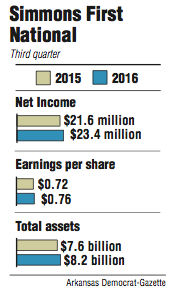

Simmons First National Corp. earned $23.4 million in the third quarter that ended Sept. 30, up 8.5 percent from $21.6 million for the same period last year, the Pine Bluff firm said Wednesday.

Simmons earned 76 cents per share compared with 72 cents per share in the third quarter last year.

Excluding almost $1 million in one-time charges, Simmons earned 79 cents per share.

Still, that was well below the 85 cents per share expected by five analysts surveyed by Thomson Reuters.

Shares of Simmons closed at $49.60 per share Wednesday, up 25 cents in trading on the Nasdaq exchange. Wednesday's report was released after the market closed.

Since 2010, Simmons has made nine acquisitions. Last month, it closed on the purchase of Citizens National Bank of Athens, Tenn., which had almost $560 million in assets.

"We look forward to continued growth in our east Tennessee markets," George Makris, Simmons' chairman and chief executive officer, said in a prepared statement.

Simmons First National, which owns Simmons Bank, continues to produce good results, Makris said. The bank posted a third-quarter efficiency ratio of 53.8 percent, meaning it costs Simmons $53.80 to earn $100.

The bank also had a return on assets of 1.21 percent for the quarter.

Simmons had loans of $5.4 billion in the third quarter, an increase of almost $550 million from the same period last year.

The bank will continue to do strategic acquisitions in the future, said Garland Binns, a Little Rock banking attorney.

Simmons had $8.2 billion in assets at the end of the third quarter. Matt Olney, banking analyst in Little Rock for Stephens Inc., expects Simmons to have at least $8.5 billion in assets at the end of 2017, without any more acquisitions.

"Clearly they want to do more deals," Olney said of Simmons. "If there is something attractive, they're going to jump on it."

It's uncertain whether Simmons will pass $10 billion in assets next year. Banks that have more than $10 billion in assets face added federal regulatory scrutiny and costs.

But it is possible Simmons could make a couple of acquisitions next year and still stay below $10 billion, Olney said.

"They could do another one or two of those that are smaller [like the Citizens National Bank purchase] and still remain below $10 billion next year," Olney said.

He does expect Simmons to pass $10 billion in assets in 2018, Olney said.

Also Wednesday, Simmons said it will close its institutional investments division.

The division sells bonds to institutional customers, such as insurance companies, other banks, credit unions or mortgage originators, said Rex Nelson, spokesman for the bank.

The change is being made "as part of our continued efforts to focus on our core banking customers by providing the products and services that most fit their needs, including retail investment management," Nelson said.

Simmons will have staff in place through the end of the year to manage closure of the department, Nelson said.

Selling bonds to institutions is an expensive endeavor, particularly in the current regulatory environment, said Edmond Hurst, senior managing director for Little Rock bond firm Crews & Associates.

"The cost of operations have just skyrocketed, including the technology and the number of personnel required," Hurst said.

Simmons will conduct a conference call for analysts and investors at 3 p.m. today to discuss the third-quarter results. To listen to the call, dial (866) 298-7926 and provide the identification number 8738-9332.

Business on 10/20/2016