State general revenue in March dropped by $37.4 million from a year ago to $510.3 million and fell $51 million short of the state's forecast largely because of a change in the filing deadline for corporate income tax returns and extension payments, state officials said Tuesday.

But Gov. Asa Hutchinson said it's premature to make any decisions about cutting the budget for the remainder of fiscal 2017, which ends June 30.

"Everybody is saying not to panic," House Revenue and Taxation Committee Chairman Joe Jett, R-Success, said, referring to state Department of Finance and Administration and Bureau of Legislative Research tax and budget experts.

"I'm still cautiously optimistic that this thing will work out," he said.

But state Sen. Bryan King, R-Green Forest, said that "the idea you are going to barely make forecast isn't good enough in this economic climate."

Hutchinson "should have been cutting things months ago," he said. "I'm not just trying to score political points."

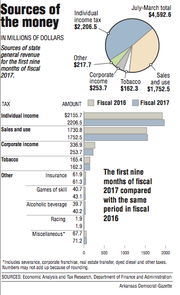

From July through March, the state's total general-revenue collections of $4.59 billion reflect a decline of $8.1 million, or 0.2 percent, from the same nine-month period in 2016.

Those collections for the nine months of fiscal 2017 were $101.7 million, or 2.2 percent, short of the state's forecast, the finance department said in its monthly revenue report released Tuesday.

The two largest sources of state general revenue are individual income taxes and sales and use taxes.

So far this fiscal year, individual income taxes have increased by $50.8 million, or 2.4 percent, over the same period in fiscal 2016 to $2.20 billion and are $0.9 million below the state's forecast.

Thus far, sales and use tax collections have increased by $21.7 million, or 1.3 percent, over the same nine months of fiscal 2016 to $1.75 million, but are $50.7 million, or 2.8 percent, below the state's forecast.

Corporate income taxes, meanwhile, have declined by $83.2 million, or 24.7 percent, from the same period of fiscal 2016 to $253.7 million and are $71 million, or 21.9 percent, below the state's forecast.

Tax refunds and some special government expenses come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

During the first nine months the current fiscal year, net available general revenue to state agencies totaled $3.77 billion, a decline of $49.7 million, or 1.3 percent, over the same period of fiscal 2016. That total is $65.2 million, or 1.7 percent, below forecast, the finance department said.

Last week, Hutchinson said he expected "a dip" in the state's general tax collections for March "caused by changes in the reporting times initiated at the federal level."

The IRS changed the filing deadline from March 15 to April 15 for extension tax payments and tax-due returns for corporations. The Legislature and Hutchinson enacted Act 48 in this year's session to match that filing date, state officials said.

The state's corporate income tax collections dropped in March by $38.4 million from a year ago to $27.6 million, and that's $40 million below the state's forecast, the finance department reported Tuesday.

"When we did our forecast, [the change in the filing deadline] was not in the plans. That was not something that we were aware of," said finance department Director Larry Walther. "We changed the law, so we are seeing the effect of that in corporate income taxes. We think that's about $31 million or $32 million of the $40 million [dip]."

"That should change [in April] when we have a lower estimate in that category," he said.

Hutchinson said Tuesday that "even though the greatest portion of the shortfall will be corrected in the coming months, I am keeping a very watchful eye on our budget both in terms of revenue and expenses.

"It should be noted that individual income tax collections remain above last year's level despite the $100 million tax cut that was in effect for the entirety of the last fiscal year," the Republican governor said in a written statement.

"Keep in mind, we have three months left to go in this budget cycle, and a lot could change before July 1. April is typically the biggest month for state revenue, and next month's results in particular will be important for any decisions as to whether the forecast should be adjusted or not," Hutchinson said.

"Given how much time is left before the end of the fiscal year, it would be premature at this time to make any changes to the budget or the forecast," he said.

When January revenue collections slid, Hutchinson said he advised state agencies "to make contingency plans in the event the budget forecast will need to be adjusted.

"In the event adjustments are needed down the road, there should not be any impact to Category A spending [in the Revenue Stabilization Act]. This type of budget variance is the reason we included over $100 million in Category B, which means the agencies cannot spend line items in Category B until late in the fiscal year," he said.

Category B has a total allocation of $127.9 million: a Medicaid allocation of $88 million, $23.7 million for public schools, $5.2 million for the merit adjustment fund, $4 million for the Department of Correction, $3.5 million for the Department of Human Services' Behavioral Services Division, $2 million for the Department of Higher Education, and $1.5 million for the Arkansas Economic Development Commission.

Legislative leaders on Tuesday were reluctant to second guess Hutchinson's decision to hold off on deciding whether to cut the state's general-revenue budget for the remainder of fiscal 2017.

"I don't feel like I'm in a position" to say whether the governor should cut the general-revenue forecast and budget for the rest of the fiscal year, said Senate President Pro Tempore Jonathan Dismang, R-Searcy.

"It's his current forecast. It's ultimately his call," Dismang said.

House Speaker Jeremy Gillam, R-Judsonia, said, "I don't see that we need to cut anything just yet.

"We knew the corporate is going to be a little off [in March], and we had talked about it a couple months ago," he said.

According to the finance department, March's general revenue also includes:

• A $3.8 million, or 1.6 percent, increase in individual income taxes over a year ago to $240.2 million and that's $0.6 million, or 0.3 percent, below the state's forecast.

Withholdings are the largest category of individual income taxes. They increased by $10.2 million over a year ago to $200.9 million and exceeded the state's forecast by $5.7 million.

John Shelnutt, the state's chief economic forecaster, said the state's individual income tax withholdings were exceptionally strong in March, "but it was offset by other filings. Returns were down and other categories were down, so the net was essentially on forecast."

• A $0.3 million, or 0.1 percent, decrease in sale and use tax collections over a year ago to $193.7 million that fell $8.9 million, or 4.4 percent below the state's forecast.

Shelnutt said the state's sales tax collections in March were down almost across the board, except for motor vehicle sales tax which was up.

"It was unusual in March for collections of sales tax," he said. "This has been noted around the country for a lot of states that their sales taxes are under-performing their economies and their income tax reports, so I don't think there is any definitive answer on why because it has been doing it around the country."

In February, Seattle-based Amazon announced it would begin collecting taxes on its sales to Arkansans on March 1. Amazon will begin remitting sales taxes to the state this month.

"We are cautiously waiting on that," Walther said.

"There is some seasonality to Internet sales involved, and it is sent on a monthly basis, so we are not expecting a huge number at all," he said.

Tuesday's revenue report came a day after the state House of Representatives voted 43-50 to reject legislation aimed at persuading out-of-state companies without a physical presence in the state to collect sales taxes on their sales to Arkansans and remit the revenue to the state.

Before recessing on Monday, the Legislature also gave final approval to a general-revenue budget of $5.49 billion in fiscal 2018 starting July 1. That's a $163 million increase over the current fiscal year general-revenue budget. Most of the increased state assistance would go to the state Department of Human Services.

A Section on 04/05/2017