Arkansas Baptist College is in jeopardy of losing its accreditation, in part because of its debt, even though it secured a $30 million federal loan last year to shore up its finances.

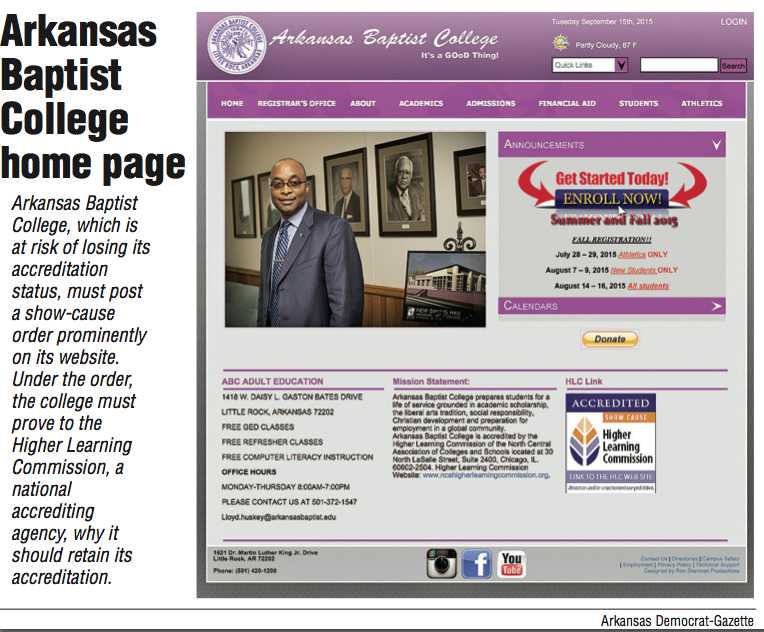

The Higher Learning Commission, a Chicago-based national accrediting agency, issued a "show-cause" order to the private college in Little Rock last month, documents show. Under the order, posted on the commission's website, the college will retain its accreditation status for the time being but must prove to the commission why it should keep it in the future.

"In light of the significant progress the institution has made in every area of its operation as we prepared for the loan from the U.S. Department of Education, we were not expecting this finding from [the commission]," LaCresha Newton, chief of staff for college President Fitz Hill, said Tuesday.

"There were no issues that the HLC raised as concerns that we have not already addressed or are in the process of addressing. It's apparent that there is a significant lag time between the HLC review of our status and the time in which they have issued this change in status," Newton said.

If a college or university isn't accredited, it will not be eligible for federal student financial-aid dollars. More than 95 percent of the 1,003 students enrolled at Arkansas Baptist in the fall of 2013 were receiving grants or scholarship aid, data from the U.S. Department of Education show.

For several years, the college has faced what Hill called "cash flow problems." The commission had received student and staff complaints about delays in receiving financial-aid checks and paychecks from the college, and vendors had complained about outstanding debts.

Those debts resulted in several civil lawsuits, in which the companies demanded payment.

The commission questioned whether the college could meet its financial obligations and whether the college's leaders could fulfill the institution's mission. The panel placed the college on "notice status," meaning it was at risk of noncompliance with one or more accreditation standards.

The college submitted a report to the commission in August 2014 to allay the accrediting agency's concerns, and the commission sent a review team to the college for a site visit earlier this year.

In December, the college caught a break, receiving a $30 million federal loan guaranteed through the U.S. Department of Education. The college used part of the loan to pay its two biggest debts, totaling $25.6 million, to two local banks. Revenue from student tuition and future capital campaigns will repay the federal loan, the college's officials have said.

The federal Education Department still had the college listed on Heightened Cash Monitoring status as of June 1. Later that month, the Higher Learning Commission said it needed further evaluation and information before taking more action.

On Aug. 21, the commission found the college in violation of four accreditation and component standards. The commission posted its findings on its website last week.

One standard ensures "the institution operates with integrity in its financial, academic, personnel and auxiliary functions." The commission said the historically black college's recent financial audits and commission reports since the fall of 2013 have shown a "significant lack of internal financial controls and appropriate financial practices," which could lead to the college's inability to monitor its finances.

"While the College has indicated in its response to this concern that it has hired a qualified individual for a new administrative position overseeing finances and that this individual is working to improve internal financial controls and practices and is drafting new financial policies, the College has not provided evidence to demonstrate that these initiatives will be any more successful than previous initiatives in establishing appropriate financial controls or ensuring that effective oversight of finances is taking place at the College," commission President Barbara Gellman-Danley wrote to Hill on Sept. 9.

Gellman-Danley noted that the college has had three chief financial officers in the past 18 months to two years.

The accrediting agency also said Arkansas Baptist's board was not sufficiently autonomous to make decisions in the best interests of the college and to assure its integrity. Specifically, the agency said, it didn't have evidence showing that the board was regularly reviewing budget information.

"The Board of the College was aware that the former CFO paid certain vendors directly when the College was short on cash and was reimbursed by the College at a later date, which is an irregular financial practice," Gellman-Danley wrote.

"While the College notes in that response the extremity of circumstances surrounding this practice, the College does not seem to understand the inherent conflict of interest in a CFO loaning money to the College, paying its bills from the loan, and reimbursing himself, nor has the College identified mechanisms in place such as policies, processes, or other written commitments to ensure the practice does not occur in the future."

The commission's other concerns pertained to uncertainties that the school's resource base could support its current educational programs, and that leadership and collaborative processes were not effective enough to enable the college to fulfill its mission.

Concerns also surrounded the chief financial officer's position.

Arkansas Baptist College hired Charlotte Comer in June 2014 as its chief financial officer, but college officials kept the former chief financial officer "as a consultant" for about 10 months. The person who formerly held the position reported directly to the chairman of the college's board finance committee instead of to the president, documents show.

"The CFO hired in summer 2014 ... indicated that she requested documentation from the previous CFO ... and in spite of beginning her employment in July 2014, she did not receive such documentation until May 2015," Gellman-Danley wrote.

She added: "The general ledger for the prior year [fiscal 2014] for the College was located, not on College premises, but on the computer of the former CFO who was on retainer at $5,000 per month, according to Board minutes, to assist in the preparation of the FY2014 audit ... neither the Commission evaluation team in February 2015 nor the auditors engaged by the Commission to conduct an investigation of the College's finances during spring 2015 were able to access this information and were told by College personnel that it was only available to the former CFO on his computer."

The commission noted the college's improved financial picture after it received the federal Education Department loan.

But, "the College has acquired its recent financial stability through continued indebtedness even though the sources of loan monies have changed," Gellman-Danley wrote.

Bob Childress, a certified public accountant and chairman of the college's board of trustees finance committee, cited the commission's "significant lag time" between the review and the issuance of the "show-cause" status.

"The HLC asked for a forensic audit to determine if there was any basis for allegations of ethical or financial improprieties at the College," Childress said in a statement Tuesday. "The HLC forensic audit found absolutely no indication of ethical or financial improprieties. The audit did identify other areas for improvement, [of] which we were aware."

Arkansas Baptist College's board chairman, Beth Coulson, met with the commission's staff members Tuesday to "advise them of the significant differences between their findings of over one year ago, and the current condition of the institution," according to a news release from the college Tuesday.

"In our 132-year history, Arkansas Baptist College has never been stronger, more successful in meeting its goals, not had a stronger faculty or staff," Coulson said in Tuesday's prepared statement. "Over the last few years, we have faced some difficult challenges, but they have made us stronger and more resilient than ever."

The college will have until February to send the commission a report showing evidence of improvements in the four areas. The commission members are tentatively scheduled to visit the campus in April for an evaluation and to make a decision on the college's accreditation status by November 2016.

A recent U.S. Government Accountability Office report found that in a 4½-year period, independent accrediting agencies recognized by the federal Education Department sanctioned about 8 percent of schools for noncompliance with accreditation standards. Only about 1 percent of the schools had their accreditations pulled, the report found.

Financial problems are generally at the root of accreditation concerns, said Ben Miller, the senior director for postsecondary education at the Washington, D.C.-based Center for American Progress, a nonpartisan policy institute.

"If the college actually loses its accreditation, it becomes ineligible for any federal student loans and grants," he said. "For most colleges, losing accreditation is akin to a death blow because they are so dependent on federal money that they cannot exist without it."

While agencies rarely pull accreditation from a school, Miller said, it has become a bit more frequent in recent years because small, private colleges are financially struggling.

"They're in a hard spot," he said. "They're not a rich college that can depend on its endowment. They're not a public college that can kind of depend on state funding. The only source for money is students and families, and students and families don't have enough money lying around."

A Section on 09/16/2015