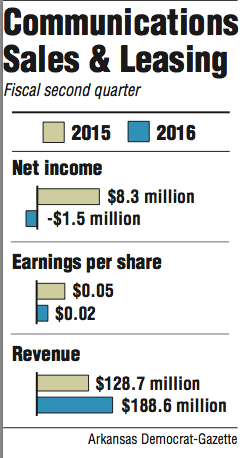

Communications Sales & Leasing, created last year from a spinoff of Windstream's copper and fiber assets, posted on Thursday a second quarter loss of $1.5 million, or 2 cents per share.

The company just met analyst expectations of $189 million in revenue, but fell short of analysts' six cents per share estimate.

In the same period last year the company reported a profit of $8.3 million, or 5 cents per share.

Shares of CS&L rose 8 cents, or .3 percent, to close Thursday at $30.30.

Of the company's $188.6 million in revenue, $13.8 million came from the acquisition of PEG Bandwidth. The purchase was finalized June 30.

CS&L agreed to pay $409 million for PEG, which provides infrastructure for telecommunications carriers.

In June the company announced plans to acquire Tower Cloud, a privately held data transport services company based in St. Petersburg, Fla. The $230 million deal is set to close this quarter, pending regulatory approval.

Transactional costs accounted for $11 million of the company's expenses for this quarter, or a loss of seven cents per share. Last quarter the company had $73,000 in transaction-related costs.

Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock, said the company is in a period of heavy spending.

"All the expenses were relevant, but transaction costs are expensive," Williams said. "They've got to continue to grow."

Kenny Gunderman, president and chief executive officer, hinted at future acquisitions.

"This is something that we foreshadowed starting last year," Gunderman said during a conference call to discuss the report. "We felt that once we started showing progress and putting wins on the board that we would see building momentum not only in our conversations with the industry and potential counterparties, but also on our cost of capital, which would all help facilitate more deals and importantly, better deals, high-quality deals."

The company's fiber infrastructure business turned a profit for the first time, bringing in $13.7 million this quarter.

Gunderman announced plans to brand the fiber infrastructure business as "Unity Fiber." Once the deal with Tower Cloud closes, Ronald Mudry, the current CEO of Tower Cloud, will become president of Unity Fiber.

During Windstream's second quarter, the company disposed of its 20 percent stake in CS&L.

This week CS&L expanded its board of directors from five members to six by adding Andrew Frey, a partner at Searchlight Capital. In June Scott G. Bruce, managing director of Associated Partners, joined the board.

Going forward the company has $49 million in unrestricted cash and cash equivalents and $485 million in borrowing power, CS&L's report said.

"I am confident we are well positioned to continue the momentum we have established this year," said Mark Wallace, vice president and chief financial officer, during the conference call.

Business on 08/12/2016