For the third month in a row, Arkansas' general revenue collections fell short of the state's forecast, and Gov. Asa Hutchinson said Tuesday that while the state's economy appears robust, consumers may be spending cautiously as the Nov. 8 presidential election approaches.

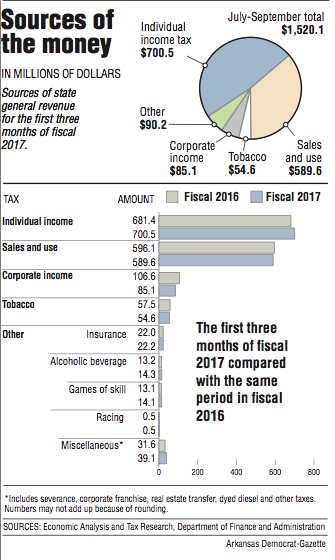

For the first three months of fiscal 2017, Arkansas' general revenue totaled $1.52 billion, below forecast by $36.1 million, or 2.3 percent. Compared with the same period in fiscal 2016, collections are nearly flat, according to the monthly revenue report from the state Department of Finance and Administration.

In September, fiscal 2017's third month, general revenue fell $17 million short of the forecast because of lower-than-expected sales-tax and corporate income-tax collections. Total collections were $578.8 million, a $1.7 million increase compared with the same month a year ago. The state's record collection for the month continues to be the $590.1 million collected in September 2013, said Whitney McLaughlin, a tax analyst at the finance department.

Individual income taxes and sales and use taxes are the two largest sources of state general revenue. State general revenue helps fund much of state government and state support for the public schools.

Hutchinson said collections of individual income taxes "continue to do well despite the $100 million tax cut [enacted] last year" and that those collections have increased the past two months over the same period a year ago.

"So that is a significant message that the income-tax cuts have a beneficial impact on a growing economy, and our income-tax collections have continued to grow," the Republican governor said at a news conference at the state Capitol.

"I think the question is, why is our economy robust ... yet the sales-tax collections are down, and the only explanation I can see is that there is some concern about consumer confidence," Hutchinson said. "Perhaps it's an election year, and people are just being cautious in their spending habits. It is not an Arkansas trend. We see this in other states as well, and so that is something that we should watch carefully as we continue to prepare for next year's budget."

The International Monetary Fund on Tuesday downgraded its forecast for the U.S. economy this year and warned that political discontent threatens global growth. The IMF cut its estimate for U.S. economic growth in 2016 to 1.6 percent from the 2.2 percent it had predicted in July. The economy grew 2.6 percent in 2015.

The IMF's dimmer outlook for the U.S. occurs even as the Federal Reserve is thought to be preparing to raise interest rates in December.

The U.S. economy has been sputtering since late last year. The main culprit is weak business investment. The IMF blames the U.S. investment drought on cutbacks in the energy industry, a strong dollar that's depressing exports and "policy uncertainty" regarding the November elections, in which Republican Donald Trump faces Democrat Hillary Clinton for the White House.

During the first three months of fiscal 2017, Arkansas' total general revenue dipped by $1.8 million, or 0.1 percent, from the same period in fiscal 2016 to $1.52 billion. The total also fell below the state's forecast by $36.1 million.

Tax refunds and some special government revenue, such as court-mandated desegregation payments, come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

So far in fiscal 2017, the net has dropped by $4.3 million, or 0.3 percent, from the same period in fiscal 2016 to $1.33 billion. That is $32 million, or 2.3 percent, short of the state's forecast.

Hutchinson said he would probably wait until the October report on general-revenue collections to "see whether that pattern continues or whether that breaks" before deciding whether to cut the general-revenue forecast and the budget. The October report will come out in the first week of November.

Michael Pakko, chief economist at the University of Arkansas at Little Rock Institute for Economic Advancement, said the state's wages and salaries have been increasing at a slower rate than the national average and that it could be a factor slowing consumer spending in the state.

Earlier this year, the Republican-controlled Legislature and Hutchinson enacted a $5.33 billion general-revenue budget for fiscal 2017 that factors in nearly $101 million in rate cuts approved in 2015 for individual income taxes. Most of the $142.7 million increase in the budget goes to the state Department of Human Services and public schools under the Revenue Stabilization Act enacted in this spring's fiscal session.

On Nov. 9 -- the day after the general election -- Hutchinson is to propose a general-revenue budget for fiscal 2018, which starts July 1, 2017. The budget will be based on a fiscal 2018 general-revenue forecast. He has said he wants to work with the 2017 Legislature to enact an individual-income-tax cut of a yet-to-be-determined size, which may be phased in.

For the first three months of fiscal 2017, the finance department reported that:

• Individual-income-tax collections increased by $19.2 million, or 2.8 percent, over the same period in fiscal 2016 to $700.5 million, which is $2.1 million, or 0.3 percent, above the state's forecast.

• Sales- and use-tax collections declined by $6.5 million, or 1.1 percent, from the same period a year ago to $589.6 million, which is $27.9 million, or 4.5 percent, below forecast.

• Corporate income-tax collections declined by $21.5 million, or 20.1 percent, from the same period in fiscal 2016 to $85.1 million, which is $25.1 million, or 22.8 percent, below the state's forecast.

According to the finance department, September's general revenue included:

• A $10.5 million, or 3.9 percent, increase in individual-income-tax collections over a year ago to $275.8 million, which is $1.3 million, or 0.5 percent, above forecast.

Withholdings are the largest category of individual income taxes. Withholdings in September increased by $10.7 million over a year ago to $184.5 million, which is $6.6 million above the state's forecast, McLaughlin said.

The increased individual-income-tax collections reflect more people working and working more hours, said John Shelnutt, the states' chief economic forecaster.

• A $2.1 million, or 1 percent, decrease in sales- and use-tax collections from a year ago to $196.4 million, which fell $10.9 million, or 5.3 percent, below the state's forecast.

The sales and use taxes have declined from a year ago on the basis of "a combination of extraordinary activity last year and weakness currently," Shelnutt said.

Sales-tax collections in other states "are seeing weakness now," he said. Retail sales in the United States in August declined, and the state collects sales taxes from businesses in September on the basis of their sales to consumers in August, he noted.

"I think it's fairly new at the national level, so it really hasn't jelled as to what the story is about consumers," Shelnutt said.

• A $7.3 million, or 9.1 percent, decrease in corporate income-tax collections from a year ago to $72.8 million, which is $9.7 million, or 11.8 percent, below the state's forecast.

"We have had another soft month in corporate income tax," said Larry Walther, director of the Department of Finance and Administration. "It's a continuation of what we have seen for the first three months [of fiscal 2017]. John [Shelnutt] believes that's going to start turning itself around and will not continue throughout the year."

State officials have said corporate income-tax collections often fluctuate widely on the basis of federal tax strategies.

September's net general revenue available to state agencies declined by about $500,000, or 0.1 percent, to $515.5 million, which fell $16.7 million below the state's forecast.

Senate President Pro Tempore Jonathan Dismang, R-Searcy, said the state's latest revenue report "should definitely be part of the discussions about a future tax cut."

"That's why it's premature to put out a number on a tax cut," he said.

But Sen. Bart Hester, R-Cave Springs, said he still "fully supports" at least a minimum $100 million income-tax cut in the 2017 session, which starts Jan. 9.

"We are still early in the fiscal year, and I think we'll see [general revenue] correct itself," he said. "I wouldn't expect anything but doom and gloom from [the Department of Finance and Administration] from this point on until we get out of the session."

Information for this article was contributed by staff members of The Associated Press.

A Section on 10/05/2016