WASHINGTON -- President Barack Obama on Tuesday sent his final annual budget proposal to a Republican-led Congress, seeking $19 billion for a broad new cybersecurity initiative and declaring that his plan "is about looking forward."

RELATED ARTICLE

http://www.arkansas…">Arkansas' 6 in D.C. slam plan as reckless

The budget for fiscal 2017, which starts Oct. 1, would top $4.1 trillion, although only about one-quarter of that is the so-called discretionary spending for domestic and military programs that the president and Congress dicker over each year. The rest is for mandatory spending, chiefly interest on the federal debt and the Social Security, Medicare and Medicaid benefits that are expanding as the population ages.

In a message accompanying his budget, Obama said the plan -- his eighth and final one -- "a roadmap to a future that embodies America's values and aspirations: a future of opportunity and security for all of our families; a rising standard of living; and a sustainable, peaceful planet for our kids."

The budget calls for a major new $10-per-barrel tax on crude oil that would raise the price of gasoline, currently averaging about $1.80 per gallon nationwide, by about 24 cents. All told, its tax raises would average more than a $250 billion each year to cover deficits. The $2.8 trillion package of tax increases would almost double the tax increases Obama sought -- and was denied -- last year.

Under the plan, the deficit would increase in this fiscal year to $616 billion from $438 billion last year, the budget projects, in part because of myriad tax cuts that Obama and Congress agreed in December to make permanent. That would make this year's shortfall equal to 3.3 percent of the economy's output, or gross domestic product, up from 2.5 percent. That exceeds the 3 percent threshold that economists consider sustainable for a growing economy.

In fiscal 2017, the deficit would dip again for a couple years but then begin increasing again, mainly because of the costs for aging Americans' retirement and health care. But the administration says annual deficits would remain below 3 percent of the GDP through the decade to 2026.

Deficits would not return to levels exceeding $1 trillion, and nearly 10 percent of GDP, like the shortfall he inherited in 2009 in the depth of recession, according to his budget.

Obama struck an optimistic tone that contrasted sharply with Republican presidential candidates and congressional Republicans.

"Together, we have brought America back," Obama said. "We rescued our economy from the depths of the recession, revitalized our auto industry, and laid down new rules to safeguard our economy from recklessness on Wall Street."

He added: "We made the largest investment in clean energy in our history, and made health care reform a reality. And today, our economy is the strongest, most durable on earth."

Some Republicans disagreed.

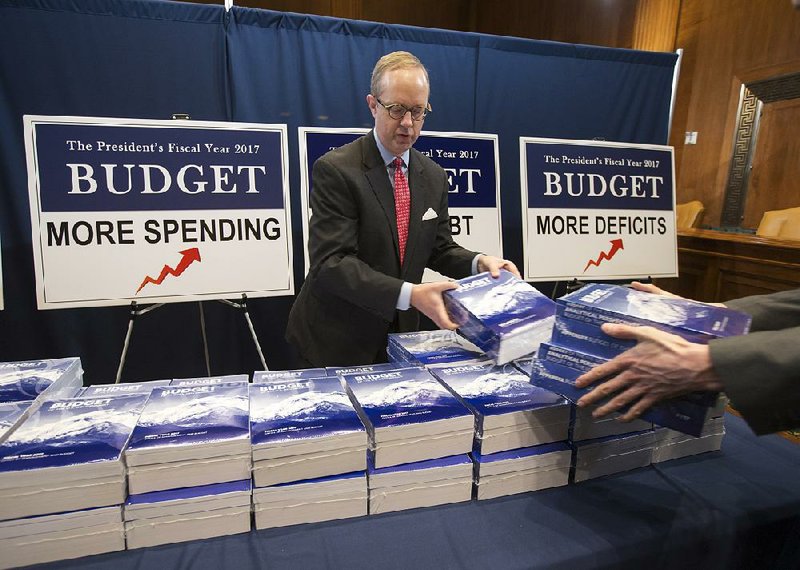

"This isn't even a budget so much as it is a progressive manual for growing the federal government at the expense of hardworking Americans," said House Speaker Paul Ryan, R-Wis.

"This budget joins his others by placing America on a fiscal path that is unsustainable and threatens our long-term economic growth," said Sen. Michael Enzi of Wyoming, chairman of the Senate Budget Committee.

Enzi and the chairman of the House Budget Committee, Rep. Tom Price of Georgia, jointly announced days ago that they would not invite Obama's budget director, Shaun Donovan, to testify before their panels -- a break with a tradition dating to the start of the modern budget process in 1975.

Discretionary spending

Administration officials were quick to point to a number of initiatives this year that likewise draw support from some Republicans, especially senators vulnerable in this election year. They include Obama's proposed increased spending for treating people addicted to opioids and heroin; cancer research; education; efforts to overhaul the criminal justice system; and stepped-up fighting against the Islamic State.

"It's tempting to adopt the conventional wisdom that a president's final budget isn't relevant, but I think the conventional wisdom is wrong," said Donovan.

Of the $1.2 trillion in discretionary spending, about half would go to domestic programs and half to the military.

The White House pointed to the cybersecurity initiative as a centerpiece proposal that should garner bipartisan support. Obama made cybersecurity a theme of his 2008 campaign and held events in the White House his first few months in office to announce new cybersecurity steps.

His $19 billion cybersecurity request reflects a 35 percent increase -- $5 billion -- above current spending. But part of that, a $3.1 billion proposal to overhaul the federal government's aging computer systems, was prompted by a huge embarrassment, the successful Chinese theft of security records on 22 million Americans from the system run by the Office of Personnel Management. The attackers were in the system for more than a year, undetected. They shipped the data out of the federal systems almost daily, also without being noticed.

Obama also announced the formation of a commission to examine the broader cybersecurity problems, which will report just weeks before he leaves office.

The plan also calls for a 10-year, $400 billion initiative for "clean" transportation projects on infrastructure improvements and innovations for green-energy vehicles. That would be paid for with the oil fee, which Republican leaders have already rebuffed.

The budget also proposes additional funding for a summertime food program for children who receive free lunches during the school year.

It also calls for a $4 billion plan to teach computer science; and $6 billion in training funds to help young people land their first job.

Other tax increases include a 0.07 percent fee on larger banks that would raise about $10 billion a year; reducing the value of itemized deductions taken by wealthier taxpayers to raise $646 billion over a decade; almost doubling the approximately $1 per pack federal cigarette tax; and a new proposal to require a greater number of wealthier people pay a 3.8 percent Obamacare tax surcharge.

The so-called Buffett Rule would require a minimum 30 percent tax rate for upper-income earners.

Some of those tax increases would raise more than $1 trillion over 10 years to offset new tax cuts such as an expansion of tuition tax credits, giving the earned income tax credit for the working poor to those without children, and broadening a tax credit for child care expenses.

Among the health care provisions in Obama's budget, several address the rising cost of prescription drugs. One new proposal would gradually shift most of the burden of paying for drugs in the "catastrophic" portion of Medicare's prescription program to insurers who deliver the benefit, as opposed to taxpayers.

Another idea, estimated to save $5.8 billion over 10 years, would allow the federal government to join forces with states to negotiate Medicaid rebates from drug companies.

The new budget caps a combative few years in Obama's dealings with Republicans. A major deficit reduction effort in 2011 fell apart, though after his re-election in 2012 Obama won a higher income tax rate on couples earning more than $450,000 per year and individuals earning more than $400,000.

Information for this article was contributed by Jackie Calmes and David Sanger of The New York Times and by Andrew Taylor, Martin Crutsinger and Ricardo Alonso-Zaldivar of The Associated Press.

A Section on 02/10/2016