Investors remained in a buying mood Thursday, driving U.S. stocks broadly higher for the third day in a row.

The Dow Jones industrial average gained 235.31 points, or 1.3 percent, to 17,929.99. The Standard & Poor's 500 index rose 28.09 points, or 1.4 percent, to 2,098.86. The Nasdaq composite added 63.43 points, or 1.3 percent, to 4,842.67.

The latest gains added to the market's rebound from the brief but steep slump that followed Britain's vote to leave the European Union last week.

While the rally suggests that traders' anxiety over Britain's departure from the EU have eased, a surge in U.S. bond prices Thursday signaled many investors remain cautious about the possible long-term implications. As bond prices rose, the yield on the 10-year Treasury note fell to 1.47 percent.

Consumer staples companies posted the biggest gains. Utilities stocks, a traditional haven for investors seeking less risk, were a close second. Oil prices fell.

"The equity market has realized that the [U.K. vote to leave the EU] in a vacuum by itself is not a reason to wholesale abandon equities," said David Schiegoleit, managing director of investments for the private client reserve at U.S. Bank. "But there is still the fear that it becomes contagious with other economies in Europe."

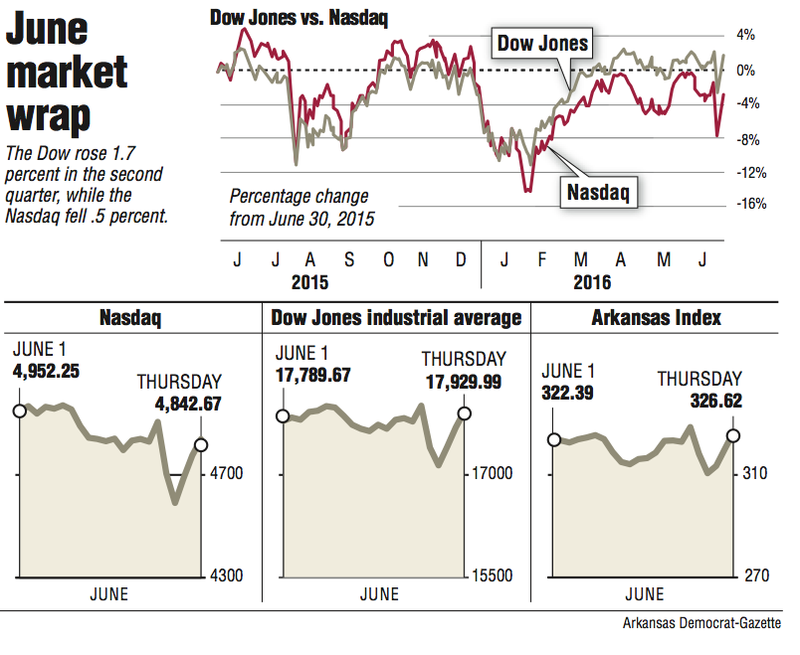

The stock market closed out the second quarter with modest gains.

The S&P 500 index added 1.9 percent in the April-June period. Much of the biggest gains came from energy stocks, which benefited from a rebound in oil prices, and utilities and telecom companies, which became more attractive as bond yields declined. The index is up 2.7 percent so far this year.

The Dow, which gained 1.7 percent during the second quarter, is up 2.9 percent this year. The Nasdaq lost 0.5 percent in the second quarter and is down 3.3 percent through the first half of 2016.

Trading got off to a tepid start on Thursday but got going into rally mode by midmorning, suggesting a resolve among investors to put their worries about Britain's eventual EU exit in their rearview mirror.

Markets in Europe also extended their rebound from the two-session slump that ended on Tuesday. Britain's FTSE 100 rose 2.3 percent. The U.K.'s stock market has recouped its losses, though that is largely thanks to a drop in the British currency, which favors earnings for big companies overseas.

Germany's DAX added 0.7 percent, and France's CAC 40 rose 1 percent.

The simultaneous rise in prices for stocks and U.S. bonds on Thursday was unusual and suggests nervous investors overseas are seeking the relative safety of bonds even as other traders look to ride the U.S. stock market rally further, Schiegoleit said.

In energy futures trading, benchmark U.S. crude oil fell $1.55, or 3.1 percent, to close at $48.33 a barrel in New York. Brent crude, used to price international oils, slid 93 cents, or 1.8 percent, to close at $49.68 a barrel in London. Wholesale gasoline fell 2 cents to $1.50 a gallon, while heating oil shed 5 cents to $1.48 a gallon. Natural gas rose 6 cents to $2.92 per 1,000 cubic feet.

In metals trading, gold lost $6.30 to $1,320.60 an ounce, silver gained 22 cents to $18.62 an ounce, and copper added 1 cent to $2.20 a pound.

Business on 07/01/2016