State general revenue in April dipped by $7.5 million over what was collected a year ago, but it still exceeded the state's forecast by $8.4 million.

RELATED ARTICLES

http://www.arkansas…">Bid to rein poor now part of bill http://www.arkansas…">Funds to update campaign-gift filing sail in House http://www.arkansas…">Capitol-zoning appeal process advances

Collections totaled $793.7 million, according to state figures.

The month's individual income tax collections outdistanced the forecast, while sales and use tax collections fell slightly short of the forecast, the state Department of Finance and Administration reported Tuesday in its monthly revenue report.

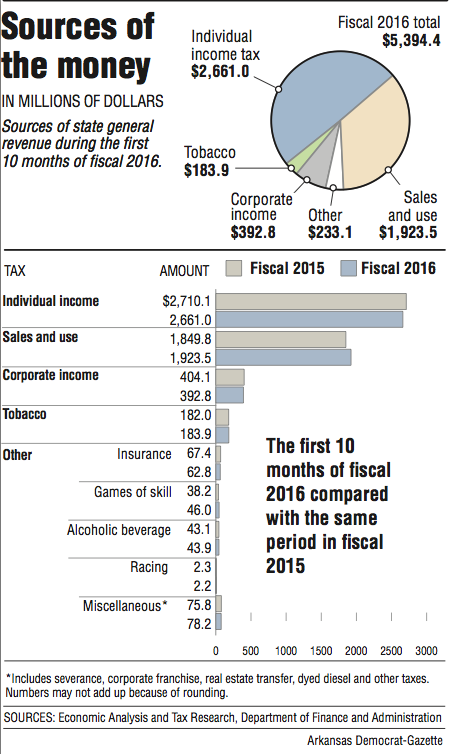

Sales and use tax collections and individual income taxes are state government's two largest sources of general revenue.

Gov. Asa Hutchinson said the report for April "continues our trend of showing solid growth in Arkansas' economy. Individual income tax collections are up, an indication that more Arkansans are on the job and making more money.

"We're also seeing overall revenue exceed the forecast, which will likely put us in a position to end the year with a surplus," the Republican governor said.

"This is the result of good, conservative budgeting. It's a good reminder of the benefits that come from efficient operations and keeping costs low, especially now, as we conclude the fiscal session and pass the budget that will guide state operation in the coming fiscal year," Hutchinson said.

April's tax collections fell short of the record for the month. Historically, the state's best month for tax collections is the one in which tax returns are due. That month has been April in the past several years, although it was May in earlier years.

The record for general revenue collections for April is $817.4 million in 2013, said Whitney McLaughlin, a tax analyst for the finance department.

Arkansas' tax refunds and some special government expenditures, such as court-mandated desegregation payments, come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

In April, the net increased by $37.2 million, or 6 percent, over the same month a year ago, to $661.3 million. That exceeded the state's forecast by $37.1 million, or 5.9 percent.

Lower than expected individual and corporate income tax refunds fueled April's net available general revenue, which added $26.9 million to the net, and a one-time deposit of $8.1 million from excess funds after the end of the Arkansas Comprehensive Health Insurance Pool program.

During the first 10 months of fiscal 2016, total general revenue collections have increased by $21.5 million, or 0.4 percent, over the same period in fiscal 2015, to $5.394 billion. That exceeded the state's forecast by $22.5 million, or 0.4 percent.

So far in fiscal 2016, the net general revenue has increased by $160.2 million, or 3.7 percent, over the same period in fiscal 2015 to $4.488 billion. That's $110.2 million, or 2.5 percent, above the forecast.

Asked whether finance department officials expect the net to become $110.2 million surplus at the end of the fiscal year on June 30, department Director Larry Walther said, "We are praying that it does. Obviously, it is good for the state and moving ahead into fiscal year 2017 with a surplus is a good deal."

The state's Feb. 1 general revenue forecast projected a fully funded general revenue budget in fiscal 2016 and a $35.9 million surplus.

Last year, the Arkansas Legislature enacted a $5.19 billion general revenue budget for fiscal 2016 -- a $131.5 million increase over what was spent in fiscal 2015 -- as it approved individual income tax cuts projected to reduce state general revenue by $26.5 million in fiscal 2016 and nearly $101 million in fiscal 2017.

Richard Wilson, an assistant director of research for the Bureau of Legislative Research, said, "Since the recent forecast revision of February 1st, the three heaviest refund months have now been completed.

"During those three months, the refund situation has provided an additional $80 million to what will become a surplus on June 30th," Wilson said in a written statement. "Because the refund situation represents a correction to erroneous withholding tables for tax year 2015, these surplus funds will be 'one-time' (nonrecurring) money."

Asked whether the erroneous withholding tables were a finance department error, Wilson said that "I am not certain, but one would think that the Department of Revenue is the origin of that information."

But finance department spokesman Jake Bleed said, "The withholding tables were not erroneous and were instead created in full compliance with the law."

According to the finance department, April's general revenue includes:

• A $2.6 million (1.4 percent) increase in sales and use tax collections over a year ago to $192.7 million. That's $1.6 million (0.8 percent) below the state's forecast. The collections largely reflect taxable sales activity in March for which businesses paid sales taxes to the state in April. The state's chief economic forecaster John Shelnutt said sales tax collections from utilities have slipped because of warm winter.

• A $4.8 million (0.9 percent) decrease in individual income tax collections from year-ago figures to $505.3 million. That exceeded the state's forecast by $4.8 million (1 percent).

Withholding taxes are included in individual income tax collections. They increased by $13.9 million over a year ago to $235 million, which exceeded the state's forecast by $8 million.

The unemployment rate in Arkansas dropped to 4 percent in March, its lowest level in 59 years, the U.S. Bureau of Labor Statistics reported last month. The state's unemployment rate was 4.2 percent in February. The national rate was 5 percent in March.

• A $10.5 million (15.9 percent) decrease in corporate income tax collections over a year ago to $55.9 million, which is $3 million (5.1 percent) below the forecast. Walther said that the corporate taxes are a volatile source of tax collections for the state.

• A $1.1 million (5.7 percent) decline in tobacco tax collections from year ago figures to $18.5 million, which is $1.7 million (10 percent) above the forecast. Monthly changes in tobacco tax collections can be attributed to uneven patterns of stamp sales to wholesale purchasers, the department said.

Metro on 05/04/2016