The Walton Family Foundation will invest $750,000 in a nonprofit loan fund affiliated with Southern Bancorp to make it easier for small businesses in two Mississippi River Delta counties to obtain startup or day-to-day cash.

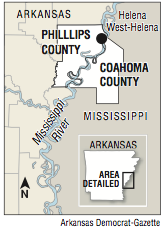

Loans through the program will be offered to mom-and-pop shops and heavier industrial projects in Phillips County and Coahoma County, Miss., which include Helena-West Helena and Clarksdale, officials said.

The initiative, the latest aid to once-wealthy farming towns on the Mississippi River that have been in decline for decades, aims to help job creators make ends meet or turn hard-to-finance ideas into reality.

"Praise the Lord," said John Mohead, who owns a restaurant in downtown Helena-West Helena, after hearing the news. "Hopefully it trickles down."

The Walton Family Foundation has long funded programs in the Delta, having invested $28 million there in the past five years, with plans for an additional $38 million by 2020, a spokesman said.

"We ultimately want to see business expansion or retention of existing employees" through the fund, said Karen Minkel, the Walton Family Foundation director of the program focused on the Delta and Northwest Arkansas. "We know that this has been an issue in the Delta for a number of decades."

Aside from job creation, the foundation focuses on prekindergarten education, public safety and after-school activities for kids, in addition to the millions of dollars it invested in Kipp Delta Public Schools, five open-enrollment charter schools in the area.

"I think the goal, right, is that you have a community that is ultimately self-sustaining in terms of people moving there and job growth," Minkel said.

The foundation's investment will go to Southern Bancorp's nonprofit arm, Southern Bancorp Community Partners. The nonprofit has more flexibility when issuing loans -- it's able to bend a bit on credit scores and the time that has elapsed since a person filed bankruptcy, for example, said Darrin Williams, chief executive officer of Southern Bancorp.

That investment will increase Southern Bancorp Community Partners' existing $16 million to $17 million loan capacity by close to 5 percent. This capacity covers a wider territory than the two counties directly affected by this program, meaning the program's impact will be greater on its concentrated area, Williams said.

Southern Bancorp Community Partners will try expanding the program with similar partnerships, Williams said.

"Because of the strength, the name and the important work the Walton Family Foundation does, we're able to use that [investment] as leverage to go and secure other [investments]," Williams said.

Minkel said she expects the investment will ultimately result in a $1.5 million increase to the two counties' loan capacity when other partners are included.

Southern Bancorp Community Partners will repay the foundation the $750,000 plus small interest fees in 10 years, Williams said.

Phillips and Coahoma counties, home to a combined 48,000 people, straddle the Mississippi River but are connected by U.S. 49. As with many Delta communities, the shrinking counties have high poverty rates and few economic opportunities.

In both counties, one in three residents lives below the poverty line, according to U.S. Census data. (Poverty level is set at $24,257 for a family of four.) Phillips County's unemployment rate was 5.7 percent in December, ranking it 65th of 75 Arkansas counties, and Coahoma's was 9.2 percent, or 72nd of 82 Mississippi counties.

"Economic development used to be about bringing in the next big Toyota plant, right? That's not going to happen," Williams said. "These communities are going to survive one small business at a time."

John Edwards, economic development director of Helena Harbor, said the loan fund will "help fill a need" and that it's one piece to the broader development puzzle.

"[With] traditional lenders, you really don't see that many smaller [commercial] loans out there, by and large, whether it be a $50,000 loan, $100,000 loan or $200,000 loan," Edwards said. "I think there's a decent demand now [for small business loans], but I think it's an opportunity for this demand to grow as we grow our other industries."

Edwards said he believes the loans will go to a mix of industrial projects and consumer-facing stores, such as retail or restaurants.

"I could see some going in both directions," Edwards said. "I would certainly hope that that would be the case."

One of the program goals is to provide so-called microloans to business owners with 10 or fewer employees, officials said. Such loans help provide working cash and can pay for inventory, equipment and furniture, for example.

Mohead, owner of the restaurant Southbound, said short-term, low-dollar loans are sometimes necessary during seasonal downtime but can be hard to come by in the Delta.

"I don't want to beat up on the banks too much," Mohead said. "It's just a fact of life here: They just don't make many small business loans."

Stan Street, who owns the Hambone Gallery in downtown Clarksdale, said he doesn't presently have need for a loan but that he could see the benefits for a town that has trended in the right direction since he moved there in 2004.

"We can always use some extra money to be available for people who want to start their own business," Street said. "I think it's helped in the past, so I would think it would help in the future."

Nationally, the average U.S. Small Business Administration microloan is for $13,000, and the maximum repayment term is six years, according to the government agency.

But the loans can be for far less and for shorter terms, Williams said. These loans are considered an alternative to credit cards, which typically carry higher interest rates, he said.

Of Phillips County's 410 businesses, 79 percent employ nine or fewer workers, according to the Census Bureau's 2014 business patterns data. In Coahoma County, 75 percent of 559 businesses employ fewer than 10 workers, the data show.

Bill Clinton, Rob Walton, the Winthrop Rockefeller Foundation and others co-founded what's now Southern Bancorp in 1986 with the purchase of an Arkadelphia bank, Williams said. The bank now operates more than 40 branches in Arkansas and Mississippi and holds $1.2 billion in assets.

Southern Bancorp Community Partners, the nonprofit, raised $4.5 million and spent $4.2 million in 2014, according to its most recent public tax filing. Of its spending, 78 percent was related to program services. That includes $1.2 million, or 30 percent of total spending, in grants to organizations.

SundayMonday Business on 02/05/2017