gives us a growing sense of confidence that Arkansas is headed in the right direction," the Republican said in a written statement.

August was the fifth consecutive month that sales- and use-tax collections increased from year-ago figures, said finance department Director Larry Walther.

"That has been pretty positive from our view as an indicator of the economy in Arkansas," he said.

Richard Wilson, assistant director of research for the Bureau of Legislative Research, said the recent downturn in the stock market may lead to a "future decline in [the] consumer confidence index," to people spending less money and to reduced sales-tax revenue.

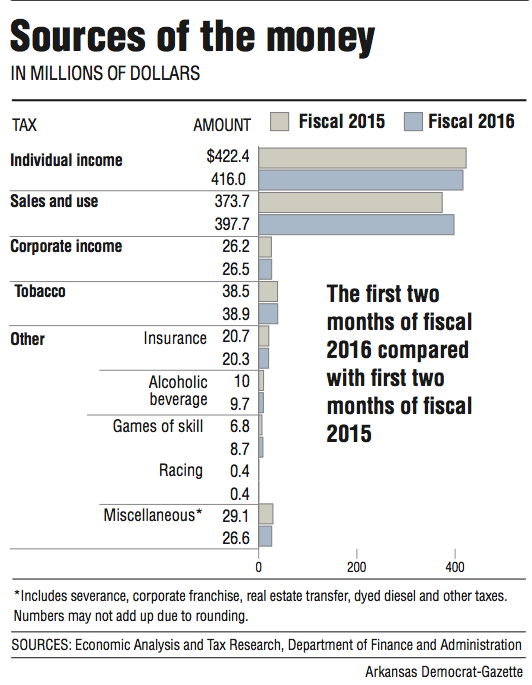

Individual income taxes and sales and use taxes are the two largest sources of state general revenue.

Tax refunds and several other government expenditures come off the top of total general revenue, leaving "net" general revenue that agencies are allowed to spend.

The net in August increased by $23.1 million (5.8 percent) from a year ago to $421.4 million, exceeding the state's forecast by $28 million (7.1 percent), the finance department reported.

Fiscal 2016 began July 1.

In the fiscal year's first two months, the state's general revenue has increased by $17.1 million (1.8 percent) from the same period in fiscal 2015 to $944.9 million. That's $27.7 million (3 percent) above the state's forecast.

During that time, the net has increased by $19.1 million (2.4 percent) from the same period last year to $820.6 million. That's $34.8 million (4.4 percent) above the state's forecast.

"Overall, we've had a good month," Walther said.

But it's still early in the year, he said: "We have got 10 more months to go, and a lot will happen over the next 10 months."

Earlier this year, the Republican-dominated Legislature enacted a $5.18 billion general budget for fiscal 2016 -- a $127 million increase from fiscal 2015 -- as it approved tax cuts projected to reduce state general revenue by $26.5 million in fiscal 2016 and nearly $101 million in fiscal 2017.

According to the finance department, August's general revenue included:

• A $16.4 million (8.7 percent) increase in sales and use taxes from a year ago to $204.6 million, which exceeds the state's forecast by $12.7 million (6.6 percent.)

These collections include one-time payments of about $6 million from sales-tax audits. Even if the $6 million is factored out, the state's sales-tax collections still increased by more than 5 percent from a year ago, Walther said.

People are spending more money because of a combination of "fairly good job growth and low gas prices," said John Shelnutt, the state's chief economic forecaster.

Motor-vehicle sales-tax collections in August increased by 11.2 percent from a year ago, so "there is a lot of purchases of vehicles, both new and used vehicles," said Walther.

Arkansas' unemployment rate dropped to 5.6 percent in July from 5.7 percent in June, the U.S. Bureau of Labor Statistics reported last month.

The national rate was 5.3 percent in July.

The state's unemployment rate has fluctuated between 5.6 percent and 5.8 percent since September 2014. It hasn't slipped below 5.6 percent since August 2008, in the middle of the recession.

• A $6 million (2.9 percent) increase in individual income-tax collections from a year ago to $215.2 million, exceeding the state's forecast by $11.5 million (5.6 percent.)

Withholdings is the largest category of individual income-tax collections.

Last month's withholdings increased by $5.2 million from a year ago to $202.8 million, which is $10 million above the state's forecast.

Shelnutt said August had one more Friday payday than a year ago and that "we expect it to flip in the September collection."

Walther said he expects September's individual income-tax collections to be "down a little" and that "there should be an offset" to August's collections exceeding the forecast by $11.5 million.

• A $1.7 million (21.3 percent) dip from a year ago to $6.2 million in corporate income-tax collections, falling $1.5 million (20 percent) short of the state's forecast. State officials have said that corporate income taxes are often a volatile source of taxes.

• A $500,000 (2.6 percent) increase in tobacco tax collections over year-ago figures to $18 million, which is $200,000 (1.1 percent) above the state's forecast. Monthly changes in tobacco tax collections can be attributed to uneven patterns of tobacco stamp sales to wholesale purchasers.

Metro on 09/03/2015