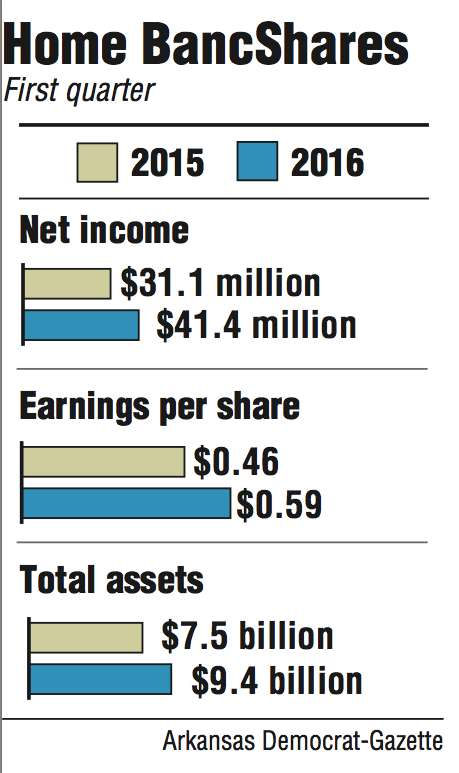

Home BancShares, which owns Centennial Bank offices in four states, earned a record $41.4 million in the first quarter, up 33 percent from the same period last year, the Conway bank said Thursday.

The bank earned 59 cents a share, beating the expectations of 57 cents from eight analysts surveyed by Thomson Reuters.

It was the 20th-straight record quarter for the bank, and the $41.4 million profit was $4 million more than it earned in the fourth quarter of 2015.

Shares of Home BancShares fell 61 cents, or 1.4 percent, to close Thursday, at $42.50 in trading on the Nasdaq exchange.

Home BancShares' stock deserves to be trading at a multiple higher than its peer banks because of its strong profitability, its outlook for double-digit loan growth and its potential of buying more banks, Matt Olney, a bank analysts in Little Rock for Stephens Inc., said in a research brief Thursday.

Olney, who has no stock in the bank, has a buy rating on it.

Last year, Home BancShares announced one bank acquisition and bought $289 million of another bank's loan portfolio.

There are many banks for sale, said John Allison, Home BancShares' chairman.

"I don't know that any of them have a great price," Allison said in a conference call Thursday.

Home BancShares still has a letter of intent out on a Florida bank.

"We're trying to work through a situation that's out there," Allison said. "Hopefully we'll get a resolution on that this quarter."

A deal for another possible bank purchase was brought to Home BancShares in recent weeks, Allison said.

"It looks like it has real possibilities for the corporation," he said.

The bank is looking for another opportunity in Florida, Allison said.

"If you watch what we've done over the years, we don't get in a hurry or get excited," Allison said. "We're not going to be doing deals for the sake of doing deals."

Deals the bank will consider are ones that improve the bank's earnings per share, Allison said.

Home BancShares is within $600 million of reaching $10 billion in assets, a point where the federal government increases its regulatory scrutiny, driving up costs.

The bank's assets likely will remain below $10 billion this year unless another bank purchase is completed, Allison said.

If Home BancShares delays the closing of a bank purchase until 2017, it will give the bank 18 months -- until July 1, 2018 -- before it will have to begin paying the extra costs and receiving the added regulatory oversight, said Brian Davis, the bank's chief financial officer.

Home BancShares had a efficiency ratio of 37.5 percent for the quarter, bettering the ratio of 41.4 percent in the first quarter last year. That means Home BancShares spent $37.50 for every $100 it earned in the first three months this year.

Centennial has 143 offices, including 77 in Arkansas, 59 in Florida, six in Alabama and a lending office in New York City. It closed two offices in Arkansas and two in Florida in the first quarter. It already has closed one other Florida location in the second quarter.

The bank also plans this quarter to convert the New York lending office to a branch bank. The office has been open a year.

Business on 04/22/2016