Murphy Oil Corp. on Wednesday became the latest U.S. energy company to cut its capital budget for 2016 as the prolonged slump in oil prices continues to curtail investment in the industry.

The El Dorado-based company plans to spend $850 million during fiscal 2016, down 62 percent from last year. The spending cuts come after Murphy Oil reduced its budget by more than 30 percent in 2015 because of low oil prices.

Murphy Oil said its capital budget remains under review for possible further reductions should low oil and natural gas prices continue.

"We remain focused on driving down operating and [general and administrative] costs across all segments of our business," said Chief Executive Officer Roger Jenkins in a statement. "The cost reductions better position the company to weather the anticipated 'lower-for-longer' commodity price environment."

Murphy Oil said on Wednesday that in response to prices in 2015, the company reduced its workforce more than 20 percent, and general and administrative expenses by 16 percent, or $57.3 million.

Globally, the energy industry has seen hundreds of billions of dollars fade from expectations as oil prices remained low, said Rob Lutts, president and chief investment officer for Cabot Wealth Management.

The oil and gas companies announcing their spending cuts so far include Hess Corp., which said earlier this week that it is cutting its 2016 capital spending 40 percent from a year ago to $2.4 billion.

"This is about preserving the balance sheet so you can survive," Lutts said about the spending cuts. "One of the major problems in the financial markets right now is high yield bonds are on credit watch because some of the companies may not survive."

Oil prices, which are hovering around $30 a barrel, began to plummet in 2014 as the world became awash in oil and demand weakened. Since 2014, when crude last traded for more than $100 a barrel, prices have fallen more than 70 percent.

The global oil glut began as U.S. shale production increased and OPEC decided not to cap output from members. And despite significant pullback in investment and drilling in the United States, domestic production has fallen only about 3 percent since last year, Lutts said.

"We cut the number of rigs in half, and we are still producing a very similar amount as we did last year," he said.

For prices to reach $60 a barrel again, there would have to be more-meaningful cuts to production in the United States and pullback from producers in the Middle East.

As it is, OPEC, led by Saudi Arabia, has refused to cut its production levels, and more oil is expected to come on line as Iran plans to increase its output in response to sanctions being lifted under the nuclear deal.

"More analyst now are expecting lower prices for longer," he said.

Murphy Oil shares rose 2.4 percent before closing Wednesday at $18.14 on the New York Stock Exchange. The company released its 2015 fourth-quarter financial results Wednesday after markets closed.

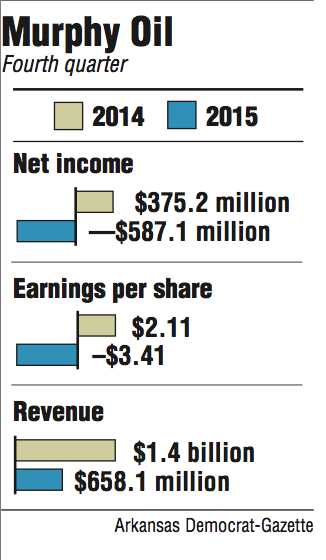

The company reported a loss of $587.1 million, down from a profit of $375.2 million in the same period in 2014.

The company said its quarterly financial results include a noncash impairment charge of $192.2 million on oil and natural gas properties. The charge occurred mainly in deepwater fields in the Gulf of Mexico.

Murphy Oil said the loss also included exit costs of $282 million on a deepwater rig contract because two rigs were idled. The company said it had to pull the rigs before the contract was up because the drop in oil and natural gas prices forced Murphy Oil to reduce its capital spending in 2016.

Murphy Oil's earnings per share for the fourth quarter came in at a loss of $3.41, compared with a positive $2.11 a year ago. Murphy Oil missed analysts average estimate of a loss of $1.20.

Revenue for the fourth quarter was $658.1 million, down from $1.4 billion in the same quarter in 2014.

"Despite a major decline in oil prices, 2015 was a good year operationally for Murphy," said Jenkins, the CEO. "We increased our proved reserves even with the inclusion of the 10 percent sell-down of our Malaysian assets."

Murphy Oil also said Wednesday that it entered into an agreement with Enbridge G&P Limited Partnership, a subsidiary of Enbridge Inc., to divest its natural gas processing and sales pipeline assets in British Columbia, Canada. Murphy Oil will get $381.6 million in cash from the deal.

In a separate deal, Murphy Oil also entered into a joint venture with Athabasca Oil Corp. in Canada in which Murphy Oil will pay about $177. 4 million at closing and another $159.6 million in financing for a period of up to five years, according to the news release.

Murphy Oil will hold a conference call at noon today to discuss its quarterly earnings. The call can be accessed on the investor section of the company's website or by calling 1 (888) 631-5929 and using the conference number 753454.

Business on 01/28/2016