Windstream Holdings ended its 11-year-old dividend "effective immediately," the Little Rock telecommunications company announced Thursday, and immediately the stock price collapsed.

Windstream's stock fell to an all-time low of $2.37 a share in trading on the Nasdaq exchange before closing at $2.38, losing more than a third of its value from Wednesday's close of $3.72.

The value of Windstream's stock fell about $255 million in a day, from about $707 million on Wednesday to about $452 million on Thursday.

About 19 million shares were traded, more than six times the average daily volume of 3.1 million shares.

"Our [stock] is undervalued, especially given our improved strategic direction with enhanced product capabilities and anticipated acquisition synergies of $180 million," Tony Thomas, Windstream's chief executive officer, said in a statement.

Windstream said it expects the recent purchases of EarthLink, an Internet and network products and services business, and Broadview, which provides Internet data communications services for small businesses, will strengthen the company.

In addition to the end of the dividend, Thomas said Windstream will buy back $90 million of the company's stock.

At an average of $3 a share, $90 million would buy 30 million shares of Windstream, reducing the outstanding shares from about 190 million to about 160 million.

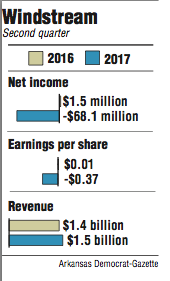

Windstream said it lost $68.1 million in the second quarter compared with a $1.5 million profit in the same period last year. That equals a loss of 37 cents per share compared with earnings of 1 cent a share in the second quarter of 2016.

Windstream beat the average estimate of a loss of 40 cents a share by seven analysts surveyed by Thomson Reuters.

But the elimination of the dividend overshadowed other news Thursday.

"I can't say that it was unexpected," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock. "If you look at the company's earnings over time, [Windstream] was having difficulty covering the dividend with earnings."

The dividend was what attracted investors to the stock traditionally, Williams said.

"So given the total elimination of the dividend, it's not surprising that the shares got hit hard [Thursday]," Williams said.

Windstream, a spinoff from Alltel Corp., had a $1 a share annual dividend when it became a public company in July 2006, said David Avery, a Windstream spokesman.

In April 2015, Windstream completed a spinoff of what is now Uniti Group and had a reverse stock split. At that point, Windstream began paying an annual dividend of 60 cents per share, Avery said.

The dividend yield at Wednesday's close of $3.72 a share was 16 percent, Avery said.

Windstream had revenue of almost $1.5 billion in the second quarter, up from $1.4 billion in the second quarter last year.

Business on 08/04/2017