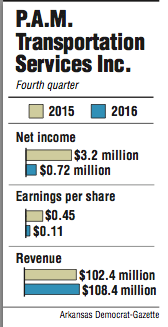

P.A.M. Transportation Services Inc. finished off what its chief executive called a "very challenging year" with about $720,000 in quarterly profit, down nearly 80 percent from the fourth quarter of 2015.

Daniel Cushman, the Tontitown company's president and chief executive officer, explained the tough year in Tuesday's release. Though total revenue grew slightly to $108.4 million, he said that lower rates attributed to industry overcapacity, as well as high operating costs related to employee health insurance and driver acquisitions, affected the bottom line.

Cushman said that overall the year remained "one of the top four in the Company's history from an earnings per share standpoint." Earnings per share for the year were $1.67. The company posted its highest overall earnings per share in 2015, at $2.93.

For the quarter, earnings per share were 11 cents, which missed Stifel Financial Corp.'s projection of 17 cents. P.A.M. stocks trading Tuesday on the Nasdaq exchange fell about 12 percent to $21.16.

The company's trucking segment represents 90 percent of its business. Cushman said that because the industry has been dealing with too much capacity and too little freight, there has been "sustained downward rate pressure."

While the company raised its total miles for the quarter by almost 7 percent, total loads grew only about 2 percent, and revenue per mile excluding fuel surcharges remained flat at $1.44.

"This industry pricing environment is almost morbid," said Bob Williams, senior vice president and managing director at Simmons First Investment Group.

"There's a lot of competition out there and when you combine that with rising health care prices and the cost of hiring new drivers, they just got squeezed."

Stifel's transportation and logistics research team said in a preview note, "As truckload pricing industry wide has been deteriorating we suspect that the large shippers that make up the majority of P.A.M.'s revenue are likely pressuring the company for concessions." The researchers said P.A.M.'s top five customers represent almost half of its business.

The company slightly decreased its fleet size to almost 1,300 but increased its owner-operator fleet by more than 100. By outsourcing certain overhead costs to independent contractors, trucking companies can minimize some costs while keeping revenue up.

Cushman said the company's automotive business "remained healthy" and that it expects "to see additional opportunities to grow this sector of our business in 2017." P.A.M. does about half of its business across the border.

Cushman also said the logistics division, which represents about 10 percent of P.A.M.'s business, "did not reach the anticipated levels of growth in revenue or margin," but that "we plan to be more aggressive in our approach in 2017."

The company did not respond to a request for clarification about what that might entail.

Ultimately, Cushman characterized 2016 as "a strong positioning year" with growth in some divisions, new shippers, improvement in average equipment age and growth in base trucking revenue, despite the profit drop from 2015.

Business on 02/08/2017