WASHINGTON -- The federal budget deficit fell sharply in July from a year earlier, largely because of a quirk in the calendar.

The U.S. Treasury Department said Thursday that the budget gap came in at $42.9 billion last month, down from $112.8 billion in July 2016. The bulk of the improvement came because benefit payments that normally would have gone out in July went out in June this year because July 1 fell on a Saturday.

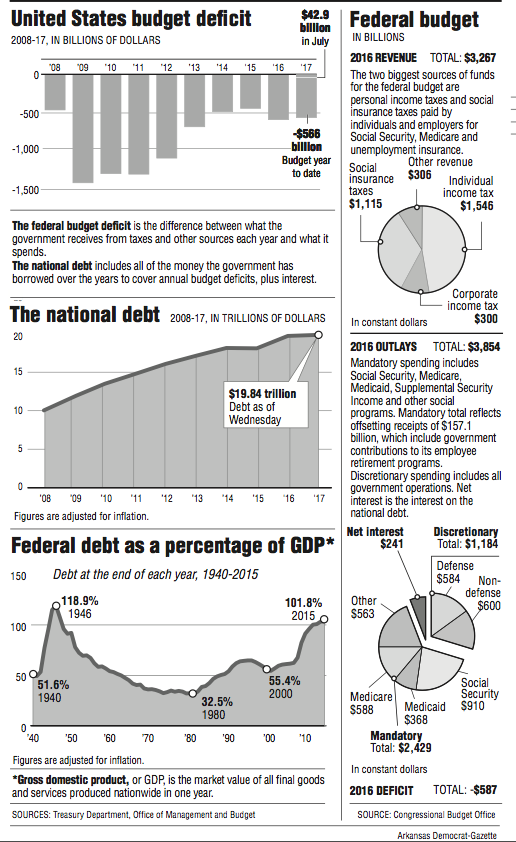

The Congressional Budget Office is forecasting that the federal deficit for the fiscal 2017 budget year, which ends Sept. 30, will come in at $693 billion, up from $584 billion in budget year 2016.

Through the first 10 months of the budget year, the federal government is running a $566 billion deficit, up 11 percent from the same period of fiscal 2016. Year-to-date tax collections are up 2.3 percent, at $2.7 trillion, while spending has risen by 3.6 percent, totaling $3.3 trillion, so far this fiscal year.

The department reported that individual income tax collections through July totaled $1.31 trillion, up from the $1.27 trillion collected over the same period a year ago. Year-to-date corporate income taxes rose slightly, from $231.9 billion a year ago to $232.3 billion.

Congress is facing a deadline of Oct. 1 for getting a budget approved for the next fiscal year or face the prospect of a government shutdown. Lawmakers are expected to pass a stopgap spending measure to buy time to iron out differences.

Separately, Federal Reserve Bank of New York President William Dudley on Thursday cautioned that "it's going to take some time" for inflation to rise to the central bank's 2 percent target even as he offered a generally positive outlook for the U.S. economy, job market and price pressures.

"Our outlook anticipates a continued moderate growth trend, with some further strengthening in the labor market and an increase in inflation over the medium term toward our objective of 2 percent," he said in prepared remarks in New York.

That language compares with the policy-setting Federal Open Market Committee's post-meeting statement on July 26, which said inflation was expected to "stabilize around the Committee's 2 percent objective over the medium term."

Dudley, who also serves as vice chairman of the Fed's Open Market Committee, later explained to reporters that the year-over-year measures would be constrained by weak readings in recent months.

"I do think I expect inflation to also start to move higher in the medium term but probably not get all the way back to 2 percent on a year-over-year basis, because remember, we've had these very weak inflation readings for a number of months," he said. "So we're not going to get to a year-over-year number of 2 percent until some of these very low readings drop out of the statistics 6 to 10 months from now."

Fed policymakers are expected to announce when they meet next month that they will begin paring down the U.S. central bank's $4.5 trillion balance sheet, which they built up after the financial crisis in an effort to stimulate the economy by reducing long-term interest rates. They have raised their benchmark interest rate four times since December 2015, but the chances of another increase this year have fallen to around 40 percent after a string of government reports that showed muted wage and price pressures in recent months.

Information for this article was contributed by Paul Wiseman of The Associated Press and by Matthew Boesler of Bloomberg News.

A Section on 08/11/2017