For the second straight year, oil prices posted large drops as a result of a global glut of crude, and the outlook for 2016 is just as bleak for the industry, analysts say.

Oil prices ended the year 30 percent cheaper than they started. In 2014, oil was selling for more than $100 a barrel before an oversupplied market and weak demand pushed oil into a rout that cut prices by 50 percent.

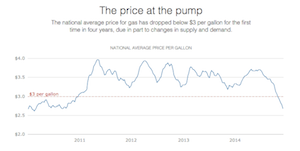

For U.S. consumers, the decline in oil has resulted in some of the cheapest gasoline prices in years, with the national average at $2 a gallon on Thursday.

But on the other side of the oil price plunge are the layoffs and decline in spending in an energy industry that in recent years was experiencing a boost in domestic operations and investment as a result of the nation's shale boom.

Analysts say things are unlikely to improve for oil producers in 2016.

"It does not look like a happy year for the U.S. oil industry," said Michael Lynch, president of Strategic Energy and Economic Research Inc. "They will have to tighten their belts."

The last few days of 2015 highlighted how volatile the oil market has been in the past year.

Oil prices fell Wednesday after a report by the U.S. Energy Information Administration showed that U.S. oil stockpiles had increased.

But by Thursday, the market got a lift on reports that President Barack Obama's administration is preparing financial sanctions against Iran, the first ones since the nuclear agreement was reached in July.

The Wall Street Journal reported that the sanctions are aimed at almost a dozen companies and individuals in Iran, Hong Kong and the United Arab Emirates regarding their purported roles in Iran's ballistic-missile program.

New doubts were raised in regard to the nuclear agreement when The Wall Street Journal further reported that Iranian President Hassan Rouhani ordered that the development of Iran's ballistic-missile program be expedited in response to the sanctions.

West Texas Intermediate oil rose 44 cents Thursday to finish the year at $37.04 a barrel on the New York Mercantile Exchange. Brent crude increased 82 cents to finish 2015 at $37.28 a barrel on the ICE Futures Europe exchange in London.

Some analysts and experts said they expect oil to stay between $30 and $50 a barrel in 2016, and possibly longer.

"Oil is not going to go up beyond $60 unless there is a disruption," said Hossein Askari, Iran professor of business and international affairs for the Elliott School of International Affairs at George Washington University.

"I think that right now there is more excess capacity in the world than we have seen in a number of years," he said, adding that "demand is not going to expand rapidly in the future."

Exacerbating the oil glut is the fact that there have been no significant production cuts, analysts said.

Despite the spending cuts and a pullback on drilling by companies such as Murphy Oil Corp., U.S. production has yet to significantly decline. Analysts said this is in part because companies have gotten more efficient at pulling oil from the ground and keeping costs down.

"Production has dropped off but not what other analysts thought it would," said Tariq Zahir, a managing member of Tyche Capital Advisors LLC. "We're still not seeing meaningful production cuts here in the U.S."

Murphy Oil of El Dorado slashed its 2015 budget by about 30 percent and said in October that by the end of 2015, its workforce would be reduced by about 23 percent from 2014 levels. The company has not provided details of the job cuts.

Energy stocks and earnings also took a hit in 2015. Murphy Oil was the worst-performing stock on the Arkansas Index, with shares losing more than 50 percent. The company's shares finished the year at $22.45 on Thursday.

When asked about production in 2016, Zahir said: "We are still going to see a tremendous amount of oil being pumped."

But if oil stays below $40 a barrel for a longer period, then there will be meaningful cuts to shale production, he said.

The Organization of the Petroleum Exporting Countries also has not cut its production.

OPEC's response to the glut and falling prices has been to keep pumping, as the cartel is looking to defend its market share against the rise of U.S. shale production, analysts said.

Traditionally, OPEC, led by Saudi Arabia, has forced prices higher by reducing production levels or lowered them by adding to the market.

But so far, cartel members have held to their output levels, and analysts said those countries are unlikely to change course in 2016.

"Saudi Arabia can no longer do that because there is excess capacity in other countries," Askari said. "With this excess capacity, it is going to take time."

He said other countries, including U.S. producers, are going to keep pumping oil "until somebody cannot bear the pain anymore."

"Until they feel the pain, I don't think they are going to do anything," Askari said.

There's a chance that more oil could enter the market as Iran, which once was OPEC's second-largest producer, has said it will seek to regain its share of the market.

Iran has said it plans to quickly place its oil on the market if some sanctions are lifted under the nuclear deal reached in July between the country and six nations led by the United States.

Phil Flynn, an energy analyst with Price Futures Group, said that unlike many analysts, he expects to see an increase in demand for oil that will help alleviate the glut, in large part because of cheaper gasoline prices.

"My sense is that we are getting pretty close to a bottom on oil [in 2015], going into [2016]," he said.

AAA said this week that with a national average of $2.40 a gallon, 2015 gas prices were the second-cheapest in a decade.

At those low prices, Americans last year saved more than $115 billion on gasoline, or an average of $550 per driver, AAA said.

While consumers have been saving on prices at the pump, they haven't been spending all of the extra money. Instead, they are saving and using their extra money to pay down debt.

Thursday's national average of $2 a gallon was down from $2.26 on Dec. 31, 2014. The average gallon of gasoline in Arkansas was $1.75, down from $2.15 on the same date in 2014, according to AAA's Daily Fuel Gauge Report.

"I think people are going crazy for these low gasoline prices, and I think that's going to continue into the new year," Flynn said.

Business on 01/01/2016