A year after OPEC first took steps to defend its share of the global oil market against other producers, there are signs that U.S. production growth is slowing and that the cartel's strategy to stifle the North American shale boom has been successful.

The Organization of Petroleum Exporting Countries last week reduced its production estimates to show per-day growth of only 780,000 barrels in U.S. output for 2015. And a week earlier, the U.S. Energy Information Administration said domestic crude production is set to decline through August 2016.

"In North America, there are signs that U.S. production has started to respond to reduced investment and activity," OPEC said in its monthly oil market report. "Indeed, all eyes are on how quickly U.S. production falls."

The reduction in oil production in the United States not only helps protect OPEC's share of the global market, but it forces companies operating in the nation into the role of swing producers, analysts said.

Swing producers control large commodity deposits and have spare production capacity.

"It's probably a disappointing lesson for shale producers that until they get more efficient and can compete with low price producers they are going to be adjusting their production to market demand," said Jim Krane, an energy research fellow at Rice University's Baker Institute for Public Policy.

"It turns them into swing producers," he said.

When oil prices began to decline last year as a result of an oversupplied market and sluggish demand, OPEC shifted its strategy for managing prices. Instead of cutting production levels to force prices higher as it has done in the past, the cartel maintained its output.

Analysts said the move by OPEC was done to protect Saudi Arabia's share of the global market. The cartel's portion of the global market has lessened in recent years as production from growing shale formation drilling in the United States surged.

But the so-called price war was slow to put a dent in U.S. shale production.

The year-long slump in oil prices has forced energy companies, such as Murphy Oil Corp., to trim their capital spending budgets, lay off employees and idle rigs. While this has slowed production growth from U.S. shale formations, it has not yet reduced output enough to balance the market.

Despite a 60 percent drop in the number of oil rigs drilling in the United States since October 2014, crude production has remained vigorous. Domestic output averaged 9.4 million barrels per day in the first half of 2015 -- 200,000 barrels per day more than average daily production in the fourth quarter of 2014, according to the energy administration.

"It didn't look like U.S production was following the Saudi playbook -- it looked pretty stubborn, basically until July," Krane said.

With oil prices below $50 per barrel, energy companies are looking at further spending reductions and delayed projects.

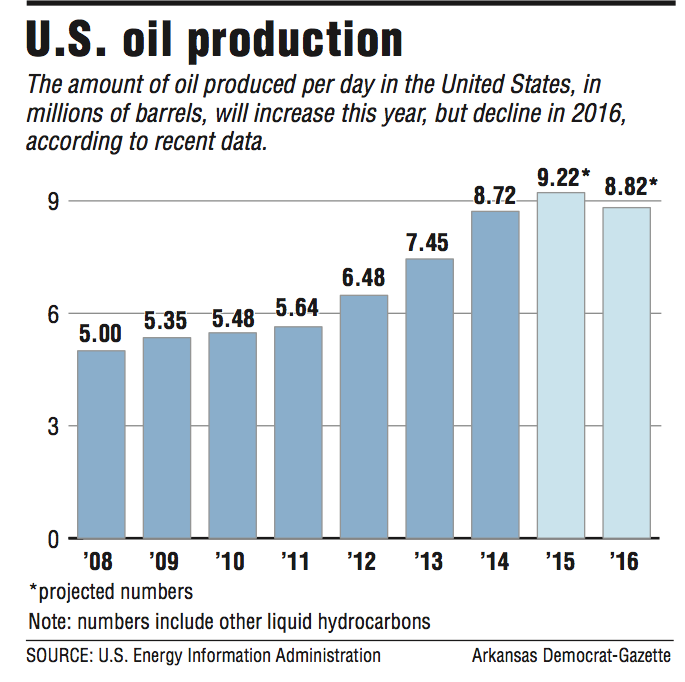

Further spending cuts by oil companies will eventually cut into production. The energy administration projections put crude production at 9.22 million barrels per day this year and 8.82 million barrels a day in 2016.

"U.S. oil producers have finally gotten the Saudi message. [OPEC is] going to do what it takes to keep prices low for a while," Krane said. "Quite a few folks seem to be throwing in the towel."

El Dorado-based Murphy Oil is preparing for further cuts in capital expenditures in 2016, Chief Executive Officer Roger Jenkins said during a Sept. 11 presentation for analysts.

Jenkins did not provide details, but the company reduced its 2015 budget earlier this year by about 30 percent and its workforce by 7 percent.

A Murphy Oil spokesman was unavailable to comment for this article.

Smaller producers and companies holding a lot of debt will not survive the oil market crash, but those that do will become more efficient and productive, analysts said.

OPEC has been able to curtail investment in U.S. shale areas, but it hasn't been able to completely bring the shale boom to a halt because companies in good financial standing will focus on drilling in the best geological spots, become more efficient and improve their productivity, said Michael Lynch, president of Strategic Energy and Economic Research Inc.

"The bigger question is with some of these smaller plays is how much time are people willing to put in to making them productive," he said.

SundayMonday Business on 09/20/2015