A real estate development company has paid $2.6 million for a long-vacant piece of land along the Arkansas River in downtown North Little Rock, with plans for a mix of commercial and residential use.

Click here for larger versions

Photos courtesy Newmark Grubb Arkansas

Terraforma LLC of Little Rock bought the 5.6 acres from North Little Rock, which has been trying to sell the property since 2005.

North Little Rock, in turn, will take its profit of $750,000 and put it toward turning Argenta Plaza, an empty lot at 510 Main St., into an area for dining, shopping and the arts.

Terraforma wants to develop its new riverfront acreage into an entertainment district that would include a hotel, condominiums, offices, restaurants and retail shops, Doug Meyer, the company's managing member, said Friday. The parties closed on the deal last week.

Meyer said Terraforma hasn't signed on with any investors or other developers for specific projects on the land, which has been referred to over the years as the Argenta Waterfront District and the Smarthouse Way property. (Argenta is the original name, from the late 1800s, for what is now downtown North Little Rock; Smarthouse Way is a street on the property's western boundary.)

Depending on investors' interest, total development costs could range from $20 million to $50 million, Meyer said.

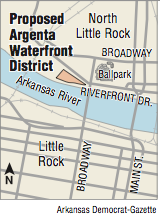

The parcel is just west of the Broadway Bridge and between West Riverfront Drive and the Arkansas River Trail. The land is a staging area now for bridge construction. Completion is scheduled for this spring. Meyer said he has been assured the land will be cleared and any holes and ruts will be filled in once construction is complete.

"I won't say the new Broadway Bridge was the catalyst for the purchase, but it is definitely an amenity," Meyer said. "I was out there just a few minutes ago, looking at the new arches. There is an almost unobstructed view of the Little Rock skyline. The new bridge sends a message that the downtowns of both North Little Rock and Little Rock are booming."

Taggart Architects Inc. of North Little Rock has produced an initial design. Newark Grubb Arkansas will be in charge of marketing the property and finding tenants.

There is no timeline for development, Meyer said.

"With a purchase like this, you close on the deal, you get your architect's renderings and then you look for a tenant to be the anchor, especially if you do a multiuse, which is what we're planning there," Meyer said. "We want a 24/7 feel to the place, where people are coming and going."

While his firm has occasionally bought property and held it only long enough to sell it for a profit, that's not the intent on this purchase, Meyer said.

"We typically buy property like this to build on and then lease," he said. "On a piece like this, you never know where it is going to take you, but certainly our preference is to build and lease."

Meyer and a business partner, Dave Bruning, started Terraforma 20 years ago. Meyer said the company has made about $100 million in real estate and development investments across central Arkansas, including in Sherwood and Conway, but has focused its most recent efforts on the downtowns of Little Rock and North Little Rock.

Terraforma's office is at 823 Main St. in Little Rock, where the firm had the former Peerless Engraving Co. building turned into indoor storage rentals. It also transformed the former Bennett's Military Supplies in the 300 block of Main Street into the new offices for the CJRW advertising firm. A new building developed by Terraforma, just across the street from the new CJRW office, is 50 percent full and just one tenant away from capacity, Meyer said.

Meyer said he moved to central Arkansas in 1987. "There was just nothing here [downtown]," he said. "Now people are moving back downtown. They want to live and work and play all in the same area."

North Little Rock has had trouble selling the riverfront property for years. It is a former industrial site, and in 2005 the city received a grant from the Environmental Protection Agency to clear it of contaminated soil but also had to take out loans to pay for the work.

After the site was cleaned, a private developer announced tentative plans for a pair of nine-story condominium towers and a marina. Those plans fell through because of a delay in removing power lines and their 70-foot poles from the property.

Once the power lines were removed, at a cost of $1.3 million, the city put the property back on the market but the recession of 2008-09 deterred investors and developers. A 2008 appraisal put the value of the property at $3.1 million.

North Little Rock Mayor Joe Smith had seen the travails of the property as director of the city's Public Building Authority and as director of commerce and governmental relations.

Some $400,000 of the Terraforma deal went toward paying off the loans the city needed for cleaning the site.

"Of course, it's always wonderful to pay off a debt that we've had for 10 or 15 years," Smith said. "But I'm even more excited for the opportunity this new development can bring. It is exactly the same vision I had when we were cleaning it up years ago."

He said he believes that Terraforma will develop the land instead of merely "flipping" it for profit.

"You look at their history, in North Little Rock, too, and you see they carry out projects," he said. "I think development is the way to make money off of it. We got a reasonable, fair-market price for it. It wasn't a quick sale."

The roots of the sale began in December 2014 when the City Council approved an "option to buy" agreement with J. Fletcher Hanson III, principal and executive managing director of Newmark Grubb Arkansas.

The firm had been in charge of listing the property at that time, for $3.2 million. The agreement gave the company one year to obtain financing, with two six-month options for extensions. Each extension carried a nonrefundable cost of $25,000 in earnest money.

The firm met all those obligations, Smith said.

A Section on 02/04/2017