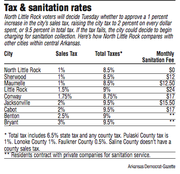

*CORRECTION: The sanitation fee for Sherwood households is $21.53 monthly. A chart accompanying this story lists an incorrect figure for Sherwood’s sanitation charge while comparing city sales tax rates and sanitation fees.

When the campaign began for Tuesday’s special election to increase North Little Rock’s sales tax by 1 percentage point, Mayor Joe Smith took it upon himself to tell the public why he believes it’s necessary.

Since early June, Smith has attended public meetings and gone before neighborhood associations, civic groups and business organizations 44 times to lay out the financial figures and ask for voters’ support in Tuesday’s election.

“I accomplished my goal of getting in front of people as much as I could to show them the numbers and show them the facts,” Smith said last week in his City Hall office.

Smith’s next goal is for North Little Rock voters to support the tax increase.

If approved, half of the tax increase would be permanent to fund the city’s general operations. The other half would end in five years, with its revenue designated for a new police and courts building, upgrades to fire stations, and street and drainage improvements.

Early voting continues from 8 a.m.-5 p.m. Monday in the Pulaski County Regional Building at 501 W. Markham St. in Little Rock. Polls will be open in North Little Rock from 7:30 a.m.-7:30 p.m. Tuesday.

Under a change in state law that took effect Tuesday, voters will need to show photo identification or sign sworn statements confirming their identities before casting ballots.

The 1 percentage-point tax increase would raise what consumers pay in sales tax within North Little Rock to 9.5 percent, one-half percentage point higher than in Little Rock. North Little Rock businesses now collect an 8.5 percent total tax, consisting of a 1 percent city sales tax approved in 2000, a 6.5 percent state tax and a 1 percent Pulaski County tax.

Collection of the new tax wouldn’t begin until Jan. 1. The tax is projected to bring in about $16 million per year.

Smith has a plan for whichever way the vote may go, he said.

“If this passes, we will hit the ground running the next day to work on our construction issues, and street and drainage issues,” Smith said. “So when the money starts coming in, we’re ready.

“If it does not, it will be my intention to bring to the City Council a balanced budget [for 2018], without pulling any money from the emergency fund,” he said. “I’ll issue an executive order Aug. 9 to put on a hiring freeze.”

The city has financial difficulties, Smith has said in his presentations to the public, because combined city and county sales tax revenue has grown by 0.3 percent on average annually in the past 10 years, while expenses have gone up by an average of 3.5 percent annually.

The City Council opted for a tax election instead of charging a sanitation fee that Smith has said wouldn’t be enough to sustain the city for long. North Little Rock doesn’t charge for the collection of trash or yard waste because of a promise a previous City Council made in writing to entice voters to approve the current 1 percent city sales tax in a March 2000 election.

While Smith hasn’t talked about an either-or situation between a new tax or restarting the sanitation fee, the implication has been there. Without increasing revenue, Smith has said, the city is facing $5 million in cuts that would reduce the number of employees or city services.

It costs the city almost $5 million to provide sanitation services, according to city figures.

“As I’ve said a number of times, doing nothing is not an option,” Smith said in an interview. “We have to do something.”

Some potential voters have viewed the sanitation-fee option as a threat.

“I don’t appreciate the strong-arm tactic to threaten us with a garbage fee,” Carolyn Reed said after one public meeting, though she added that she would “probably” support the tax.

“I don’t think they’ll do a sanitation fee” if the tax fails, Bubba Lloyd, a North Little Rock businessman and onetime mayoral candidate, said in a recent interview. “I think it is a selling point. Scare tactics are wrong. He can say it’s not, but that’s what it is. I tell people to ignore the sanitation fee and vote against the sales tax.”

The City Council can implement a fee without a vote of the public. However, the council in 2000 included in a binding ordinance its pledge to remove the sanitation fee if that year’s proposed tax increase passed. The ordinance also stated that to reinstate the fee, the 2000 tax would have to be abolished.

The council “would have to address this” if it decides to reinstate the sanitation fee, City Attorney Jason Carter said last week. The council has the authority to repeal the previous ordinance, he said.

Murry Witcher, the only council member remaining from the 2000 council, said the city would be going back on its pledge if it did so.

“We made a commitment to the public that we weren’t going to do that, and I think we should hold to it,” Witcher said in an interview. “In my opinion, it was tied specifically to that tax, and we would have to go back on our word if we indeed decide to institute a charge for sanitation.”

The biggest criticism Smith said he has received during public meetings concerned recent pay raises for policemen and firefighters, which also resulted in nonuniformed city workers and elected officials receiving 3 percent raises in 2016 and 2 percent raises this year. The city also pays 100 percent of city employees’ health insurance.

To fund the raises, the city moved from its reserve, or emergency fund, $2.5 million in 2016 and $4.2 million for this year, city Finance Director Karen Scott said last week.

The transfer figures presented to the City Council at the time council members approved city budgets were $1.25 million and $2.3 million. The higher figures are budget amounts amended later, Scott said.

“If our police officers were being paid the equivalent to other [cities’ police] departments, we wouldn’t have,” Smith said about using reserve money for raises. “But it was necessary in wanting to keep public safety at 100 percent.”

The City Council also awarded $795,000 in each of the past two budgets to 19 nonprofit community programs such as the Regional Innovation Hub ($150,000), the Argenta Downtown Council ($95,000), the city History Commission ($85,000), and the Argenta Community Theater ($50,000).

Literature from the “Stop The 2017 North Little Rock Sales Tax” campaign refers to such funding as “wasted taxpayer funds on pet projects” and says the city intends to provide such funding while raising taxes.

Smith has twice warned the community groups that cutbacks are likely, but reductions haven’t occurred. In last week’s interview, Smith said those funds would “absolutely hold steady” if the tax passes.

Promotion of the sales tax also has focused on the $40 million over five years — the one-half percentage point to be devoted to capital improvements — that would build a new police and courts building, upgrade fire stations and reach into neighborhoods to improve streets and address drainage problems.

With that extra money, the city has said, it would put $500,000 annually into each of its four wards — for a total of $10 million over the five years — for street and drainage work, a healthy increase from the current $75,000 for each ward per year.

Each ward’s council members will help prioritize the projects, Smith said.

Police and courts would likely move from the current 57-year-old building at 200 Pershing Blvd., Smith said last week. Three locations are already being reviewed as possible locations for a new building, he said. The estimate for the building’s share of the tax revenue is $20 million over the next five years.

“It makes more sense to move it,” Smith said. “There are 224 people who work there every day. We need a lot more room and a lot more parking than they have now. We’re looking at options.”

Among the city’s 11 fire stations, the newest was built in 2002. Fire improvements would be funded with $10 million over five years from the new tax.

“There could be an opportunity to move a fire station or two to give better [fire] coverage,” Smith said. “I’ve asked [police and fire chiefs] to work on a wish list and have everything to me by the end of the year with their suggestions.”