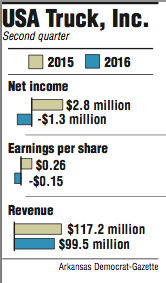

USA Truck Inc. reported a net second-quarter loss Wednesday of $1.3 million compared to a $2.8 million profit in the same quarter of 2015.

CEO Randy Rogers said it "wasn't the quarter that we anticipated nor wanted to report" in an earnings call. The report breaks down to a 15-cent loss per share, compared with a 26-cent gain the year before. Analysts polled by Thomson Reuters had predicted, on average, 19 cents earnings per share.

"Generally speaking, these results are disappointing as the company widely missed consensus and our expectations," said analyst Brad Delco of Stephens Inc. "With the new management team in place we're going to have to carefully track progress that's being made to turn around [the company's] trucking operations."

Blaming the results on the loss of some dedicated customers and a generally soft freight economy, the Van Buren-based company reported base revenue of $99.5 million in the quarter ending June 30, down about 15 percent from $117.2 million from 2015. Total revenue, including that from fuel surcharges, was $109.9 million.

"Wall Street was expecting them to make 19 cents and they lost 10. That's the largest disparity between expectation and actual results among the publicly traded truckload carriers in the current quarter," Delco said, referring to the company's adjusted loss per share of 10 cents, which excluded certain one-time severance costs.

USA Truck, Inc. shares, trading on the Nasdaq exchange, fell 23.6 percent or $4.54, closing at $14.69 on Wednesday.

"It's been a while since we've seen a company in Arkansas take a 23.5 percent hit in a day," said Bob Williams, senior vice president and managing director of Simmons First Investment Group.

The company highlighted its strategies for improving performance in the future, among them, reducing fleet size, working to control costs, refining its customers to increase density of loads per mile and generally growing USAT Logistics, USA Truck's asset light business towards the goal of 50 percent of total revenue.

As Rogers pointed out, the trucking division's operating loss of $2.7 million "overshadowed" USAT Logistics' $2.2 million operating income. The trucking segment posted $75.8 million in total revenue, down 19 percent from 2015's $93.8 million. The asset light division, USAT Logistics, had $37.0 million in total revenue, which was an 11 percent decrease from $41.6 million last year.

"On the plus side we're continuing to refine our network to transition from a backhaul to more profitable headhaul markets," said Martin Tewari, president of the trucking segment. The first leg of a trip is called the "headhaul" and the return trip is the "backhaul."

The earnings presentation also mentioned a plan to improve "density" of sales by making sure the clients they keep are profitable ones. Williams said that "narrowing their focus" would hopefully mean "better penetrations of the market" as opposed to a previous "shotgun approach."

In an ongoing effort to make its trucking operations more efficient, USA Truck has continued to shrink its fleet "to better match demand," said Tewari. The presentation to investors outlined a decrease of their fleet by 5.3 percent so far and a plan to reduce the fleet by 130 tractors and more than 400 trailers by the end of the year. The company retired 73 tractors in the second quarter, out of total of 84 so far in 2016.

"Normally, downsizing is not a growth strategy," commented Williams.

The company also hopes to reduce costs associated with owning its own heavy equipment by continuing to increase owner-operator fleet, which grew 17.6 percent in the quarter, Rogers said. This apparently contributed to the company's "biggest setback in June," mentioned by Jim Craig, president of USAT Logistics in the earnings call. Many independent contractors opted to stay off the roads simultaneously during the Department of Transportation's Roadside Inspections to avoid the hassle, making it hard for USA Truck to find drivers.

Another way the company has decided to cut costs involves a changing approach to maintenance. After closing some shops, they retain "a modest footprint" of four maintenance shops this year, Tewari said. The company has moved towards outsourcing a reported 80 percent of direct repairs and maintenance, including its mounted-tire program.

Tewari also noted a "restructuring" of the road assist program and hopes this will save about half a million dollars in the rest of 2016.

"The results we reported today are disappointing to all of us, and speaking for myself personally, frankly frustrating," Rogers said. He explained his hope that "focusing on those things within our control will yield sustained or sustainable improvements in our trucking business."

However, he concluded: "We clearly have a great team in place. We are improving the fundamentals of business in large ways and small, and we are on the right track."

Business on 08/04/2016