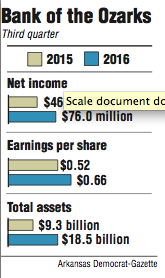

Bank of the Ozarks had record earnings of $76 million for the third quarter, up 65 percent from profit of $46.1 million in the same period last year, the Little Rock bank said Tuesday.

The bank had earnings of 66 cents per share, beating the average estimate of 60 cents a share projected by 10 analysts surveyed by Thomson Reuters.

Shares of Bank of the Ozarks fell $1.44 to $39.92 Tuesday in trading on the Nasdaq exchange.

Bank of the Ozarks had assets of $18.5 billion on Sept. 30, almost double the $9.3 billion it had a year earlier. The bank's assets are more than any other bank based in Arkansas.

Bank of the Ozarks is building infrastructure, including technology, to prepare it to ultimately reach $50 billion in assets in the next few years, Greg McKinney, Bank of the Ozarks' chief financial officer, said Tuesday during a conference call with analysts.

Bank of the Ozarks could be at $50 billion in assets in three years to five years, George Gleason, the bank's chairman and chief executive officer, said on the conference call.

"We're going to go ahead and build the infrastructure [for a $50 billion bank] and are busy about that," Gleason said.

The closing in July on the purchase of Community & Southern Holdings of Atlanta and C1 Bank of St. Petersburg, Fla., contributed to Bank of the Ozarks' increase in assets.

Bank of the Ozarks likely won't acquire any other banks this year, but it expects to exceed $20 billion in assets next year, McKinney said.

Bank of the Ozarks will focus on finishing conversions, including of computer systems, at the two acquired banks for the rest of this year, Gleason said.

Early next year, Bank of the Ozarks will begin looking more actively at acquisitions, Gleason said.

The two acquired banks had total assets of about $6.4 billion.

"At first glance, we believe the recently closed acquisitions were more [profitable] than anticipated," Matt Olney, a banking analyst in Little Rock with Stephens Inc., said in a research brief Tuesday.

The biggest portion of Bank of the Ozarks' loans are generated by the bank's real estate specialties group, which was formed 13 years ago. Its priorities for making loans are quality, profitability and growth, Gleason said.

Over the 13 years, it has had only two failed loans totaling $10.4 million or 0.08 percent of its total loans.

The real estate specialties group focuses on commercial real estate lending and construction and development lending. It originates between $2 billion and $3 billion in loans every quarter, Gleason said.

In the third quarter, about $1 billion in loans were paid off or paid down, Gleason said.

"What is occurring, that we really didn't fully appreciate, is condo lot sales, home construction sales, all those assets are selling much faster than projected," Gleason said. "And refinancing activity is very robust."

Gleason referred to an office building on which Bank of the Ozarks had a $63 million construction loan. The building already is under contract to sell for $271 million. He expects the bank's $63 million loan to be paid off this quarter, Gleason said.

Bank of the Ozarks' efficiency ratio of 35.5 percent through the first six months of this year rose to 38.1 percent in the third quarter, primarily because of expenses from the purchases of Community & Southern Holdings and C1 Bank, McKinney said.

An efficiency ratio of 38.1 percent means it costs Bank of the Ozarks $38.10 to earn $100.

Bank of the Ozarks received 10 weeks of business from the two acquisitions during the third quarter, McKinney said.

"We hope to achieve an improving efficiency ratio over the next several years at ultimately a sub-30 percent efficiency ratio," McKinney said.

Bank of the Ozarks opened three branches in Northwest Arkansas during the third quarter, in Siloam Springs, Fayetteville and Springdale, Gleason said.

The branches had been in Bank of the Ozarks' plans for a long time, but were put on hold during the recession, which severely affected the region, Gleason said.

Bank of the Ozarks plans to open new offices in the next few quarters in several central Atlanta counties and in Dallas County and Tarrant County in Texas, Gleason said.

For the first nine months of this year, Bank of the Ozarks had net income of $182.2 million, up 39 percent from $130.8 million over the same period last year.

Business on 10/12/2016