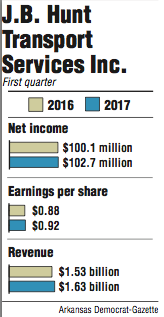

J.B. Hunt Transport Services Inc. reported net income of $102.7 million for the first quarter of 2017, a 2.6 percent increase from the same three-month period a year ago.

The Lowell company's earnings per share of 92 cents and revenue of $1.63 billion also were increases from last year, when J.B. Hunt reported 88 cents per share and $1.53 billion in revenue. Earnings per share beat Yahoo Finance analyst estimates of 86 cents, while the company just missed revenue expectations of $1.64 billion for the quarter.

The performance was aided by a one-time tax benefit "from the claiming of research and development tax credits and domestic production tax deductions during the 2012 through 2016 tax years" that equated to $13.6 million, or 12 cents per share, according to the company's earnings report. J.B. Hunt said its income tax rate decreased to 28 percent in the quarter compared to 38 percent a year ago and the company paid $21.5 million less in income taxes during the quarter.

While profits and revenue increased from last year, operating income -- earnings before interest and taxes -- decreased 11 percent to $149 million. J.B. Hunt said it was affected by lower customer rates because of competitive pricing, increased purchased transportation costs, higher driver wages, branch network expansion and insurance and claims costs.

"The company has been hit across the board on most of their metrics," said Bob Williams, senior vice president at Simmons First Investment Group Inc. "Fuel surcharges dropping, increased labor costs, increased insurance costs, combine that with soft demand for their services, particularly on the East Coast, it's almost like the perfect storm."

Shares of J.B. Hunt stock closed trading Monday at $89.11, down 3 cents.

J.B. Hunt's intermodal business, which is the company's largest segment and accounted for 57 percent of its quarterly revenue, reported a 5 percent revenue increase to $937 million. The revenue rise was aided by load volume growth of 2 percent and a 3 percent increase in revenue per load.

But operating income dipped 8 percent to $95 million because of factors such as lower revenue per load excluding fuel surcharges, increases in rail purchased transportation costs, 6 percent reduction in network volumes in eastern states and increased driver wages and recruiting costs.

"Competitive pricing dynamics were pretty visible in these results," said Brad Delco, transportation analyst for Stephens Inc. in Little Rock. "I think what has been a little bit of a surprise to investors, historically when the intermodal pricing environment is competitive, J.B. Hunt tends to take market share. And with intermodal volume growth only at 1.6 percent, that's created a little bit of confusion amongst the investor base."

J.B. Hunt's brokerage division, Integrated Capacity Solutions, reported the biggest revenue gain among segments with a 14 percent increase to $209 million from the same period in 2016. The division also endured the biggest slip in operating income, decreasing 59 percent to $4.5 million.

The company said a larger number of startup branches -- those locations open for less than 2 years -- from 2016 were a culprit. The company had 18 startup branches in 11 locations compared to nine in the first quarter of 2016.

Startup branches typically produce less revenue and lower gross margins than older branches, according to J.B. Hunt.

"You don't have to buy trucks, you don't have to buy trailers to grow that business," Delco said. "So it doesn't require a lot of capital, but it does require an investment in people. That growth that you're investing in is really going to dilute margins in the near-term and I think you're seeing that in these results."

Operating income was flat at $45 million and revenue increased 10 percent to $392 million in J.B. Hunt's dedicated contract services segment. The company said productivity increased about 6 percent and there was a net addition of 392 revenue-producing trucks by the end of the quarter compared to last year.

Meanwhile, revenue decreased 2 percent to $94 million in the company's trucking segment, while operating income fell 46 percent to $4.9 million. J.B. Hunt said the division's performance was affected by increased equipment maintenance costs and higher insurance and claims costs than the first quarter of 2016.

Overall, the first quarter results are from what Delco described as a "challenging freight environment." Pricing has been under pressure because there's an excess of supply and not enough demand for freight services.

"We need to see some change in supply or demand dynamics to see underlying improvement in freight rates, but not sure if that's going to play out here over the next three months which is historically a period of time when most annual contracts are renegotiated," Delco said.

J.B. Hunt will hold its annual shareholders meeting at 10 a.m. Thursday in Lowell. The agenda includes electing 10 people to the board of directors and a shareholder's proposal requesting the company prepare and maintain a publicly available report regarding political contributions and expenditures.

J.B. Hunt's board recommends shareholders vote against the proposal. The board believes the proposal is "unnecessary and not in the best interest of the company or its stockholders."

Business on 04/18/2017