Bankers expect to receive relief from what some consider to be egregious regulations after Donald Trump becomes president, Candace Franks, commissioner of the state Bank Department, said last week.

"I would expect there to be some regulatory changes under the new administration," Franks said. "I'm hopeful that we will see some positive rollback of some of the areas of overregulation we've had."

Some of those include tighter scrutiny and more expenses for banks that have more than $10 billion in assets, restrictions on lending that make it difficult for small banks to make some kinds of loans and changes in the Consumer Financial Protection Bureau, which is responsible for consumer protection in the financial sector.

Neither Trump nor his transition team has said what changes will be made in banking regulations, said Garland Binns, a Little Rock banking attorney with the Dover Dixon Horne firm.

But the team did issue a statement that said the Dodd-Frank economy does not work for working people and that the new administration would work to dismantle the act, which became law in 2010.

The Dodd-Frank Act was passed to prevent excessive risk-taking by lenders that led to the financial crisis.

Janet Yellen, chairman of the Federal Reserve, cautioned the Trump administration not to rework the Dodd-Frank Act, according to the American Banker.

"It is very important not to roll back" Dodd-Frank, Yellen said in a news conference Wednesday after the Federal Open Market Committee raised the federal funds rate by a quarter point.

Yellen conceded that some changes could be made "but I would urge that it is important to keep this in place."

But Franks believes the administration is interested in rolling back some areas of Dodd-Frank that could benefit banking customers.

"I think banks will be more willing to loan [with some changes in federal regulations]," Franks said. "Particularly in mortgage lending. Those have really been tough and complicated for community banks."

For example, Franks said, under the Dodd-Frank Act, if a mortgage loan didn't meet qualifications, a bank couldn't sell it on the open market, but had to service it in-house.

"If your customer didn't keep up the payments, then there could be questions of whether you should have made the loan in the first place," Franks said. "That made it difficult for community banks to make loans to some customers who had been with the bank for a long time. That caused a number of institutions to just quit making those kind of loans."

One executive at a small Arkansas bank estimated as the regulations began to become more burdensome that his bank spent 7 percent of its income addressing regulatory compliance issues, twice what it had been. Even so, 7 percent was less than many banks spend.

Like children at Christmas, bankers are anticipating good things as far as regulatory changes under the Trump administration, said Randy Dennis, president of the DD&F Consulting Group in Little Rock.

It would be relatively simple to change the $10 billion threshold that now requires banks to undergo more oversight and expense to $50 billion or even $25 billion, Dennis said. That and changes in the Consumer Financial Protection Bureau would be "huge boons for banks," Dennis said.

"I would hope that there would be changes in Dodd-Frank, but more importantly that they will have an influence on the other regulators, whether it is the [Office of the Comptroller of the Currency] or the [Consumer Financial Protection Bureau] or the [Federal Reserve]," Dennis said.

The Consumer Financial Protection Bureau is an agency that was designed to watch out for the consumer, Dennis said.

"But it has crushed the credit availability for consumers," Dennis said.

The regulatory outlook for banks is promising, based on Trump's comments about reducing regulatory burdens, Binns said.

"Most people think that the current regulatory state is burdensome to banks," Binns said. "It is a cause of the consolidation that we continue to see in Arkansas among smaller banks."

Any changes in banking regulations won't occur immediately, but will take time, Binns said.

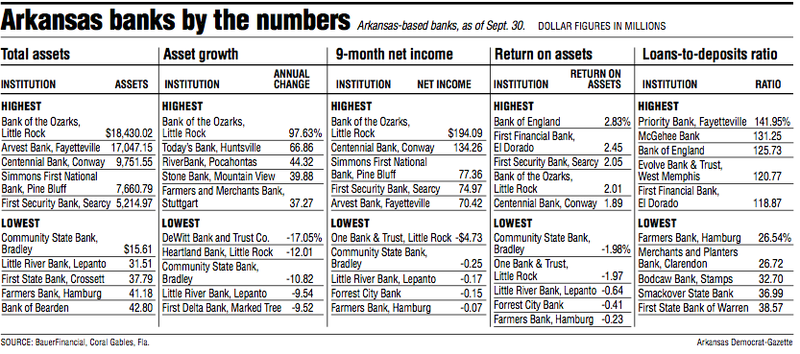

Despite regulatory troubles, banks in Arkansas are performing well, Franks said.

"We have very favorable trends in the state," she said. "We have an increase from last year at this time as far as return on assets [profit as a percentage of assets] and profitability. Noncurrent [delinquent] loans are manageable."

Commercial real estate loans also are manageable in Arkansas, Franks said.

Even though regulators have told all banks to track high concentrations of commercial real estate loans, the American Banker has reported that some are ignoring the warnings.

"We continue to monitor that very closely and federal agencies do as well," Franks said. "[Arkansas] banks that have large concentrations in [commercial real estate loans] tend to manage that fairly well."

There could be some risk to Arkansas banks as the Federal Reserve begins to raise interest rates, Franks said.

There could be downward pressure on earnings for the short term for some banks, Franks said. Because of low interest rates for so long, some banks have lengthened the maturities on their investments, Franks said.

"We'll be watching that fairly closely," Franks said.

SundayMonday Business on 12/18/2016