NEW YORK -- Stocks were mostly unchanged Monday, despite several big merger announcements over the weekend.

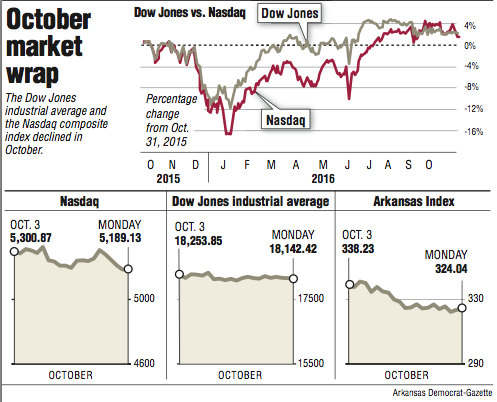

The Dow Jones industrial average fell 18.77 points, or just over 0.1 percent, to 18,142.42. The Standard & Poor's 500 index fell 0.26 points, or less than 0.1 percent, to 2,126.15, and the Nasdaq composite fell 0.97 points, or less than 0.1 percent, to 5,189.13.

With Monday's close, the major indexes ended the month of October broadly lower. The Dow fell 0.9 percent, the S&P 500 fell 1.94 percent and the Nasdaq fell 2.3 percent.

The news out late last week regarding newly found emails possibly related to the investigation of Hillary Clinton's use of a private server threw the election's results into more uncertainty, which investors typically don't like. Over the weekend, the FBI obtained a warrant to begin reviewing newly discovered emails that may be relevant to the Clinton email investigation, a law enforcement official said.

"The reopening of the email investigation into Hillary Clinton certainly throws a wrench into the presidential election," said John Briggs, head of fixed income strategy for the Americas at RBS, in a note to investors.

Along with the election, investors have two big events on the economic front this week: a meeting of the Federal Reserve and the October jobs report. It's widely expected that the Fed's policymakers will not raise interest rates so close to the election and will wait until the December meeting. However, any economic observations from the bank will be important to investors. The jobs report will be the last major piece of economic data out before the Nov. 8 election.

It's also a busy week for corporate earnings, with more than one-fifth of S&P 500 companies reporting their quarterly results.

Wall Street got another wave of megamergers. General Electric announced it would combine operations of its oil and gas division with Baker Hughes, creating a new company with $32 billion in annual revenue. GE fell 12 cents, or 0.4 percent, to $29.10 while Baker Hughes fell $3.72, or 6.3 percent, to $55.40.

Separately, telecommunications company CenturyLink announced it was purchasing competitor Level 3 Communications for $24 billion. CenturyLink fell $3.81, or 12.5 percent, to $26.58 and Level 3 rose $2.10, or 4 percent, to $56.15.

The mergers were not limited to the U.S. On Monday, three of Japan's largest shipping companies announced they would merge their shipping container operations.

U.S. government bond prices rose slightly. The yield on 10-year Treasury note fell to 1.83 percent from 1.85 percent on Friday. The dollar rose against the euro, the British pound and the Japanese yen.

U.S. benchmark oil futures extended their losses. Crude fell $1.84 to $46.86 a barrel in New York. Brent crude, the international standard, fell $1.41 to $48.30 a barrel.

In other energy commodities, wholesale gasoline fell 2 cents to $1.45 a gallon and heating oil fell 5 cents to $1.496 a gallon. Natural gas fell 8 cents to $3.026 per thousand cubic feet.

Business on 11/01/2016