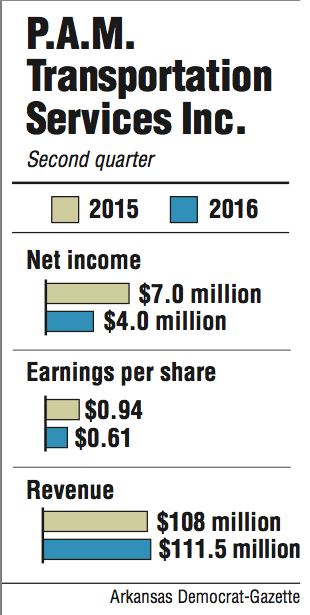

P.A.M. Transportation Services Inc. on Wednesday reported just under $4 million in net income, or 61 cents a share, for the second quarter of 2016.

Profit dropped about 43 percent compared with the $7 million record-breaking net income, or 94 cents per share, from the same quarter of 2015. The Tontitown company reported $111.5 million in total revenue in the quarter that ended June 30, up around 3 percent from the $108 million of last year's second quarter.

"During the second quarter of 2016, we continued to experience some weakness in the market for our services but were able to continue our positive trend of revenue growth," said P.A.M. President Daniel Cushman.

He explained that overall revenue increase in the trucking division could be attributed mostly to a larger fleet and expansion in Dedicated and Mexico divisions.

Total loads were up to 84,540 from 77,903 last year, and revenue per truck per workday was up to $709 from $684 in 2015's second quarter. P.A.M.'s empty-miles factor also dropped to 6.28 percent from 6.45 percent.

"These earnings were interesting because on the earnings-per-share side they had a disappointment, while on the revenue side, they had a positive surprise," said Bob Williams, senior vice president and managing director of Little Rock's Simmons First Investment Group Inc.

Cushman qualified that the lower margins of the quarter were not because of "less profitable freight selection" but rather "an increase in our normal operating costs, which cannot currently be passed on to customers." He also blamed "entry costs as we expand into new markets we wish to add to our service profile."

"If they can continue gaining market share in these new markets, once they cover the fixed expenses then hopefully it will accrete to earnings over time, but you never know," said Williams. "That seems to be [Cushman's] goal though."

Cushman explained that while the company has ventured into new markets, namely automobile and retail and manufacturing, it is trying to stay nimble.

"We wanted to maintain our current customer base and build around that base with more capacity. We believe this positions us for exponential improvement when the general freight market rebounds and capacity begins to tighten, but also provides us with the flexibility to downsize quickly should a freight recovery take longer than anticipated."

Williams agreed: "You have to be able to respond to this soft economy these days."

The trucking industry has seen five-straight months of job loss in 2016. However, as Bob Costello, chief economist for the American Trucking Associations, said in a recent interview, "I'm hoping we're near the bottom and that things will slowly start to move in the right direction."

Cushman elaborated on the higher operating costs by citing the expense of "enhancements" in driver recruiting and retention, something the company had warned about last quarter. In addition, he acknowledged the effect of high employee health care costs and an inability to make as much money as hoped from reselling used trucks.

P.A.M., like many of its competitors, also has taken a hit from lower fuel prices. The company's fuel surcharge revenue decreased about 26 percent compared with the second quarter of 2015.

After the earnings release Wednesday, share prices in Nasdaq trading closed up about 1.8 percent.

Business on 07/28/2016