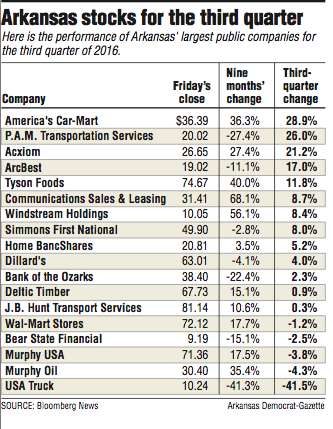

America's Car-Mart, the Bentonville-based retailer of used vehicles, had the best return among Arkansas' largest public companies in the third quarter, rising 28.9 percent.

P.A.M. Transportation Services of Tontitown and Little Rock's Acxiom Corp. also were up more than 20 percent for the three-month period that ended Friday.

Car-Mart's "financial outlook improved during the most recent quarter and investors went along for the ride," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"Despite lower unit sales and productivity, earnings per share rose, fueled by improved profit margins and reduced charges for bad debt," Williams said.

America's Car-Mart has more than 140 dealerships in the south-central U.S.

P.A.M. Transportation gained 26 percent in the third quarter.

"P.A.M. saw robust growth in overall revenue despite declines in fuel surcharges," Williams said. "Overall, strong financial metrics were reduced, but not completely offset, by spikes in rent and purchased transportation expenses."

Acxiom was up more than 21 percent for the quarter.

"The company's efforts to transform its business model from traditional marketing services to digital subscription-based marketing showed results," Williams said. "Tight controls on research and development spending, and general and administrative expenses, allowed the company to increase marketing without too much damage to the bottom line."

With a strong close to the quarter Friday, only five of Arkansas' largest public companies lost ground in the third quarter while 13 rose.

The Arkansas Index, which tracks the largest public companies based in the state, was up 3.8 percent in the third quarter.

None of Arkansas' four publicly traded banks were among the top performers in the third quarter.

Simmons First National was up 8 percent, Home BancShares rose more than 5 percent, Bank of the Ozarks gained 2.3 percent and Bear State Financial fell 2.5 percent.

The performances were not unusual for banks in the southwest, according to a recent report by Matt Olney, an analyst with Stephens Inc.

For the past three months, Home BancShares was among three banks in the region with the most executives selling their shares, Olney said. Bank of the Ozarks was among three banks with the highest levels of short selling, although short selling of Bank of the Ozarks' stock has declined by 10 percent in the past month, Olney said.

USA Truck had by far the worst performance among Arkansas firms, losing 41.5 percent of its value for the quarter.

The biggest contributor to USA Truck's decline was a surprise loss in the second quarter, Williams said.

The Van Buren firm lost $1.3 million for the second quarter. It was a loss of 15 cents per share, compared with the expectations of analysts of a gain of 19 cents per share.

The stock fell 23.6 percent on the day the loss was announced in August, a one-day decline greater than any of Arkansas' largest public companies have endured in recent memory, Williams said.

The loss caused company stock to be pummeled "as management slashed payroll and sold equipment in response to [what the company described as] an 'uncertain industry environment,'" Williams said.

Two related Little Rock firms -- Communications Sales & Leasing and Windstream -- have risen more than 60 percent since Jan. 1. Communications Sales has improved by 68 percent and Windstream is up 56 percent for the first nine months of the year.

Windstream, a telecommunications company, spun off Communications Sales, a real estate investment trust, last year.

Business on 10/01/2016