Dillard's Inc. posted a 50 percent drop in profit Thursday as the Little Rock retailer's sales fell in the third quarter.

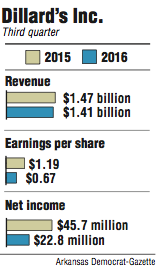

Dillard's had a net income of $22.8 million, or 67 cents per share, for the 2016 third quarter, down from $45.7 million, or $1.19 a share, during the same period a year ago.

"Our sales decline continued to weigh heavily on profitability during the third quarter," said Chief Executive Officer William Dillard II in a prepared statement.

"As we work through this tough time, we are focused on improving customer experience through attracting and maintaining premium brands while providing exceptional service," he said.

Dillard's reported total sales of $1.41 billion for the period ending Oct. 29, down from $1.47 billion a year ago.

Total merchandise sales, which exclude its construction business, declined 4 percent, as did same-store sales.

Dillard's said sales declined in all of its retail categories, but were better in home and furniture, junior's and children's apparel, ladies' apparel and men's clothing and accessories.

The company said it bought back $53.1 million, or 900,000 shares, of stock under its $500 million share repurchasing plan.

Dillard's shares surged almost 10 percent to $70.47 on the New York Stock Exchange. The company released its financial results after markets closed.

Dillard's was one of several retailers to release their quarterly financial results Thursday.

Kohl's Corp. reported a increase in third-quarter earnings despite seeing revenue fall 2.3 percent. The company saw profit increase to $146 million from $120 million a year ago.

The company said improved earnings were the result of a strong back-to-school season, along with reduced expenses. Shares of the company soared 11.5 percent to $50.96 on the New York Stock Exchange.

Better-than-expected earnings from Kohl's gave most department store stocks a boost Thursday, said Rob Lutts, president and chief investment officer for Cabot Wealth Management.

"That helped the whole group," he said. "The whole group ... all the department stores have been under pressure for earnings and sales. The top line has been really stressed for all of these companies."

Macy's Inc.'s earnings missed analysts' estimates for the third quarter, but the company's shares rose after the company said it will partner with Brookfield Asset Management to explore "value creation opportunities" for its real estate.

"Over time, that [retail] space has been costing more and more, and they are getting less and less of turnover and efficient use of that space," Lutts said of Macy's real estate holdings.

Macy's reported a profit of $17 million for the third quarter, down from $118 million in the 2015 period. The results missed Wall Street's estimates. Shares of the company rose 5.6 percent to $40.53 on the New York Stock Exchange.

Macy's partnership with Brookfield comes as the retailer has sought to find value from its real estate holdings and as many of its stores struggle.

"We are reallocating and prioritizing our spending to drive growth, improve the customer experience, increase our agility and deliver strong financial results," Chief Executive Officer Terry Lundgren said in a prepared statement.

"We also are making good progress on our strategies to create shareholder value through our real estate, while preserving our ability to operate as a top retailer with a healthy balance sheet," he said.

Business on 11/11/2016