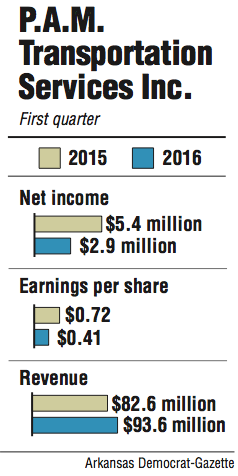

P.A.M. Transportation Services Inc. reported first-quarter income of $2.9 million, down 46.3 percent from the previous year.

Earnings per share declined 43.1 percent to 41 cents. P.A.M. reported first-quarter earnings per share of $0.72 in 2015 and overall earnings of $5.4 million during that three-month span.

Revenue was up for the Tontitown-based company. P.A.M. reported revenue of $93.6 million, compared with $82.6 million during the first quarter last year.

P.A.M. CEO Dan Cushman said he was encouraged by the revenue increase during the quarter. Still, the company saw cost increases associated with fuel, "driver acquisition" and health care.

"While we are not satisfied with our earnings results for the first quarter of 2016, they do represent one of our top three best reported results for a first quarter," Cushman said in a statement. "We remain optimistic that our business model will allow us the flexibility to quickly adapt to changing market conditions so that we can advance our goal of continuous improvement."

Net fuel costs for the company were up $1.2 million. Cushman said the company saw an 87 percent increase in health care costs when comparing the first quarter of 2016 with the same time frame in 2015.

P.A.M. also reported a $1.4 million increase year-over-year related to the hiring of drivers. Cushman said he expected the additional costs to lessen during the rest of 2016.

"They did manage to increase revenue per total mile before factoring in the fuel surcharge. From the operating efficiency side that's good and a very positive number," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock. "Obviously some of those expenses, like health care, can't be predicted or helped. All things considered, they did a pretty decent job of managing that company."

Cushman said the company still has the option of repurchasing 435,000 shares as part of a stock repurchase program. P.A.M. bought back 567,413 shares of stock in April and has acquired 2.2 million shares of its stock since 2013.

It is possible the company could continue to increase costs associated with driver pay.

"For the remainder of 2016, we will continue to focus on revenue growth opportunities which are driver friendly and provide a reasonable rate of return," Cushman said. "Given the current state of the driver market, we expect that we will continue to see driver pay pressure during the remainder of 2016 and the near future. Many of our competitors have announced significant across-the-board driver pay increases over the last few years while we have limited our driver pay increases to select drivers based on lane-by-lane profitability and desirability. We cannot rule out the possibility of a future broad based pay rate increase to our drivers and third-party owner operators."

After what the company described as a "record" fourth quarter to end 2015, P.A.M. reported yearly net income of $21.4 million. It saw earnings per share of $2.93 for 2015, the company's most profitable year since 2006.

P.A.M. shares ended trading on Friday at $24.71, down 24 cents.

Business on 04/30/2016