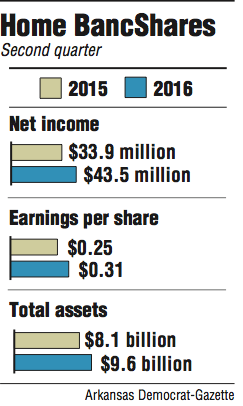

Home BancShares, which owns Centennial Bank offices in four states, reported a record profit of $43.5 million for the second quarter, up 28 percent from $33.9 million in the same period last year.

It was the 21st consecutive quarter for increased earnings, the Conway-based bank said Thursday.

Earnings came to 31 cents a share, beating expectations of 30 cents by nine analysts surveyed by Thomson Reuters. That was up from 25 cents earned per share in the second quarter last year.

In trading on the Nasdaq exchange, shares of Home BancShares fell 11 cents to close Thursday at $20.44.

The bank had $9.6 billion in assets at the end of the second quarter.

Home BancShares will remain below $10 billion in assets this year, John Allison, chairman of the bank, said during a conference call Thursday.

Allison said the bank still hopes to announce an acquisition this year, but the purchase won't close until next year. That would delay until 2018 the implementation of extra regulatory costs connected with carrying more than $10 billion in assets.

"If [no deal materializes], we'll just continue to improve our performance toward our new goals," Allison said.

Home BancShares has had difficulty finding executives willing to sell their banks at a price that's agreeable to Home BancShares, Allison said.

Allison said one potential seller with a "nice bank" recently handed him a list of 17 banks that have sold at two times book value, an expensive price.

"He said that's what I needed to pay him for his bank," Allison said. "We'd like to do a deal, but at a price that works for both the buyer and the seller, that allows for an increase in the [buyer's] stock price. Most sellers just don't get it."

Home BancShares will remain disciplined, Allison said.

"And if it doesn't work, it doesn't work," Allison said.

Home BancShares has bought 13 banks since 2010 but hasn't announced a purchase in about a year.

Stephens Inc. of Little Rock has a buy rating on the bank.

Home BancShares deserves the rating because of its strong profitability, its outlook of double-digit loan growth, excluding loans acquired through purchases, and its potential for the purchase of more banks, said Matt Olney, an analyst with Stephens.

Home BancShares lowered its efficiency ratio to 36.84 percent in the second quarter, with a goal to get below 35 percent, said Donna Townsell, a senior executive vice president. That means it costs Home BancShares $36.84 to earn $100.

The bank is taking relatively minor measures to cut its expenses. It recently signed a new contract for janitorial services at its Arkansas offices, Townsell said.

Other efficiency measures included selling a branch in Florida for a profit of $738,000, marketing 14 vacant buildings for sale and making sure unused phone lines are disconnected.

"We're currently reviewing all expense categories through the first six months to see what we may be leaving on the table," Townsell said.

But the efficiency push can go too far, Allison said.

"I broke my phone and went down to AT&T to get me a new phone," Allison said. "They brought me one out, but then they told me that I was not an authorized signer for Centennial or Home BancShares. I told Donna [Townsell] that this thing is getting a little bit over the top."

Centennial Bank has 143 offices -- 77 in Arkansas, 58 in Florida, six in Alabama and two in New York, where it has a lending office. It plans to begin accepting deposits at its New York lending office by the end of September.

Centennial plans to close one branch in Arkansas in the next two months.

Business on 07/22/2016