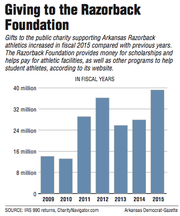

FAYETTEVILLE -- Gifts to the public charity supporting Arkansas Razorback athletics totaled $39.2 million during the 12-month period ending June 30 of last year, about an $11.3 million increase compared with the previous fiscal year.

RELATED ARTICLE

http://www.arkansas…">256-acre gift a bit wait-and-see

The rise in fundraising for the Razorback Foundation can in part be attributed to a land gift from Dallas Cowboys owner Jerry Jones and his wife, Gene.

The foundation listed a "fair market value" of $8.7 million for a single real estate gift in its 2014 annual report required by the Internal Revenue Service. The IRS report does not state the specific donation, but the University of Arkansas at Fayetteville in January 2015 announced the approximately 256-acre gift in southwest Fayetteville, property west of South Cato Springs Road and Interstate 49 that is adjacent to a city-owned park site.

[Click here to read the Razorback Foundation's Form 990]

For the 12-month period ending June 30, 2015, the foundation reported total expenses of $33.6 million, including $28.1 million to support UA athletics through "scholarships, facilities, construction, renovation, and operational funding." Of the $28.1 million total, $9.1 million went to support construction projects.

At the close of the period, the foundation listed net assets of $52.1 million, an increase of about $6.8 million compared with a year earlier.

The university has proposed a $160 million project to expand Donald W. Reynolds Razorback Stadium, increasing capacity from 72,000 to about 76,000 with the goal of boosting the number of premium seats.

More than $17 million has been raised for the project, according to an April letter from UA Chancellor Joe Steinmetz to former U.S. Sen. David Pryor, a member of the UA System board of trustees. Plans call for UA to issue bonds not to exceed $120 million to cover project costs, but trustees must vote to approve the expansion.

The foundation's IRS report is dated May 9 and lacks information about finances beyond June 30, 2015. At that time the foundation listed $23.8 million in unrestricted net assets. Another $25.3 million were listed as "temporarily restricted" assets.

The return also listed the five highest-paid independent contractors receiving compensation from the foundation. Former Razorback football Coach and Athletic Director Frank Broyles received about $3.5 million for speaking engagements in the 2014 calendar year.

Other Razorback coaches also made the list, with head football Coach Bret Bielema ($350,000) and men's head basketball Coach Mike Anderson ($200,000) receiving payments for speaking engagements. The foundation also paid $176,250 for speaking engagements to Van Horn Enterprises, a limited liability company founded by Dave Van Horn, the Razorback head baseball coach.

Former men's head basketball Coach John Pelphrey was paid $136,667 as part of a "contract buy-out," according to the IRS return. Pelphrey last coached the Razorbacks in 2011.

The foundation reported having 18 employees in calendar year 2014. Its executive director for the period covered in the report was Sean Rochelle, who earned about $202,000 in total compensation. Scott Varady took over in December as the foundation's executive director and general counsel.

The IRS return from the foundation states that it did not have a written conflict of interest policy.

Each organization was required to indicate whether it has a conflict of interest policy and whether such a policy was in place by the end of the tax year, according to IRS instructions for completing the 2014 return.

"It is not required as a matter of federal tax law except in the case of hospitals," said Bruce Hopkins, a law professor at the University of Kansas School of Law. Hopkins said he has four decades of experience representing nonprofit organizations.

Hopkins said such conflict of interest policies have become increasingly common for nonprofit organizations, however.

"It's gotten to the point now where most organizations that are public charities just adopt one," Hopkins said, explaining that such policies typically require board members and foundation officers to answer questions yearly about any business ties to the nonprofit organization or with one another. A managing body would then "decide if any particular conflict of interest poses a problem," Hopkins said.

The Razorback Foundation is governed by a 13-person board of directors. Ken Mourton is the board's chairman. He is an attorney based in Fayetteville.

The foundation did not respond to a question from the Democrat-Gazette about such a policy.

The IRS return states that the foundation has a whistleblower policy, as well as a document retention and destruction policy.

Metro on 06/05/2016