When the economic downturn of 2008 coincided with high oil prices, airlines and airports did not fare well.

Some of those most affected were small and non-hub airports, which have seen departures drop nationally by more than 30 percent since 2007. Many carriers have been lost to consolidations and bankruptcies. Today four companies control around 80 percent of all air travel.

In addition, the expense of and increased regulations on training have led to a shortage of pilots. As a result, airlines have had to maximize their pilots and move toward larger airplanes traveling between larger markets.

On Sept. 21, Arkansas' three smallest commercial airports -- El Dorado, Harrison and Hot Springs -- were left without any commercial airline service when SeaPort Airlines abruptly went out of business.

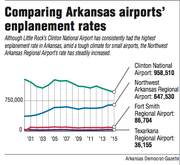

As with many of their peers across the country, three of Arkansas' four remaining commercial airports have seen average declines or flat-lines in enplanement rates since the recession. Northwest Arkansas Regional Airport, however, has had steady growth, with enplanement rates higher than ever. That has prompted a long-term strategy for continued infrastructure growth.

"The health of the economy and the direction of air service are inextricably tied," said William Swellbar, executive vice president at InterVistas Consulting in Washington, D.C. He is working to put together the Regional Air Service Alliance to lobby Congress about issues facing small and non-hub airports.

"Arkansas has pretty much followed national trends," he said. "There are going to be some winners in this process, and there are going to be some losers, but I would say Northwest Arkansas is going to be on the winning side of this ledger."

Others in Arkansas agree with that outlook. "The economy is still driving traffic at the airport," said Mike Harvey, interim director and chief executive officer of the Northwest Arkansas Council. "From where I sit right now, our economy is running about as hot as it ever has. I'd have to go back into the 1990s to see it running this way. We're in a good place."

Scott Van Laningham, executive director and chief executive officer of Northwest Arkansas Regional Airport, agreed that the region's business growth is driving the airport's expansion. He cited data from a recent Arvest Bank Skyline Report, revealing that in the first half of 2016, $206 million in commercial building permits were issued in the region, way up from $75 million in the first six months of last year.

"Central Arkansas isn't having the same level of business activity outside of the airport that we are," he said. He reports an average of 60 percent business travelers to 40 percent leisure. Bill and Hillary Clinton National Airport/Adams Field in Little Rock reports 73 percent leisure passengers, 18 percent business, 5 percent both, and the remainder as school or "other."

According to the 2015 State of the Northwest Arkansas Region Report from the Northwest Arkansas Council and the Walton College of Business at the University of Arkansas in Fayetteville, employment in the area between 2010 and 2014 grew annually at an average rate of 2.9 percent, compared with 0.6 percent statewide and 1.7 percent nationally.

"What we're trying to do is meet the infrastructure needs for the airport to keep up with that activity," Van Laningham said. "When we got direct service to San Francisco, for example, that helps attract folks to our area. It's not that that in and of itself creates business opportunity though, it's sort of the other way around."

Direct service to San Francisco is the newest route at the airport, which took five years to get. Rob Smith, director of communications and policy at the Northwest Arkansas Council, believes it is indicative of the level of business occurring in the region.

"If you look at the San Francisco airport's route map ... you'll see there are bigger cities around us in the middle of the country without nonstop service," he said. "It's a real compliment to our business community that they decided we needed that air bridge between us."

More air traffic creates a need for continued growth of the airport's infrastructure. The airport, opened in 1998, added a $4.6 million rental car wash facility last year; a $2.1 million parking lot expansion that was finished in March; and a ramp expansion that was completed in September at just over $4 million.

Northwest Arkansas Regional is moving forward with about $1.2 million in expansions to its employee parking lot and administration offices. At the beginning of next year, it plans to start the $35 million construction of its first parking deck, with long-term plans for a second one dedicated to rental car use. It is also looking toward an expansion of the terminal to connect it to the parking deck, and a potential access road that will provide an interstate-quality spur from U.S. 412.

As to why the growth is happening, Steve Clark, president and chief executive officer of Fayetteville's Chamber of Commerce, pointed to several factors: "Wal-Mart is number one. Number two is the vendor community. Number three is what we're beginning to do in the field of health care ... we're moving to making Northwest Arkansas a health care destination. The fourth is the university; we're getting a lot more out-of-state and international students. The fifth would be manufacturing. We still do a lot of that around here."

Harvey does not attribute the growth to any one influence, in particular: "It's all of the above, quite frankly. It's just all been in sync over the past few years. You've seen a lot of growth recently at these companies and at the university. We also have entrepreneurial startup activity running at a level we haven't seen before."

He did highlight growth in the health care industry though. "Health care is the fastest growing occupation in raw numbers in Northwest Arkansas right now. The hospitals are all in growth mode."

"When you draw the trend line, it's been a sustained 4 [percent] to 4.5 percent annual average growth [at the airport]," said Ryan Hayes, project manager at Mead & Hunt, the company in charge of evaluating the airport's projected long-term growth to inform the planning of the terminal's expansion. The company has worked with more than 20 other airports in the country on various projects.

"And all indicators are that that's going to continue for the next 20 years. It's growing faster than most," he said. The Federal Aviation Administration's most recent Terminal Area Forecast report projected an average growth rate at U.S. airports of around 2 percent annually between 2015 and 2040.

Just as business and economic development drives the airport, the airport serves as an incentive for business. "Anytime we talk to prospects about coming to Bentonville, the proximity to the airport is always a relevant factor," said Dana Davis, president and chief executive officer of the Bentonville/Bella Vista Chamber of Commerce.

"It's a game changer, without a doubt," Clark said. "The airport and I-49 were two big game changers. They unlocked us to the world." He explained that the airport and its route map are "invaluable" when he pitches the region to potential businesses. "I get people who come in here and the first thing they say is, 'Man, you've really got a nice airport.' It makes a great first impression."

SundayMonday Business on 10/02/2016