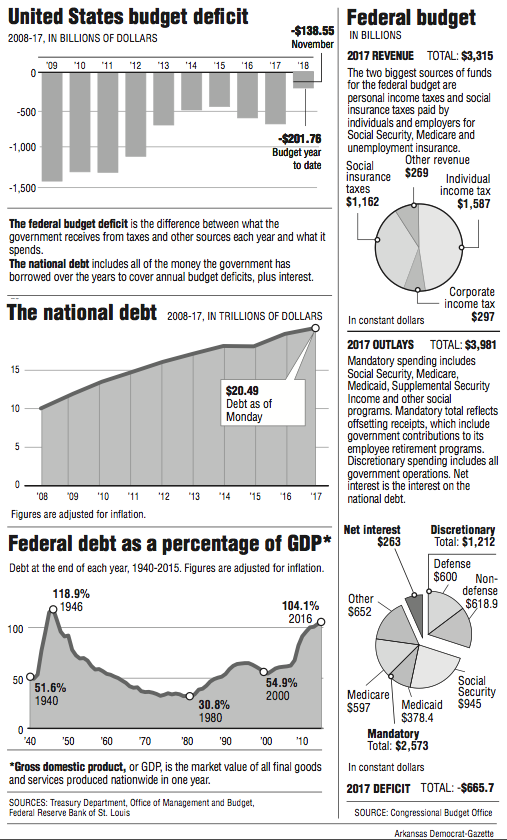

WASHINGTON -- The federal government collected a record amount of tax income for the month of November as it also had a record level of spending for the month, producing a budget deficit of $138.55 billion, up slightly from a year ago.

The November deficit was 1.4 percent higher than the same month a year ago, reflecting in part higher spending to deal with disaster relief and also higher spending by the Treasury Department on interest payments on the national debt, the Treasury Department reported Tuesday.

For the first two months of the current federal budget year, the budget deficit totals $201.76 billion, up 10.6 percent compared to the same period a year ago.

The spending increases pushed total outlays in November to $346.9 billion, a record for the month, while receipts totaled $208.3 billion, also a record for November.

The rise in revenue compared to a year ago was led by an $11 billion increase in individual income tax withholding and payroll taxes for Social Security, reflecting more people working as the U.S. unemployment rate has fallen to a 17-year low of 4.1 percent.

The month's increase in outlays, when compared to November 2016, reflected an increase of $5 billion in spending by the Department of Homeland Security, primarily for hurricane disaster relief, and a $9 billion rise in interest payments on the debt, an increase that reflected higher inflation which boosted outlays by Treasury on its inflation-protected securities.

In June, the Congressional Budget Office projected that the federal deficit for this budget year, which began on Oct. 1, would total $563 billion but that forecast did not include lost revenue from the GOP tax cut package, which Republicans hope to get passed before Christmas.

Private forecasters say this year's deficit is likely to rise to $675 billion and will be approaching $1 trillion by 2019, reflecting increased government spending and the tax cuts.

The Trump administration disputes those figures, contending that the tax cut legislation will not widen the deficit as much as has been forecast because the cuts will spur faster economic growth. The deficit for the 2017 budget year, which ended on Sept. 30, totaled $665.7 billion.

For the first two months of this year, federal revenue totaled $443.7 billion, up 5.3 percent from a year ago, while spending totaled $645.5 billion, an increase of 6.9 percent from a year ago.

A Section on 12/13/2017