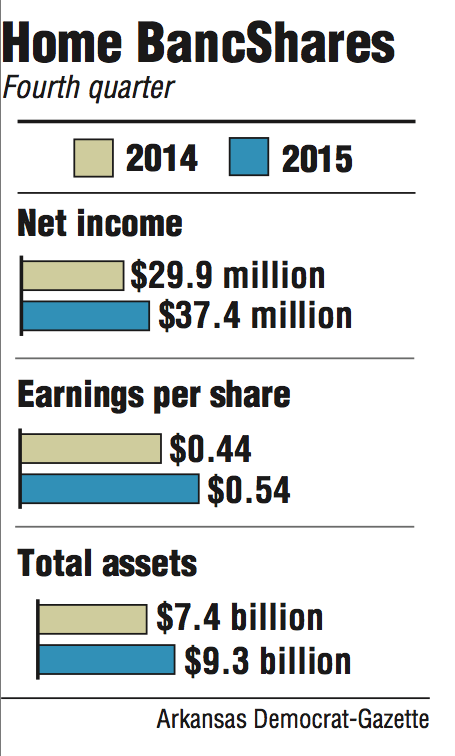

Home BancShares, which owns Centennial Bank, earned a record $37.4 million in the fourth quarter, a 25 percent jump from the same period in 2014, the Conway-based bank said Thursday.

The bank's net income per share was 54 cents for the quarter, compared with 44 cents in the fourth quarter of 2014. Excluding $2.9 million in merger-related expenses, Home BancShares earned 56 cents a share, which matched the average projection of eight analysts surveyed by Thomson Reuters.

Home BancShares fell $1.32, or 3.6 percent, to close Thursday at $35.06 on the Nasdaq exchange. The bank's stock is down 9.9 percent since Dec. 31, primarily because of the drop in the stock market in the past three weeks. The S&P 500 is down 8.6 percent since Dec. 31.

The report marks the 19th consecutive most-profitable quarter for the firm, said Randy Sims, Home BancShares' chief executive officer.

Home BancShares had a core efficiency ratio, excluding merger-related expenses, of 37.86 percent. That means it costs the bank $37.86 to earn $100.

Home BancShares earned $138 million for the full year, up 22 percent from $113 million in 2014.

Home BancShares has filed a lawsuit after its fourth-quarter acquisition of Florida Business BancGroup, which owns Bay Cities Bank in Tampa, Fla., said John Allison, Home BancShares' chairman.

"We are not a litigious company," Allison said. "But after a review of that situation, we determined that the blatant disregard for our agreement had to be dealt with. We won't make any further comments about this. We'll let the attorneys handle the situation."

Home BancShares paid about $102 million, including $81 million in Home BancShares stock, for the Tampa bank. Bay Cities had six offices in the Tampa area and in Sarasota.

Bay Cities had about $23 million in nonperforming and past due loans in the fourth quarter, Allison said.

"The good news is the [chief executive officer] and the [chief lending officer] are no longer with us," Allison said.

Home BancShares' asset quality improved throughout the organization except for "six or seven loans in the Tampa group that are kind of messy," Allison said. "We'll get this cleaned up over a period of time."

Banks located in the southwest region of the country are some of the worst performing banks in the country because of exposure to quickly declining oil prices, said Matt Olney, a banking analyst in Little Rock with Stephens Inc.

But some of the banks with no significant energy-related loans -- including Home BancShares and Bank of the Ozarks -- are outperforming other banks, said Olney, who owns no stock in the bank.

Despite its falling stock price, Olney reiterated his buy rating on Home BancShares' stock.

Home BancShares continues to consider acquisitions, Allison said.

"But it certainly makes it more difficult as we've seen the beating companies have taken in the market," Allison said.

Centennial has 147 branches, including 79 in Arkansas, 61 in Florida, six in Alabama and one lending office in New York City. The bank has plans to open a deposit-only branch in New York City by the end of March.

The bank closed one Arkansas branch and three Florida branches in the fourth quarter and has plans to close two locations in Arkansas and two in Florida during the first quarter of 2016.

Business on 01/22/2016