Home sales in Arkansas rose 11.2 percent in February with almost 2,200 sold, the 18th straight month for an increase in sales, the Arkansas Realtors Association said Wednesday.

Home sales in Arkansas have increased each month -- when compared with the same month for the previous year -- going back to August 2014, said Michael Pakko, chief economist at the Institute for Economic Advancement at the University of Arkansas at Little Rock.

The average rate of increase for those 18 months was 10.2 percent, Pakko said.

"We're still in what is typically the slow part of the year," Pakko said. "Probably the mild winter has been a factor that has helped home sales. That might detract from some growth later on in the spring, as people got an earlier start than they might otherwise have because of the fairly mild winter."

One reason for the steady growth in home sales, Pakko said, was "an overhang from the recession."

"There was a big adjustment process after the real estate bubble, the crash and recovery, where people saw foreclosures and delinquent payments," Pakko said.

Arkansas had a slow economic recovery after the recession, Pakko said, but home sales now are benefiting from a stronger economy.

The last time this many homes were sold in Arkansas in February was 2007, said Kathy Deck, director of the Center for Business and Economic Research at the University of Arkansas in Fayetteville.

"It looks like we're on track for another good year [in home sales]," Deck said.

The average home price in February was almost $153,000, down about 2 percent.

But a decline in prices seems to come during the winter months, Deck said.

Home sales in Northwest Arkansas -- and particularly Benton County -- are strong, Deck said.

"Washington County's growth is a little bit more moderate," Deck said. "Benton County and Washington County still look very attractive."

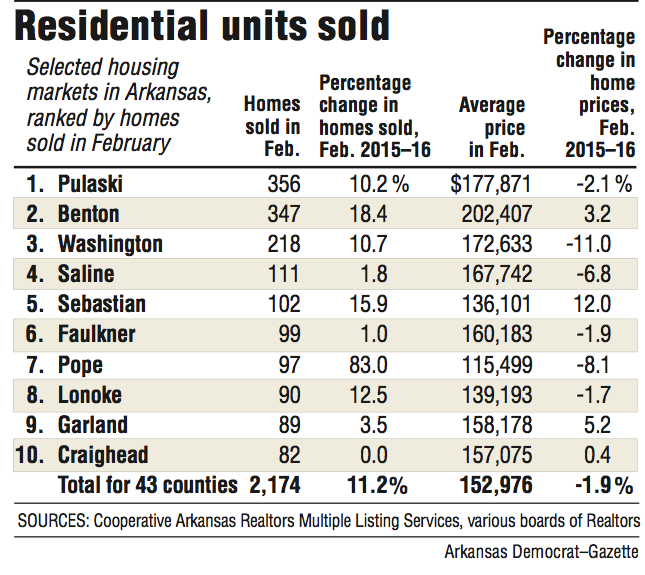

Pulaski County saw 356 home sales in February, compared with 347 in Benton County and 218 in Washington County.

Benton County's home prices averaged about $202,407 and were up 3.2 percent in February, better than Washington County's prices, which averaged about $172,633 in February and were down 11 percent.

One reason prices in Washington County were down so much, Deck said, was because they were unusually high in February last year.

"I would suspect that [Washington County home prices] will recover and have a stronger summer," Deck said.

Pope County Realtors sold 97 homes in February, up 83 percent from 53 in February last year.

James Ford with Coldwell Banker James R. Ford & Associates was surprised at the number of homes sold in Pope County in February.

"We don't know why [so many homes were sold]," said Ford, whose firm was founded in 1964. "We knew we had a better [February] than we had last year, but I can't give you an answer as to why."

There has been no major increase in jobs at businesses in the county, said Ford, who added that his firm's sales doubled in February. Low mortgage rates may be the greatest factor in the improvement, Ford said.

Home sales in the 43 counties surveyed by the Realtors Association were up 9 percent in the first two months of the year, with 3,977 homes sold.

Pakko is still expecting home sales to grow by double digits this year, as he had predicted in October.

Mortgage rates continue to be low, said Scott McElmurry, chief executive officer of Bank of Little Rock Mortgage.

The rate for a well-qualified buyer on a 30-year conventional loan is about 3.5 percent, McElmurry said. For a 15-year loan, the rate is about 2.75 percent or slightly higher, McElmurry said.

Government mortgage rates on a 30-year loan are about 3.25 percent, he said.

"We're expecting rates to go up at some point, likely at the end of the year," McElmurry said.

Nationally, sales of previously owned homes rose 5.1 percent in March, the National Association of Realtors reported Wednesday. That includes sales of single-family homes, townhomes, condominiums and co-ops, the association said.

The national market is on pace to record 5.3 million home sales this year.

Nationally, home sales had a nice rebound in March following an uncharacteristically large decline in February.

"Closings came back in force last month as a greater number of buyers -- mostly in the Northeast and Midwest -- overcame depressed inventory levels and steady price growth to close on a home," said Lawrence Yun, chief economist for the National Association of Realtors. "Buyer demand remains sturdy in most areas this spring and the mid-priced market is doing quite well."

Business on 04/21/2016