Bentonville-based America's Car-Mart, which has 143 used-car dealerships in 11 states, had the best year of the major Arkansas public companies, finishing 2016 up almost 64 percent.

The buy-here, pay-here dealer reported a profit of $5 million, or 62 cents a share, in the company's second quarter that ended Oct. 31, significantly better than the consensus from analysts of 50 cents a share.

"Despite a very competitive marketplace, America's Car-Mart's results reflected considerable growth," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock. "While the company has kept expenses under control, inventory management was a substantial contributor to the bottom line."

Sales at Car-Mart were up almost 12 percent in the second quarter at dealerships open at least a year.

Murphy Oil had the second best return for the year, its shares gaining almost 39 percent.

"Murphy Oil continued its efforts to transform the company into a standalone exploration and production firm," Williams said. "Despite this, some analysts have noted the company's lack of success in exploration with the no major discoveries since 2002."

Home BancShares stock rose 37 percent for the year, the third best return among Arkansas stocks.

"Home BancShares continues to fuel growth via acquisitions," Williams said. "With the most recent two purchases in November, the company has demonstrated its intent to establish a substantial presence in the Florida market."

Stocks for each of Arkansas' three largest public banks performed well, particularly during the fourth quarter, said Garland Binns, a Little Rock banking attorney.

Bank of the Ozarks' return was only 6 percent for the year, but it was up 37 percent in the fourth quarter. Home BancShares was up 33 percent in the fourth quarter and Simmons improved almost 25 percent for the quarter.

"A lot of it has to do with the favorable response to [Donald] Trump's election," Binns said. "But Trump and his transition team also have said there need to be changes in the [federal] Dodd-Frank Act. And I think that [the banks] were an indirect beneficiary of those types of comments."

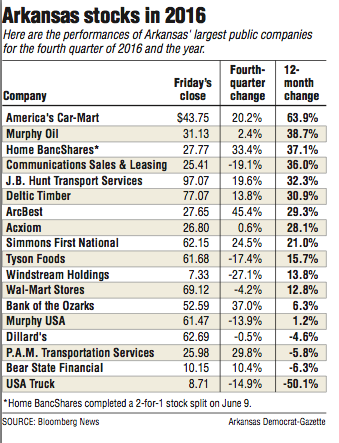

The Arkansas Index, which includes the 18 largest public companies in the state, was up almost 17 percent for the year, higher than major indexes such as the Dow Jones industrial average, S&P 500 index and the Nasdaq exchange.

Only four of the 18 stocks were down for the year. Nine of the companies had returns of more than 20 percent for the year.

Shares of USA Truck fell 50 percent for the year, the worst performing stock.

"USA Truck reported surprise losses for the second and third quarters and investors ran for cover as management slashed expenses and sold off assets in response to an 'uncertain industry environment,'" Williams said. "The company's focus on expanding its logistics division was effective although offset by competitive pressures and the loss of some dedicated customers."

Bear State Financial, which fell 6.3 percent for the year, took a hit in January after reporting disappointing results for the fourth quarter of 2015, Williams said.

"The share price buoyed in November as investors encouraged by the election results and rising interest rates shifted to the financial sector," Williams said.

Dillard's shares fell almost 5 percent for the year.

"Despite a rally early in the year, Dillard's was negatively impacted as more shoppers shifted from ... stores to ordering online from the comfort of their homes," Williams said. "With about 20 percent of its stores in the oil-impacted economy of Texas, revenues took a hit."

Dillard's online sales have been a much-smaller percentage of revenue than its peers, adding to the softness, Williams said.

"If that wasn't enough, the company has delivered negative earnings surprises for the last five consecutive quarters," Williams said.

Business on 12/31/2016