Hayneedle Chief Executive Officer Jon Barker believes his company experienced something rare in 2016 after being acquired by retailers twice in the span of seven months.

Barker said the result may be even more uncommon: Both acquisitions have resulted in growth and new opportunities for the online home furnishings retailer based in Omaha, Neb.

"Not always do acquisitions become a positive for all parties, meaning the buyer, the seller and the employees," Barker said. "In our case, it's been more than a positive for all involved in both situations."

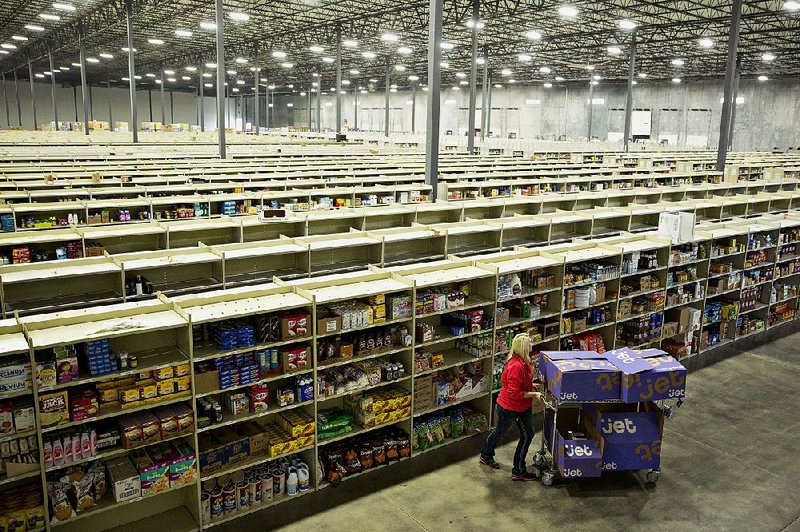

Wal-Mart Stores Inc. made one of retail's biggest splashes this year by purchasing Jet.com for $3.3 billion to expand its online business. But Jet.com, which was founded by Marc Lore, wasn't the only e-commerce outfit Wal-Mart acquired as part of the deal. Wal-Mart also added Hayneedle.

It was the second time the company had changed hands after Lore and his Jet.com team purchased Hayneedle earlier this year for a reported $90 million. While the changes in ownership have led to an eventful year for Hayneedle, Barker believes that being under Wal-Mart's umbrella -- after a few successful months as a Jet.com subsidiary -- has the company positioned for long-term success.

"It has certainly been a very busy time for us, having to focus on keeping up with not only acquisitions but with the exponential growth of the business that's happened through these acquisitions," Barker said. "It has been exciting for us."

Hayneedle traces its beginnings to 2002 when it began as hammocks.com. Over the years, the company gradually expanded its home furnishings network by purchasing and operating other online sites. The company eventually folded those sites into Hayneedle in 2009.

The e-commerce company now offers millions of products and over 3,000 brands in its online store, including its own private-label offerings. Hayneedle, which has fulfillment centers in California and Ohio, posted more than $350 million in sales in 2015, according to the Omaha World-Herald.

Despite the steady growth, Barker said Hayneedle began having conversations about forming "strategic partnerships" with other companies beginning in the fall of 2015. Those conversations included Jet.com, which Lore created as an e-commerce challenger to Amazon.com.

"He understood the value of the team and early on we talked a lot about why it should stay intact, be a separate specialty retail brand focused on home furnishings and why the Omaha area was the right place to base the business," Barker said. "And ultimately that was important for me and our board of directors in deciding that Jet was a partner we should continue to focus on in the process."

Hayneedle had about 500 employees, including 400 in the Omaha area, when it was acquired by Jet.com. It didn't take long after the acquisition that business accelerated, which led the company to boost its base of employees to about 750 over three or four months.

The growth has continued since moving under Wal-Mart's umbrella. Barker said Hayneedle now boasts more than 1,000 employees with about 850 of them working in Omaha.

Wal-Mart spokesman Dan Toporek said the addition of Hayneedle, much like Jet.com, is a good complement for the retailer because it provides customers with more shopping options.

Hayneedle will maintain its own e-commerce platform, but hundreds of products like beds, desks, swing sets, television stands, patio furniture, doghouses and storage cabinets also appear on Walmart.com. The additional items have helped expand the Bentonville-based company's assortment of home furnishings.

"Every customer is different, and some prefer one site versus another," Toporek said. "So you'll continue to see Hayneedle continue to operate as a stand-alone brand, really focused on home furnishings. But at the same time, you're seeing it play a key role for both Jet and Walmart.com."

Carol Spieckerman, a retail consultant and president of Spieckerman Retail, said Wal-Mart has vowed to keep Hayneedle intact. But she cautioned that it could make different choices down the road.

For now, Spieckerman said the acquisition has created potential benefits for both sides.

"I doubt that Hayneedle was a major consideration in the Jet.com acquisition, however, it does offer yet another diversification play for Wal-Mart, and an opportunity to become more meaningful in home furnishings," Spieckerman said in an email. "Hayneedle could benefit from Wal-Mart's multi-format brick and mortar scale, with the potential for its products to be ordered online and picked up at thousands of Wal-Mart-owned locations."

Hayneedle's management continues to report to Lore, who became the chief executive officer of Walmart.com as part of Wal-Mart's acquisition of Jet.com. But Barker said there are plenty of direct conversations taking place between Wal-Mart Stores, Walmart.com, Jet.com and Hayneedle as the companies continue to map their long-term course.

Barker said Hayneedle has found Wal-Mart to be "great partners" the past few months, helping the home furnishings company transition to new ownership for the second time this year.

"I think when we look back, this will be the catalyst that's taken us from being a small specialty retailer to being the leading home furnishings retailer in the U.S.," Barker said of 2016.

SundayMonday Business on 12/25/2016