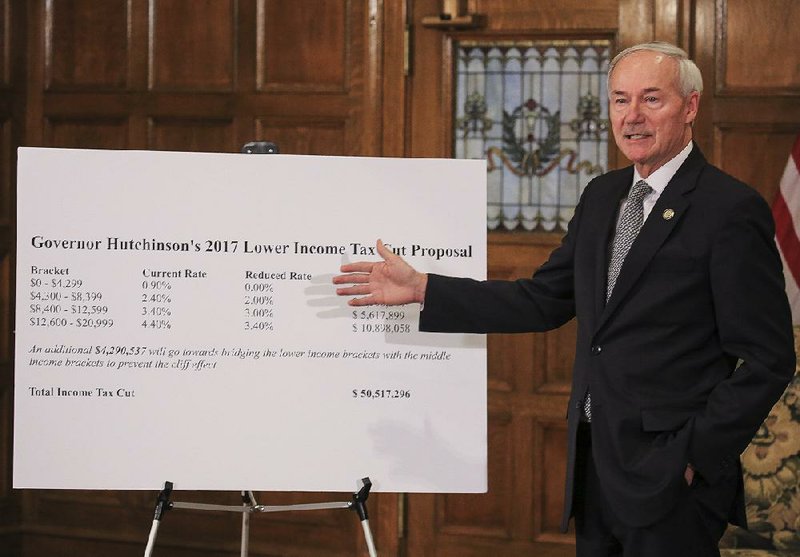

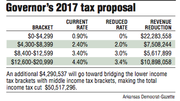

Gov. Asa Hutchinson on Tuesday unveiled a $50.5 million a year plan to reduce state income taxes for Arkansans earning less than $21,000 a year.

The Republican governor also proposed a $19.3 million a year plan to exempt retirement benefits of retired military service members from state income taxes and reduce the state's tax on soft-drink syrup in exchange for levying the full sales tax rate on the sale of candy and soft drinks, applying the sales tax on the full cost of manufactured housing and removing the exclusion of unemployment compensation from income taxes.

Legislative reaction was mixed and muted.

Hutchinson said he wants the Republican-dominated Legislature to enact his income tax rate cuts for low-income Arkansans in the session starting Jan. 9.

Two years ago, the Legislature enacted Hutchinson's legislation to reduce individual income tax rates for Arkansans with taxable incomes between $21,000 and $75,000 a year. That's projected to reduce state general revenue by about $100 million in fiscal 2017, which started July 1.

Hutchinson's proposed income tax rate cuts for Arkansans with less than $21,000 in taxable income would become effective Jan. 1, 2018, spokesman J.R. Davis said.

"This is fair," the governor said in a news conference.

"Before we start expanding into other income categories, I want to make sure the lowest income categories have the relief that they have not had before."

He said about 657,000 Arkansans would get income tax tax breaks under his proposal. Single individuals could receive an income tax cut as high as $156 and a couple could get an income tax cut as high as $312, he said.

"I recognize that the upper-income levels are job creators, they are very important to driving our economy forward, and we need to cut their taxes as well. But whenever you are looking at a limited amount that we cut this year, $50 million in the lower brackets has a much greater impact to encourage spending to drive our economy than $50 million does in the higher-income brackets," he said.

Hutchinson said there is no doubt in his mind that he will seek income tax cuts for the higher-income Arkansans during the next round of proposed tax cuts.

He said he hopes his proposals will be well-received by state lawmakers.

"I look forward to a vigorous debate with members of the General Assembly," he said.

Senate President Pro Tempore Jonathan Dismang, R-Searcy, said Tuesday night that "my personal view is we need to make sure we don't overly complicate the tax tables."

He said he didn't have enough information to know whether that would happen under Hutchinson's plan.

[EMAIL ALERTS: Sign up for free breaking news updates + daily newsletters featuring day's top stories]

House Revenue and Taxation Committee Chairman Joe Jett, R-Success, said he's encouraged by Hutchinson's proposed income tax cut for lower-income Arkansans.

But state Rep. Charlie Collins, R-Fayetteville, said he's disappointed with Hutchinson's plan, saying it is unfair to exclude Arkansans with taxable income exceeding $75,000.

"His tax policy leaves me flummoxed," Collins said. He said he favors across-the-board income tax cuts and granting income tax cuts to Arkansans who didn't receive them from the 2015 Legislature.

State Rep. Warwick Sabin, D-Little Rock, said it would be better to grant tax cuts to low-income Arkansans through an earned income tax credit.

"People who earn income at lower levels pay a disproportionate amount of taxes in the form of sales taxes, gas taxes and other regressive taxes and fees, so an income tax cut in and of itself doesn't have a lot of impact, whereas an earned income tax credit is a proven policy at the federal level and many other states to move people out of poverty, to incentivize work and to stimulate the economy," he said.

Neither House Speaker Jeremy Gillam, R-Judsonia, nor House Democratic leader Michael John Gray of Augusta could be reached for comment. Democrats and Republicans each hold 10 seats on the 20-member House tax committee.

Hutchinson said "my long-term goal is to reduce and flatten the tax rates.

"I would like to get it down to 5 percent. Maybe we can be competitive at that level, but we only do a piece at a time and still balance the budget and provide for the needed services of our state."

He said his current proposal "can be absorbed by normal growth," of tax revenue.

The state "has absorbed a $100 million tax cut" in fiscal 2017 and the state's revenue reports have shown that individual income tax collections are strong, Hutchinson said.

During the first five months of fiscal 2017, the net available general revenue available to state agencies has increased by $35 million, or 1.7 percent, over the same period in fiscal 2016 to $2.15 billion, but it's $10.6 million (0.5 percent) below the state's forecast.

"I remain confident in the current forecast. At such time as we don't have confidence in the forecast, it will have to be adjusted," Hutchinson said.

Hutchinson said he wants to completely exempt pension benefits for retired military members from the state's income tax, noting about $6,000 a year in pension benefits is currently exempt. That is projected to reduce state general revenue by $13 million a year.

He noted that Republican Lt. Gov. Tim Griffin and state lawmakers have pressed to exempt these pension benefits.

"We have seen very clearly that Arkansas is not receiving military retirees at the same rates as other states with lower income tax brackets and where their retirement benefits are exempt," Hutchinson said. "It is clearly indicated and demonstrated that this will be an economic driver for our state."

To help pay for exempting pensions for military retirees, Hutchinson said he is proposing levying a 6.5 percent sales tax on the sale of candy and soft drinks that are taxed at the 1.5 percent rate on groceries to raise $13.8 million; removing the exclusion of unemployment compensation from state income taxes to mirror federal law and raise $3.1 million a year; and applying the sales tax on the full cost of manufactured housing that is now taxed at 62 percent of a manufactured home's valued to raise $2.4 million a year.

Hutchinson said the removal of these tax exemptions also would allow the state to reduce the state's soft-drink syrup tax by 40 percent or $6.3 million a year. That would reduce the state's $2 per gallon tax to $1.20 per gallon, said Jake Bleed, a spokesman for the state Department of Finance and Administration.

"That money was originally applied to Medicaid so we would put the extra $6.3 million into the Medicaid Trust Fund, so it is not damaged in any way and yet we are able to reduce that soft-drink syrup tax that imposed years as a temporary tax," Hutchinson said.

These proposals could go into effect as early as Jan 1, 2018, Hutchinson said.

Dismang said that "there is lots of things to consider in that proposal" to reduce certain taxes and remove tax exemptions, and he needs more information.

Collins said he would rather cut income taxes for all Arkansans rather than just on the retirement benefits of military retirees.

Sabin said he's worried about the governor's proposal to no longer exclude unemployment compensation from state income taxes.

"People who are earning unemployment benefits are clearly on the ropes. They need help and they are looking to get back in the workforce, so to add an additional tax burden to them .... is a real area of concern," he said.

Metro on 12/14/2016